- United States

- /

- Semiconductors

- /

- NasdaqGS:CRUS

Cirrus Logic (CRUS): Taking Stock of Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Cirrus Logic.

Cirrus Logic’s recent share price movement reflects shifting investor sentiment as the stock continues to find its footing after a surge earlier in the year. While momentum has faded over the past month, its year-to-date share price return remains a solid 19.3%. The one-year total shareholder return of 14.4% suggests long-term holders are still well ahead.

If the back-and-forth in the chip sector has your attention, now is an ideal moment to broaden your outlook and discover fast growing stocks with high insider ownership

With recent gains appearing modest and the share price sitting below analyst targets, the question remains: Is Cirrus Logic trading at a discount ripe for opportunity, or is the market already factoring in future growth?

Most Popular Narrative: 9.3% Undervalued

Cirrus Logic's most widely followed narrative sees the fair value around $130.83, with the stock last closing at $118.64. This puts shares at a noticeable discount to what analysts consider justified, given current profit margins and projected growth. Here is a key excerpt that captures the foundation of the bullish narrative and what could drive future value for shareholders.

Cirrus Logic is expanding beyond its core smartphone audio business by increasing the value and breadth of its high-performance mixed signal solutions, particularly in areas like camera controllers, battery/power management, and sensing. This strategic diversification positions the company to capture new revenue streams and reduce customer concentration risk, which can drive higher revenue growth and bolster earnings stability over time.

Want to understand why Cirrus Logic’s potential is catching attention? There is a surprising blend of cautious profit forecasts, industry-defying margin assumptions, and one bold multiple that underpins this upbeat view. Dive into the full narrative and see what is hidden in the latest analyst projections.

Result: Fair Value of $130.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as potential declines in smartphone demand or setbacks in PC and auto diversification. These factors could challenge this optimistic outlook.

Find out about the key risks to this Cirrus Logic narrative.

Another View: Our DCF Model Raises Questions

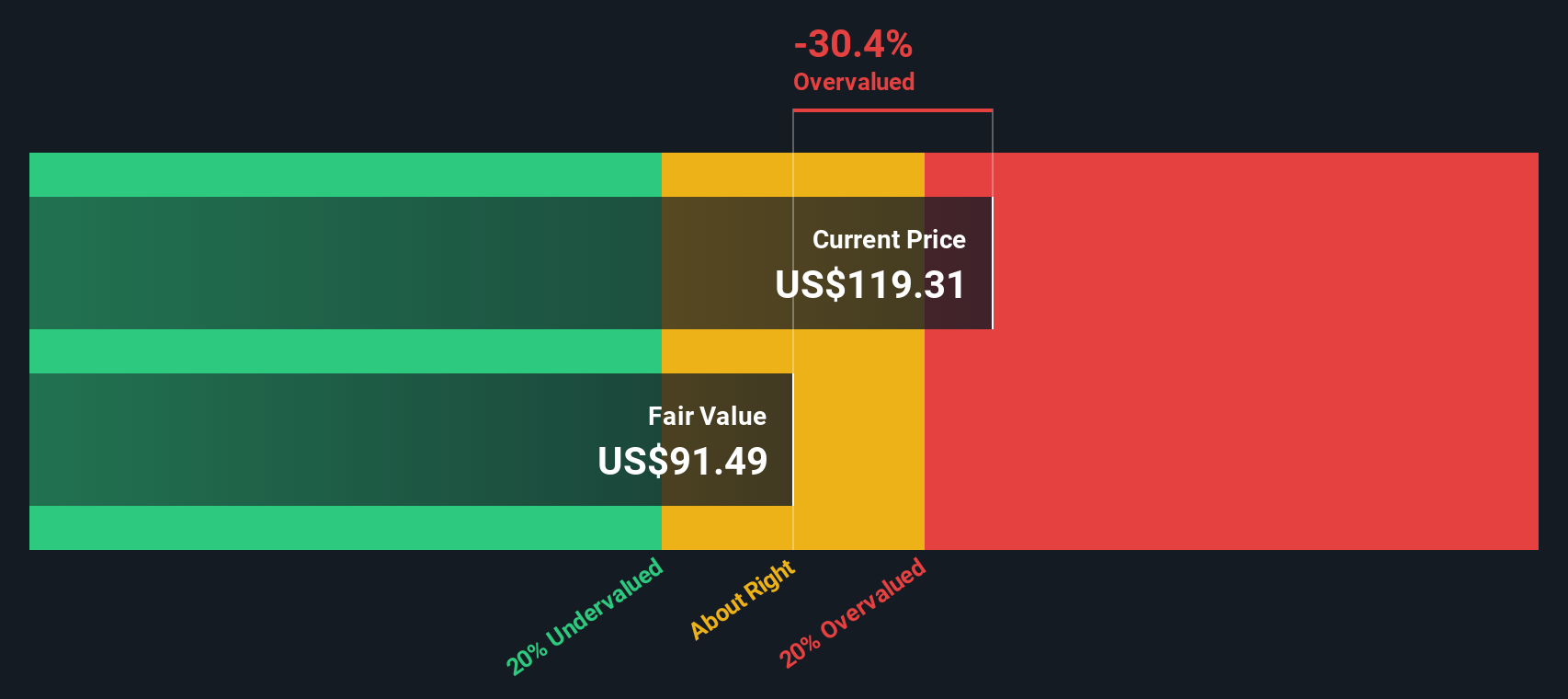

Looking at Cirrus Logic through the lens of the SWS DCF model tells a different story. According to our DCF analysis, the current share price of $118.64 sits above our fair value estimate of $76.60. This suggests the stock may be overvalued based on discounted cash flows. Does the market know something the cash flow model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cirrus Logic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cirrus Logic Narrative

If you see things differently or want to dive into the numbers yourself, you can put together your own perspective in just a few minutes with Do it your way.

A great starting point for your Cirrus Logic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't stop here. Staying ahead means seizing opportunities the moment they arise. The market rewards those who look beyond the obvious and put their money where the growth is.

- Follow the money and power up your watchlist with these 16 dividend stocks with yields > 3% offering yields over 3% from robust companies with real staying power.

- Catalyze your portfolio by jumping into these 82 cryptocurrency and blockchain stocks where leaders are redefining blockchain, digital payments, and high-growth financial innovation.

- Spot tomorrow's tech giants by tracking these 24 AI penny stocks driving AI breakthroughs in everything from healthcare to automation and beyond.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRUS

Cirrus Logic

A fabless semiconductor company, develops mixed-signal processing solutions and audio products in China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives