- United States

- /

- Semiconductors

- /

- NasdaqGS:AXTI

AXT, Inc. (NASDAQ:AXTI) Not Doing Enough For Some Investors As Its Shares Slump 26%

AXT, Inc. (NASDAQ:AXTI) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The last month has meant the stock is now only up 3.1% during the last year.

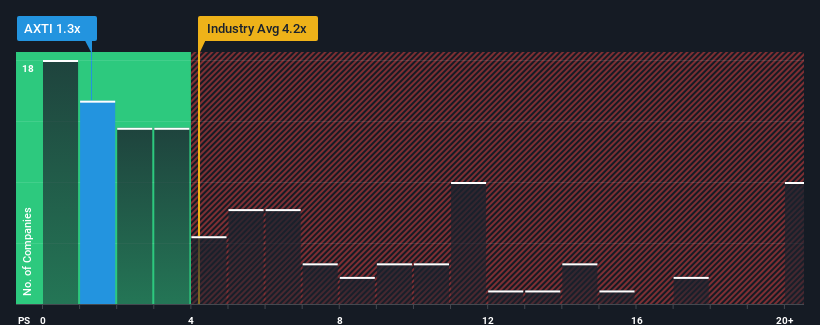

Following the heavy fall in price, AXT's price-to-sales (or "P/S") ratio of 1.3x might make it look like a strong buy right now compared to the wider Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4.2x and even P/S above 11x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for AXT

What Does AXT's Recent Performance Look Like?

While the industry has experienced revenue growth lately, AXT's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AXT.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, AXT would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 25% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 30% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 44%, which is noticeably more attractive.

With this information, we can see why AXT is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does AXT's P/S Mean For Investors?

Shares in AXT have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that AXT maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for AXT you should be aware of.

If these risks are making you reconsider your opinion on AXT, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AXTI

AXT

Designs, develops, manufactures, and distributes compound and single element semiconductor substrates.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.