- United States

- /

- Semiconductors

- /

- NasdaqGS:COHU

Cohu (NASDAQ:COHU) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Cohu, Inc. (NASDAQ:COHU) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Cohu

What Is Cohu's Net Debt?

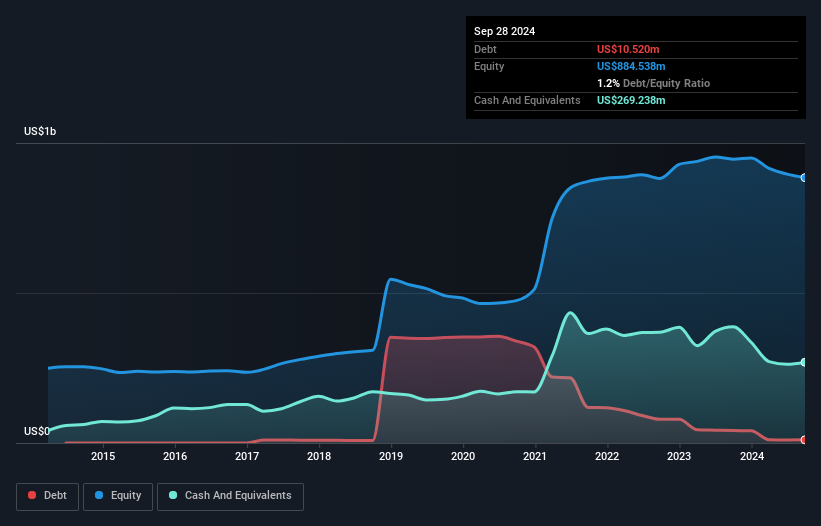

As you can see below, Cohu had US$10.5m of debt at September 2024, down from US$41.4m a year prior. But on the other hand it also has US$269.2m in cash, leading to a US$258.7m net cash position.

How Strong Is Cohu's Balance Sheet?

We can see from the most recent balance sheet that Cohu had liabilities of US$85.0m falling due within a year, and liabilities of US$62.8m due beyond that. Offsetting these obligations, it had cash of US$269.2m as well as receivables valued at US$91.9m due within 12 months. So it actually has US$213.4m more liquid assets than total liabilities.

This surplus suggests that Cohu is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Cohu boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Cohu's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Cohu had a loss before interest and tax, and actually shrunk its revenue by 36%, to US$445m. That makes us nervous, to say the least.

So How Risky Is Cohu?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Cohu had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$4.3m and booked a US$50m accounting loss. Given it only has net cash of US$258.7m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. For riskier companies like Cohu I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COHU

Cohu

Through its subsidiaries, provides semiconductor test equipment and services in the United States, China, Malaysia, the Philippines, Singapore, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.