- United States

- /

- Semiconductors

- /

- NasdaqGS:CRUS

Cirrus Logic (CRUS) Valuation Check as It Launches Automotive‑Qualified Haptic Solutions

Reviewed by Simply Wall St

Cirrus Logic (CRUS) is pushing deeper into autos, unveiling its first AEC Q100 qualified closed loop haptic drivers for car interiors. This marks a strategic step beyond its traditional smartphone focused haptics franchise.

See our latest analysis for Cirrus Logic.

The timing looks interesting, with the share price at $121.14 and a strong year to date share price return of 21.86 percent suggesting investors are starting to price in new growth drivers. The three year total shareholder return of 61.58 percent points to a longer term rerating story that this automotive push could extend.

If this automotive haptics move has you thinking more broadly about where the next wave of demand might show up in chips, it is worth exploring high growth tech and AI stocks for other semiconductor and tech names riding similar structural trends.

With the stock already up strongly, modest top line growth and earnings under pressure, and shares trading at a discount to analyst targets but a premium to some valuation models, is Cirrus Logic a genuine buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 13.5% Undervalued

With Cirrus Logic closing at $121.14 against a narrative fair value of $140, the story hinges on how future cash flows are expected to evolve.

Cumulatively, these changes illustrate a dynamic landscape, where both company-specific strengths (e.g., innovation, customer relationships) and external uncertainties (e.g., EV demand and tariffs) play pivotal roles in shaping Cirrus Logic’s future performance and investor outlook. Investors appear to be rewarding the company’s strong execution while remaining mindful of the cyclical and structural forces at play, resulting in a cautiously optimistic, but closely watched, valuation reset.

Want to see the full playbook behind that higher fair value? The narrative leans on shifting margins, flatlining top line, and a richer future earnings multiple. Curious which assumptions really move the needle? Read on to unpack the numbers driving this call.

Result: Fair Value of $140 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few flagship smartphone customers, along with uncertain scaling in automotive and PC markets, could quickly undermine that upbeat valuation narrative.

Find out about the key risks to this Cirrus Logic narrative.

Another View: What the Market Multiple Says

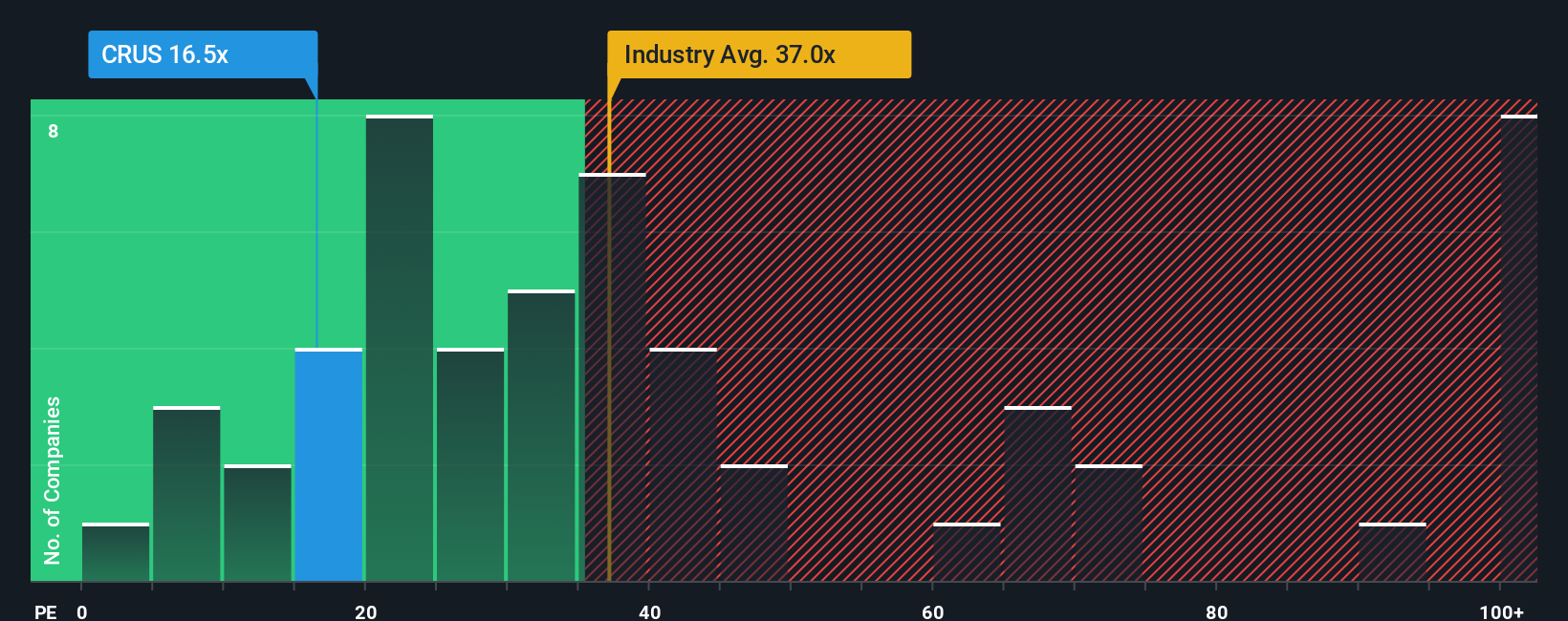

While the narrative fair value points to upside, the market is less generous. Cirrus Logic trades on a price to earnings ratio of 16.3x, slightly above its fair ratio of 15.4x, suggesting the shares may already be pricing in a lot of good news. Is that margin of safety thin?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cirrus Logic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cirrus Logic Narrative

If you see things differently or want to stress test your own assumptions, you can quickly build a personalized view in under three minutes: Do it your way.

A great starting point for your Cirrus Logic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities through targeted screeners that surface high potential stocks you are unlikely to find on your own.

- Capture income potential by reviewing these 13 dividend stocks with yields > 3% to evaluate companies that may strengthen your portfolio with cash returns.

- Ride structural growth trends by assessing these 25 AI penny stocks that are positioned to benefit from the adoption of artificial intelligence.

- Position ahead of a potential sentiment shift by filtering for value opportunities using these 914 undervalued stocks based on cash flows before the wider market reacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRUS

Cirrus Logic

A fabless semiconductor company, develops mixed-signal processing solutions and audio products in China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion