- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology (CRDO): Revisiting Valuation After Upbeat Q2 Results and Growing AI Connectivity Optimism

Reviewed by Simply Wall St

Credo Technology Group Holding (CRDO) is back in the spotlight after Jim Cramer called it a winner, pointing to upbeat second quarter results and stronger sales guidance that reinforce its growing role in AI connectivity.

See our latest analysis for Credo Technology Group Holding.

The upbeat second quarter and bullish commentary follow a volatile stretch, with an 8.34% 1 day share price return and 111.66% year to date share price return. The 3 year total shareholder return above 1,000% shows momentum is still firmly intact.

If Credo’s move has you thinking about what else is working in AI infrastructure, it is a good moment to scan high growth tech and AI stocks for other potential standouts.

With revenue and profits accelerating and the share price already up triple digits this year, the key question now is whether Credo remains undervalued or if the market has already priced in its next leg of AI fueled growth.

Most Popular Narrative Narrative: 29.9% Undervalued

With Credo closing at $150.13 against a narrative fair value near $214, the most followed view sees meaningful upside anchored in AI led growth and margins.

The fair value estimate has risen meaningfully to about $214 from roughly $163, reflecting stronger growth and margin assumptions. The future P/E has declined to about 72.7 times from roughly 81.1 times, suggesting a slightly lower multiple despite higher earnings growth expectations.

Curious how faster revenue, fatter margins, and a still rich earnings multiple can all coexist in one story? The narrative connects aggressive growth forecasts with a premium but easing valuation bar, and leans on one core assumption that could make or break that upside case. Want to see exactly which financial lever drives that projected fair value?

Result: Fair Value of $214.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside relies on continued hyperscaler spending. Slower protocol adoption or rising competition could quickly pressure growth expectations and premium valuation multiples.

Find out about the key risks to this Credo Technology Group Holding narrative.

Another Lens on Valuation

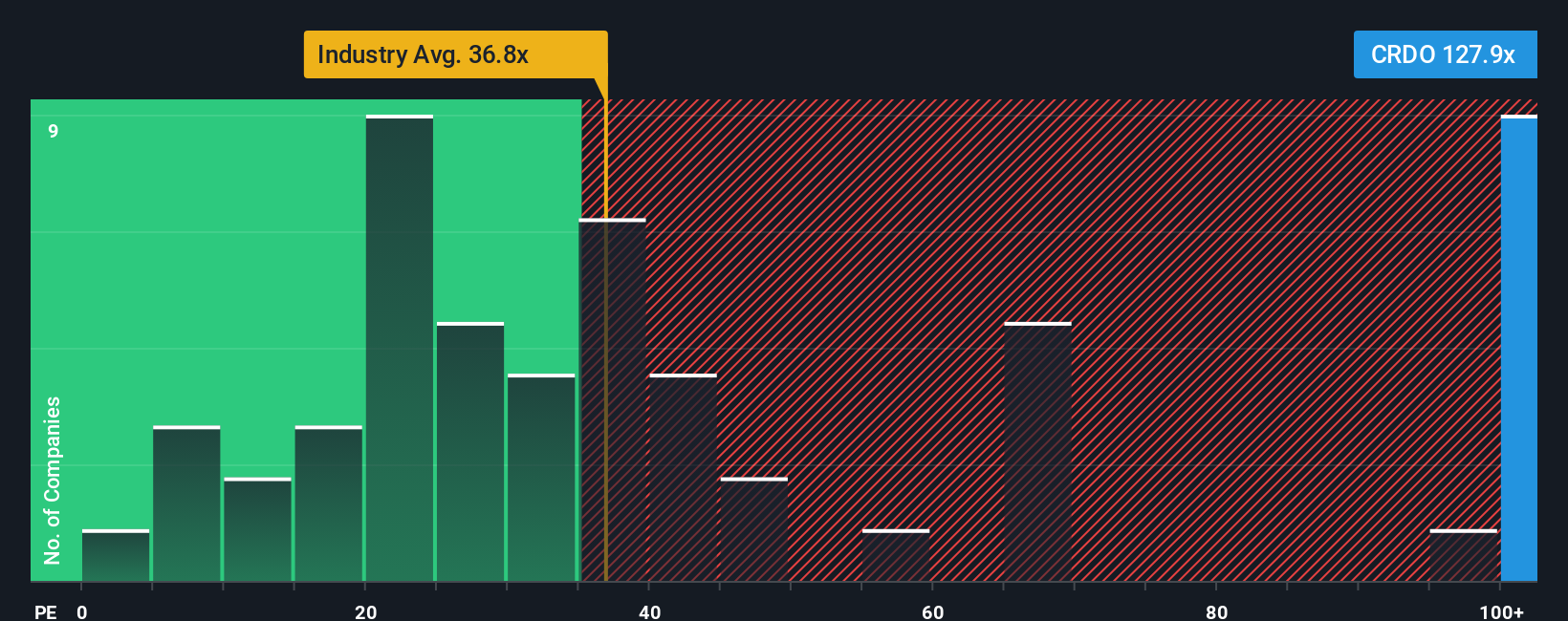

Step away from narrative fair value and Credo looks stretched. At 127.9 times earnings versus 36.8 times for the US semiconductor industry and a 69.3 times fair ratio, the gap implies a lot has to go right. Is that a buffer, or a trap, at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credo Technology Group Holding Narrative

If you see the numbers differently or want to pressure test your own thesis, you can build a custom Credo narrative in under three minutes: Do it your way.

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall St Screener to quickly spot fresh opportunities that fit your strategy before the market wakes up.

- Capitalize on misunderstood value by scanning these 914 undervalued stocks based on cash flows that may be priced below their cash flow potential and set up for powerful re ratings.

- Ride the next wave of innovation by targeting these 25 AI penny stocks positioned at the heart of machine learning, automation, and intelligent infrastructure growth.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion