- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

It Looks Like The CEO Of Credo Technology Group Holding Ltd (NASDAQ:CRDO) May Be Underpaid Compared To Peers

Key Insights

- Credo Technology Group Holding's Annual General Meeting to take place on 13th of October

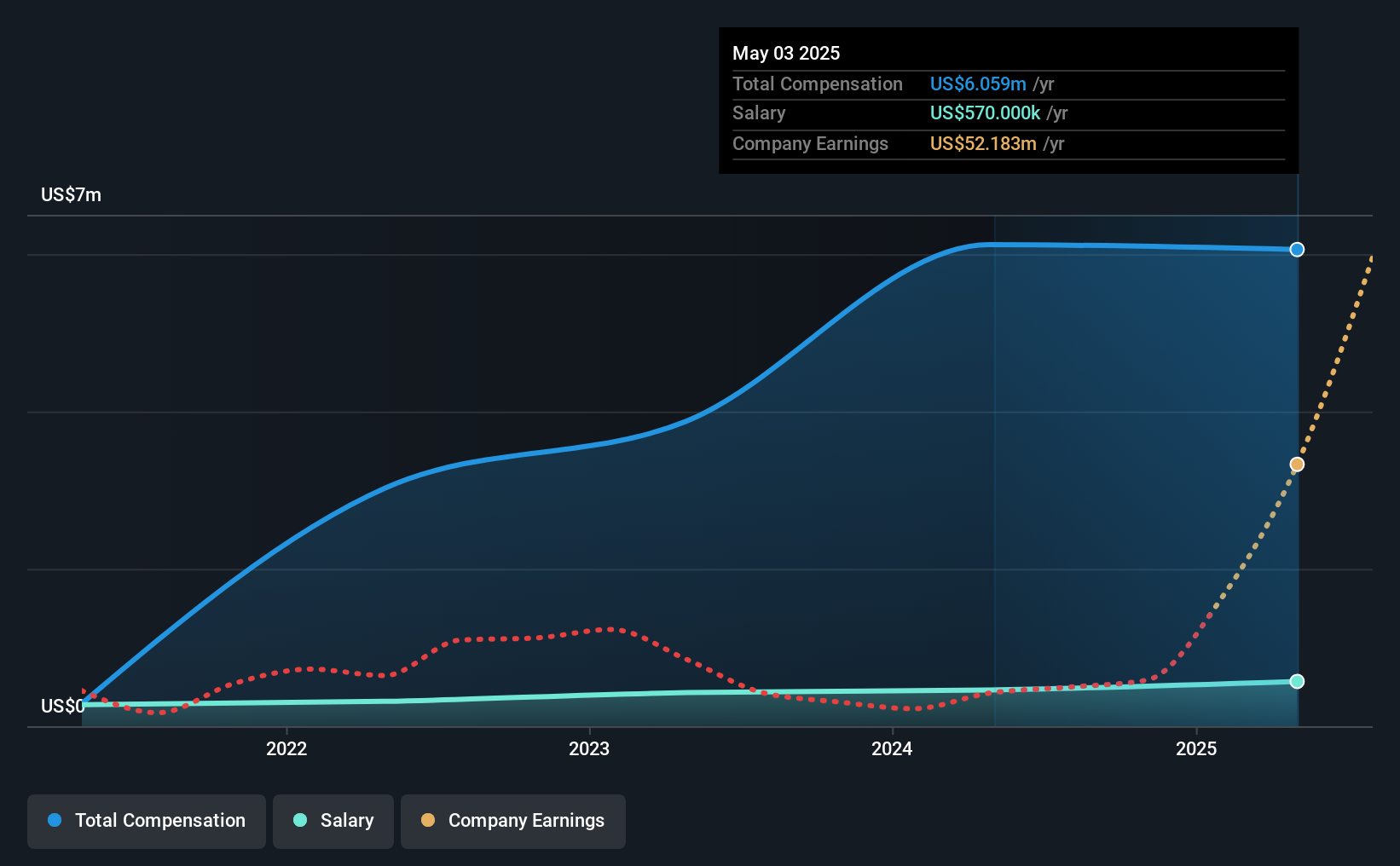

- CEO Bill Brennan's total compensation includes salary of US$570.0k

- The overall pay is 71% below the industry average

- Credo Technology Group Holding's EPS grew by 81% over the past three years while total shareholder return over the past three years was 1,326%

The solid performance at Credo Technology Group Holding Ltd (NASDAQ:CRDO) has been impressive and shareholders will probably be pleased to know that CEO Bill Brennan has delivered. This would be kept in mind at the upcoming AGM on 13th of October which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

Check out our latest analysis for Credo Technology Group Holding

How Does Total Compensation For Bill Brennan Compare With Other Companies In The Industry?

Our data indicates that Credo Technology Group Holding Ltd has a market capitalization of US$25b, and total annual CEO compensation was reported as US$6.1m for the year to May 2025. This means that the compensation hasn't changed much from last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$570k.

On comparing similar companies in the American Semiconductor industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$21m. Accordingly, Credo Technology Group Holding pays its CEO under the industry median. Furthermore, Bill Brennan directly owns US$300m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$570k | US$461k | 9% |

| Other | US$5.5m | US$5.7m | 91% |

| Total Compensation | US$6.1m | US$6.1m | 100% |

Speaking on an industry level, nearly 12% of total compensation represents salary, while the remainder of 88% is other remuneration. It's interesting to note that Credo Technology Group Holding allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Credo Technology Group Holding Ltd's Growth

Over the past three years, Credo Technology Group Holding Ltd has seen its earnings per share (EPS) grow by 81% per year. It achieved revenue growth of 176% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Credo Technology Group Holding Ltd Been A Good Investment?

Most shareholders would probably be pleased with Credo Technology Group Holding Ltd for providing a total return of 1,326% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Credo Technology Group Holding that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success