- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Canadian Solar (CSIQ) Is Up 17.4% After Securing Major Ontario Battery Storage Agreements With Aypa Power

Reviewed by Sasha Jovanovic

- Canadian Solar announced that its e-STORAGE unit has secured agreements with Aypa Power to supply SolBank energy storage systems and provide 20 years of service for two major battery storage projects in Ontario, the Elora and Hedley facilities, scheduled to begin commercial operations in the first half of 2027.

- This collaboration will add 420 MW / 2,122 MWh of storage capacity, marking some of the largest battery energy storage projects in Ontario and expanding Canadian Solar’s long-term presence in the region’s energy infrastructure.

- We’ll explore how these long-term Ontario agreements strengthen Canadian Solar’s growth outlook in energy storage solutions and recurring revenues.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Canadian Solar Investment Narrative Recap

To be a shareholder in Canadian Solar, you need to believe in the company's ability to expand beyond solar module manufacturing into higher-margin energy storage and solutions, which could provide more stable revenue over time. The new Ontario agreements with Aypa Power reinforce this narrative, supporting Canadian Solar’s shift towards recurring revenues from service contracts but do not materially reduce structural risks around supply chain costs, still a key short-term concern given ongoing industry price pressures.

The recently announced launch of the FlexBank 1.0 modular battery aligns closely with the Ontario projects, as it showcases Canadian Solar’s focus on developing advanced storage technology to capture more value from large-scale deployments. Innovations in battery storage can help the company better serve clients and strengthen its relevance amid rising competition, which ties back to future growth catalysts like an expanding solutions portfolio and the global electrification trend.

On the other hand, while these storage deals highlight progress, investors should also consider the challenges still present for module profitability as...

Read the full narrative on Canadian Solar (it's free!)

Canadian Solar's outlook anticipates $8.0 billion in revenue and $201.9 million in earnings by 2028. This projection relies on an annual revenue growth rate of 10.4% and an earnings increase of $208.8 million from current earnings of -$6.9 million.

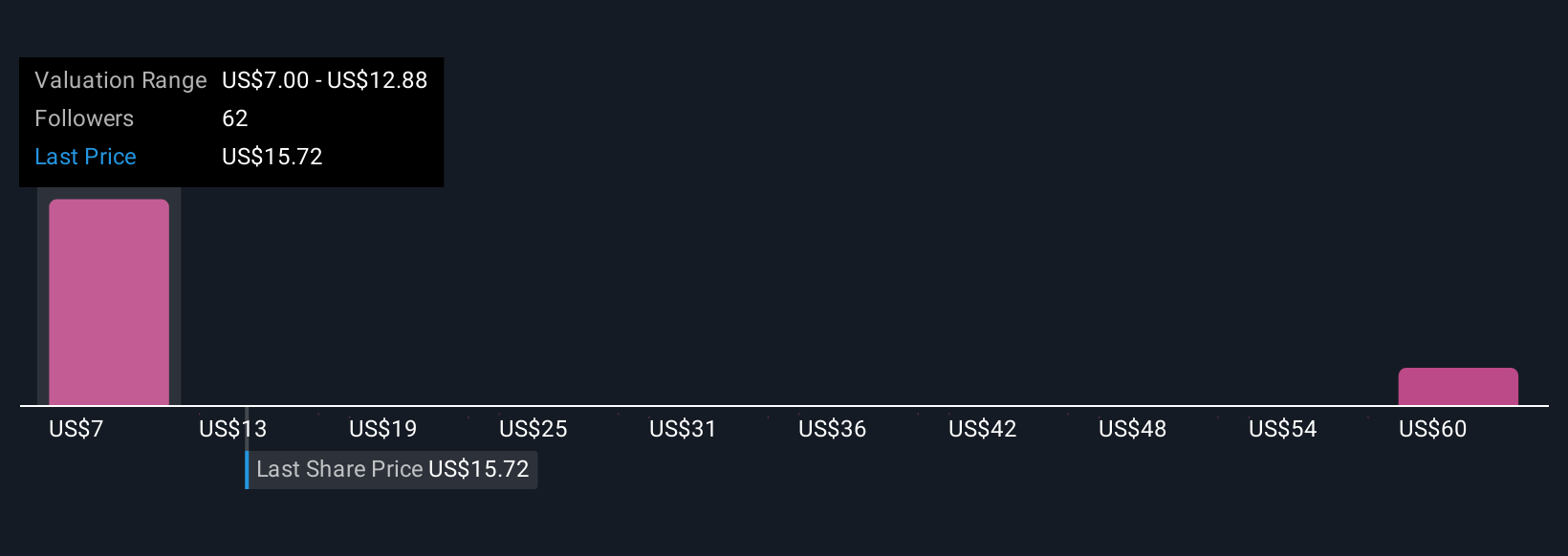

Uncover how Canadian Solar's forecasts yield a $12.37 fair value, a 19% downside to its current price.

Exploring Other Perspectives

Seven private investors in the Simply Wall St Community estimate Canadian Solar’s fair value between US$12.37 and US$65.81. With such a wide span of outlooks, keep in mind that persistent cost inflation remains a live issue for the business and informs many of the debates about future earnings potential.

Explore 7 other fair value estimates on Canadian Solar - why the stock might be worth over 4x more than the current price!

Build Your Own Canadian Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Solar's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives