- United States

- /

- Semiconductors

- /

- NasdaqGS:CRUS

Cirrus Logic (CRUS): Assessing Valuation Following Strong Earnings, Guidance, and Buyback Completion

Reviewed by Simply Wall St

Cirrus Logic (CRUS) just posted quarterly results showing sales and net income both up compared to last year, while providing revenue guidance for the next quarter and finishing a new phase of its buyback program.

See our latest analysis for Cirrus Logic.

Cirrus Logic’s upbeat quarterly report and continued buybacks have kept momentum on its side, with the share price returning 20% year-to-date and an 18.5% total shareholder return over the past year. Investors appear to be favoring the company’s growth trajectory, especially after strong sales and improved earnings per share were announced alongside upbeat guidance. These are signs that potential is building for the longer term.

If Cirrus Logic’s recent results have you hunting for more opportunities, now could be the perfect time to discover fast growing stocks with high insider ownership

Yet with Cirrus Logic’s shares surging this year, investors may be wondering whether the market has already factored in the company’s robust growth, or if there is still a genuine buying opportunity ahead.

Most Popular Narrative: 12.2% Undervalued

Cirrus Logic’s most widely followed narrative puts its fair value above the latest closing price, sending a positive signal amid renewed investor interest. The stage is set by bullish assumptions around core market strength and breakthrough diversification initiatives, inviting a deeper look at what is driving the optimism.

Cirrus Logic is expanding beyond its core smartphone audio business by increasing the value and breadth of its high-performance mixed signal solutions, particularly in areas like camera controllers, battery/power management, and sensing. This strategic diversification positions the company to capture new revenue streams and reduce customer concentration risk. This can drive higher revenue growth and bolster earnings stability over time.

What is the real financial engine powering this premium valuation? The answer lies in significant shifts in revenue mix and margin expectations, along with a future profit multiple comparable to industry heavyweights. Only in the full narrative are the bold assumptions and projected numbers revealed. Can you guess what the analysts are really pricing in?

Result: Fair Value of $135.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Cirrus Logic’s high customer concentration and potential slow adoption in PCs and automotive. Both of these factors could challenge future growth.

Find out about the key risks to this Cirrus Logic narrative.

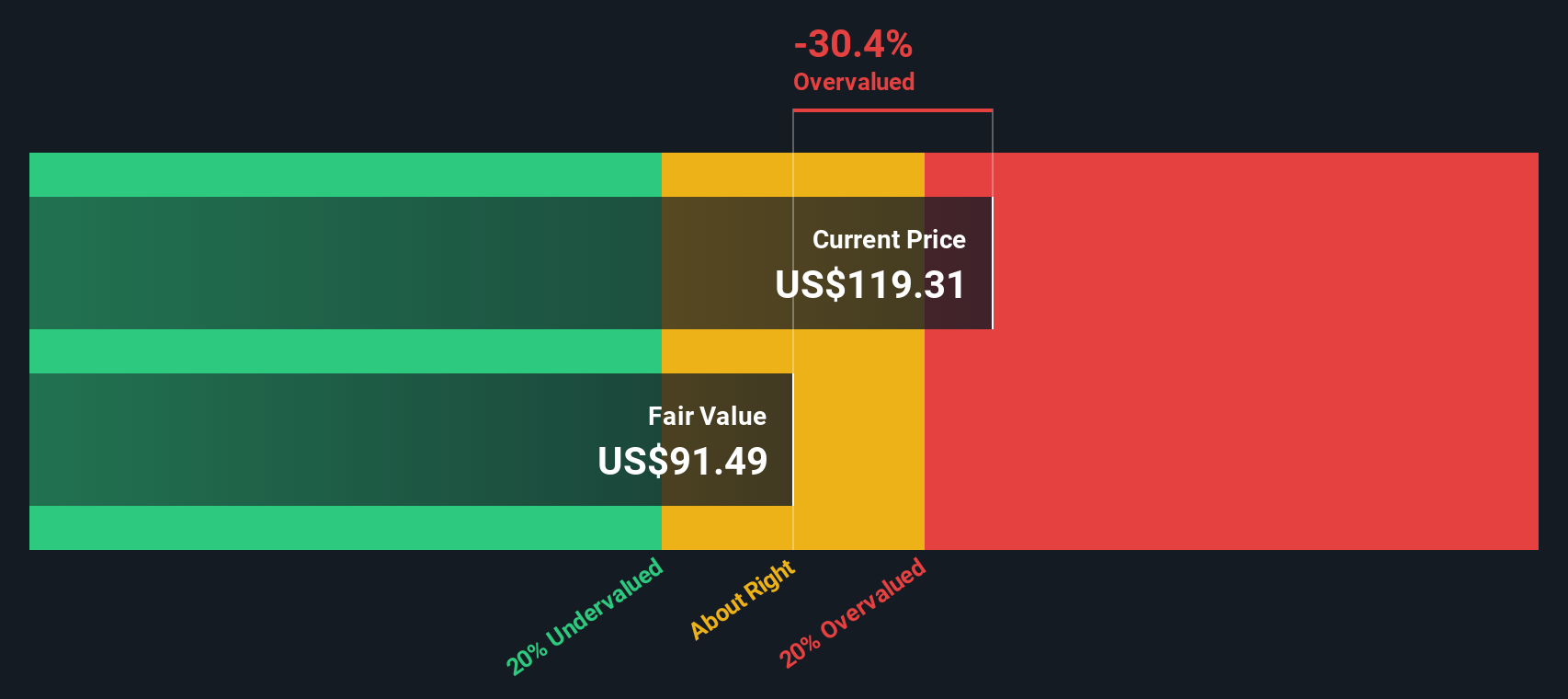

Another View: SWS DCF Model Offers a Different Perspective

While multiples show Cirrus Logic stacking up well against its peers, our DCF model tells a more cautious story. According to this approach, the stock is trading above its fair value estimate, which suggests current prices may already reflect much of the optimism. Could this mean investors should pause, or does the market still see untapped upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cirrus Logic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cirrus Logic Narrative

If you see things differently or want to dig into the numbers for your own perspective, you have all the tools to build your view in just a few minutes. Do it your way

A great starting point for your Cirrus Logic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make your next move count with a fresh look at stocks that could transform your strategy. There are exciting opportunities you don't want to miss out on.

- Supercharge your portfolio with high-yield picks by jumping into these 16 dividend stocks with yields > 3% that consistently deliver reliable income.

- Stay on the tech frontier and gain an edge by checking out these 25 AI penny stocks riding the accelerating wave of artificial intelligence innovation.

- Capitalize on market underdogs and spot tomorrow’s winners among these 879 undervalued stocks based on cash flows trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRUS

Cirrus Logic

A fabless semiconductor company, develops mixed-signal processing solutions and audio products in China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives