- United States

- /

- Semiconductors

- /

- NasdaqGM:CAMT

Camtek (NASDAQ:CAMT) jumps 6.4% this week, though earnings growth is still tracking behind five-year shareholder returns

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. To wit, the Camtek Ltd. (NASDAQ:CAMT) share price has soared 320% over five years. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 21% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Since the stock has added US$76m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Camtek

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

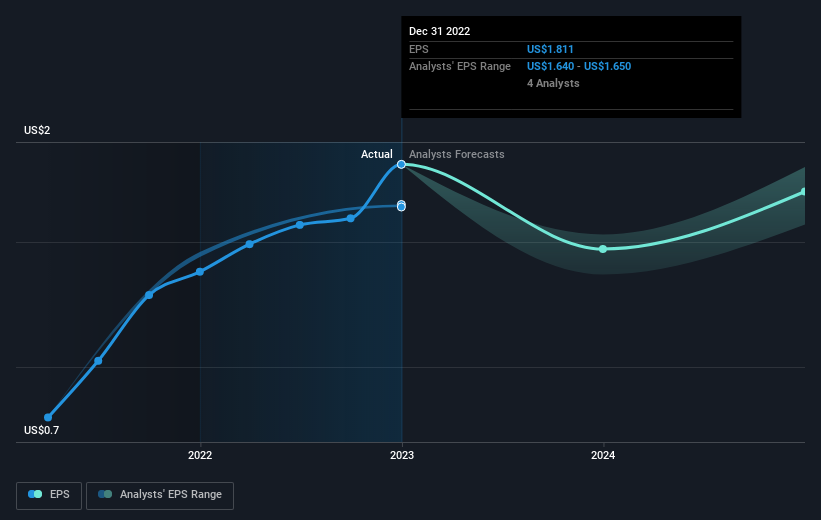

During five years of share price growth, Camtek achieved compound earnings per share (EPS) growth of 107% per year. The EPS growth is more impressive than the yearly share price gain of 33% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Camtek's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Camtek shareholders, and that cash payout contributed to why its TSR of 336%, over the last 5 years, is better than the share price return.

A Different Perspective

While it's never nice to take a loss, Camtek shareholders can take comfort that their trailing twelve month loss of 1.0% wasn't as bad as the market loss of around 6.1%. Longer term investors wouldn't be so upset, since they would have made 34%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. Before deciding if you like the current share price, check how Camtek scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CAMT

Camtek

Develops, manufactures, and sells inspection and metrology equipment for semiconductor industry.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives