- United States

- /

- Software

- /

- NasdaqGS:MNDY

US Growth Stocks Insiders Own With Up To 94% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights, buoyed by strong bank earnings and favorable inflation data, investors are increasingly optimistic about the economic outlook. In this environment of record-breaking indices, growth companies with significant insider ownership can be particularly appealing, as they often indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 34.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's explore several standout options from the results in the screener.

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and internationally, with a market cap of approximately $6.35 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, which generated $217.59 million.

Insider Ownership: 14.0%

Earnings Growth Forecast: 95% p.a.

Credo Technology Group Holding has seen substantial insider buying, indicating confidence in its growth potential. Despite recent volatility, the company is forecasted to achieve high revenue growth at 32.5% annually, surpassing market averages. Credo's recent product launch of 800G HiWire ZeroFlap AECs for AI networks highlights its innovation focus. However, shareholder dilution and significant insider selling in the past quarter are notable concerns amidst expected profitability within three years and a strong return on equity forecast.

- Dive into the specifics of Credo Technology Group Holding here with our thorough growth forecast report.

- The analysis detailed in our Credo Technology Group Holding valuation report hints at an inflated share price compared to its estimated value.

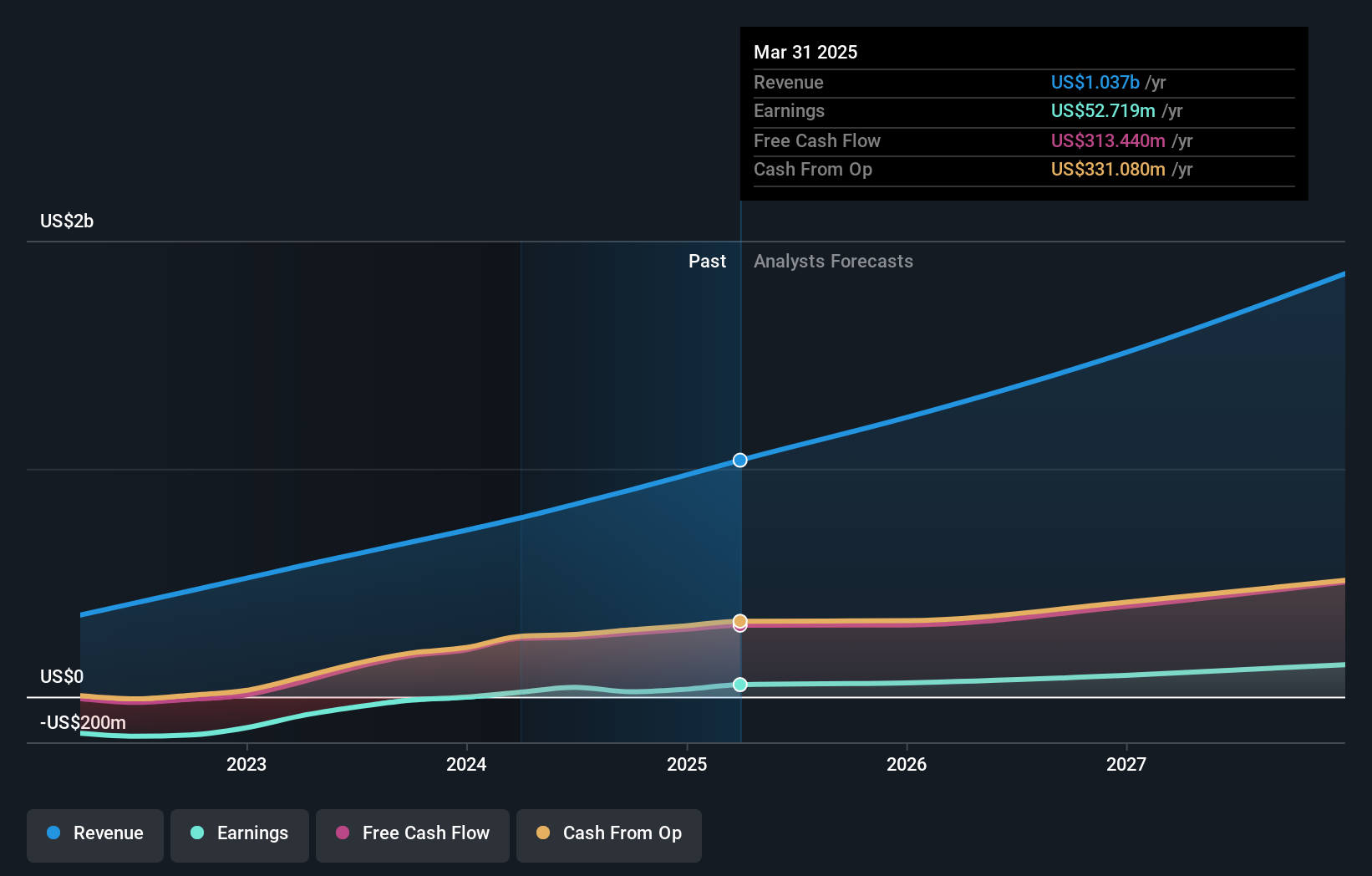

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: monday.com Ltd. develops software applications globally, including in the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $14.44 billion.

Operations: The company's revenue segment is primarily derived from Internet Software & Services, totaling $844.78 million.

Insider Ownership: 15.7%

Earnings Growth Forecast: 28.2% p.a.

monday.com is experiencing robust growth, with revenue expected to rise over 20% annually, outpacing the US market. Recent earnings reports show a transition to profitability, with net income reaching US$14.32 million in Q2 2024. Despite past shareholder dilution and trading below fair value estimates, the company projects strong earnings growth of 28.2% per year. The recent launch of its Portfolio management solution aims to enhance enterprise productivity and aligns with its multi-product strategy.

- Click here to discover the nuances of monday.com with our detailed analytical future growth report.

- Our valuation report here indicates monday.com may be overvalued.

VSE (NasdaqGS:VSEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VSE Corporation is a diversified aftermarket products and services company operating in the United States with a market cap of approximately $1.65 billion.

Operations: The company's revenue is derived from two main segments: Fleet, contributing $312.91 million, and Aviation, generating $661.27 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 58.8% p.a.

VSE Corporation shows potential for growth, with earnings forecasted to increase significantly, outpacing the US market. Despite recent financial challenges and significant insider selling, the company is undergoing strategic changes with new executive appointments aimed at bolstering growth strategies. Revenue is projected to grow faster than the overall market but remains below 20% annually. The stock trades substantially below its estimated fair value, indicating possible undervaluation amidst these developments.

- Take a closer look at VSE's potential here in our earnings growth report.

- Our valuation report here indicates VSE may be undervalued.

Key Takeaways

- Investigate our full lineup of 181 Fast Growing US Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.