- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (NasdaqGS:CRDO) Sees US$37 Million Net Income Turnaround

Reviewed by Simply Wall St

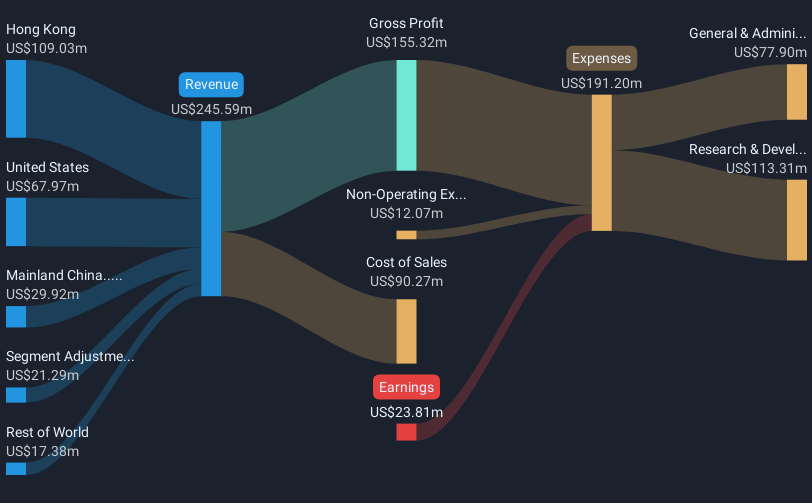

Credo Technology Group Holding (NasdaqGS:CRDO) saw a significant share price increase of nearly 80% over the last quarter, coinciding with strong financial performance and strategic product introductions. The company's Q4 revenue grew to $170 million, with a net income turnaround to $37 million compared to a loss last year. Meanwhile, the launch of the PILOT platform and positive fiscal 2026 guidance potentially bolstered investor confidence. Despite market volatility driven by geopolitical tensions in the Middle East and mixed economic data, Credo's robust earnings report and innovative product developments likely offered a positive counterbalance, supporting its substantial stock price ascent.

You should learn about the 2 risks we've spotted with Credo Technology Group Holding.

The recent achievements of Credo Technology Group Holding, featuring substantial revenue growth and innovative product introductions, significantly influence the company's narrative. By venturing into PCIe products and AEC business, Credo is poised to diversify its revenue streams and amplify revenue growth potential. The promising fiscal 2026 guidance highlights anticipated earnings improvements, generally enhancing market sentiment regarding Credo's financial trajectory.

Over the past three years, Credo's total shareholder return was very large, exemplifying substantial long-term share price gains. When compared to the previous year, Credo outshone the US Semiconductor industry, which returned 4.1%, and the broader US market, with a 10.9% gain, thus reflecting its compelling performance.

The positive news regarding financials and product development may lead analysts to revise revenue and earnings projections upward. Forecasts suggest a robust revenue trajectory of 40.8% annual growth over three years, propelled by a strategic focus on PCIe and optical DSP technologies. While risks such as customer concentration persist, successful market adoption could ease these concerns. With the current share price at US$43.21, investors may see a 36% increase to the analyst-consensus price target of US$67.47, signaling potential upside if forecasts materialize as anticipated.

Learn about Credo Technology Group Holding's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives