- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group (CRDO): Assessing Valuation Following Weaver Gearbox Launch for AI Data Centers

Reviewed by Simply Wall St

Credo Technology Group Holding (CRDO) revealed its new Weaver memory fanout gearbox, targeting the memory bottleneck challenges in AI accelerator and data center markets. This product launch could reshape conversations about memory scalability for next generation AI applications.

See our latest analysis for Credo Technology Group Holding.

Credo’s launch of the Weaver gearbox arrived just as its momentum in the market accelerated, with a 1-year total shareholder return of 266% and a remarkable 907% over three years. Despite short-term volatility, the company’s latest technology move builds on strong sentiment and long-term growth expectations in the AI hardware space.

If advancements like Weaver have you eager for more, it’s a great time to check out opportunities in See the full list for free.

But with so much optimism already reflected in Credo’s soaring share price, is this a moment where the market is underestimating future upside? Or has the company’s rapid growth already been fully priced in?

Most Popular Narrative: 9.6% Undervalued

With Credo’s fair value pegged at $160.93 per share against a last close of $145.52, the most widely followed narrative finds more room for upside, even as current optimism runs high. The reasoning behind that valuation centers on the company’s continued innovation, customer expansion, and its unique position in AI networking.

“Secular demand growth, product innovation, customer diversification, and strategic industry positioning give Credo the potential for lasting sales expansion, margin gains, and reduced risk.”

Craving the details that justify this premium price? The key lies in forecasts for surging margins and future earnings that are anything but ordinary. Click through to see which bold assumptions are fueling these high hopes.

Result: Fair Value of $160.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if hyperscaler investment slows or competition in high-speed connectivity becomes tougher, the optimistic growth forecasts supporting Credo’s current valuation could quickly be challenged.

Find out about the key risks to this Credo Technology Group Holding narrative.

Another View: Market Multiples Send a Warning

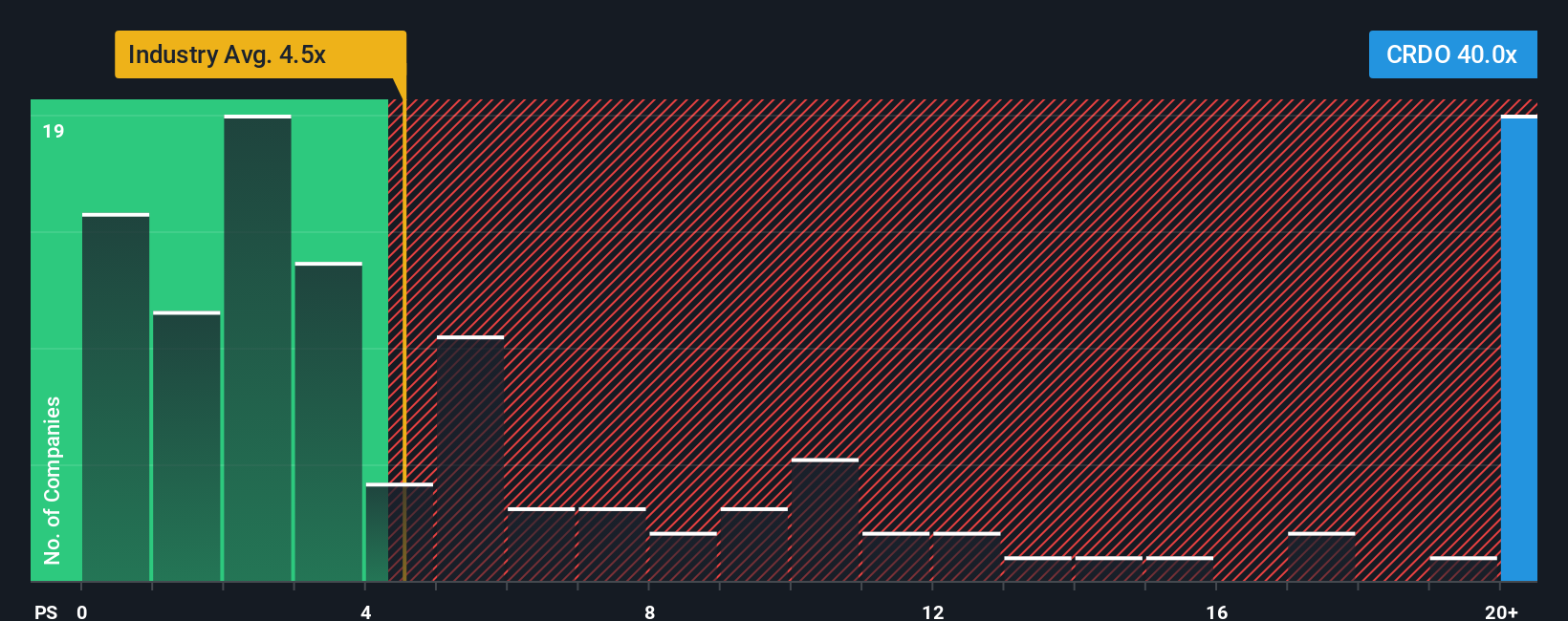

While optimism surrounds Credo’s fair value, current market multiples tell a more cautionary story. The company’s price-to-sales ratio stands at 41.9x, well above the US Semiconductor industry average of 5x and a peer average of 17x. Even compared to a fair ratio of 25.6x, Credo looks expensive. Such a premium signals elevated valuation risk. Investors may wonder how much higher the bar can be set before expectations become too lofty.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credo Technology Group Holding Narrative

Feel like the story could unfold differently, or think a fresh angle deserves to be explored? Dive into the data and craft your own narrative in just a few minutes, then see for yourself: Do it your way

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Unlock your next big win by checking out these handpicked stock ideas. Act now so you don’t miss out on opportunities other investors are watching closely:

- Tap into tomorrow’s tech giants by scanning these 25 AI penny stocks, which are currently gaining momentum from breakthroughs in artificial intelligence innovation.

- Capture reliable income with these 16 dividend stocks with yields > 3%, where strong dividend yields and healthy balance sheets help power stable returns.

- Spot companies trading below their intrinsic value by sizing up these 886 undervalued stocks based on cash flows and seize potential bargains before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives