- United States

- /

- Semiconductors

- /

- NasdaqGS:CRUS

Cirrus Logic, Inc.'s (NASDAQ:CRUS) 38% Share Price Surge Not Quite Adding Up

Cirrus Logic, Inc. (NASDAQ:CRUS) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 47%.

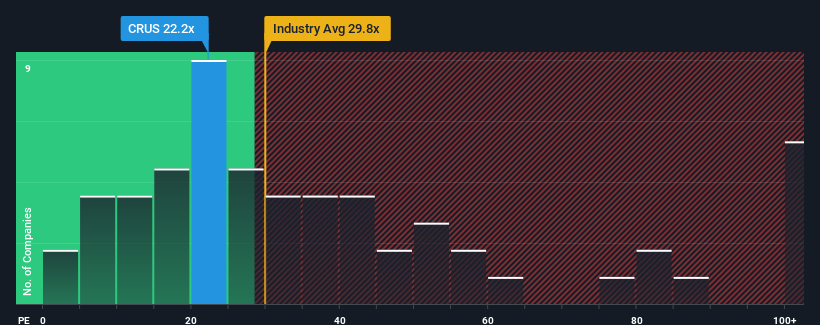

After such a large jump in price, Cirrus Logic may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.2x, since almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 9x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Cirrus Logic as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Cirrus Logic

Is There Enough Growth For Cirrus Logic?

In order to justify its P/E ratio, Cirrus Logic would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 60%. The latest three year period has also seen an excellent 36% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 6.3% as estimated by the seven analysts watching the company. That's not great when the rest of the market is expected to grow by 12%.

With this information, we find it concerning that Cirrus Logic is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Cirrus Logic's P/E

Cirrus Logic's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Cirrus Logic's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Cirrus Logic that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRUS

Cirrus Logic

A fabless semiconductor company, develops mixed-signal processing solutions and audio products in China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives