- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO) Partners With OpenAI For AI Chip, Affirms US$0.59 Dividend

Reviewed by Simply Wall St

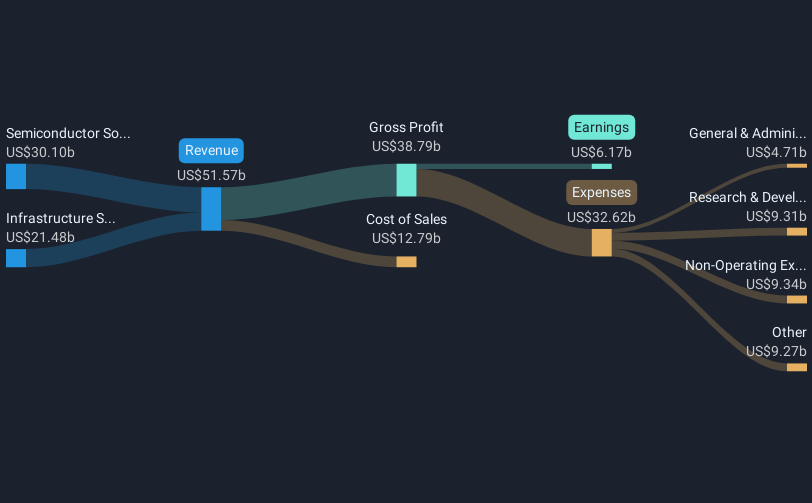

Broadcom (AVGO) recently announced its collaboration with OpenAI to produce an AI chip, enhancing its stature in the AI sector. This news, alongside a quarterly dividend confirmation and robust earnings guidance—highlighting a projected 24% revenue increase for Q4 FY2025—has reinforced positive investor sentiment. The company's strong performance has been further bolstered by its third-quarter results, reporting a significant jump in AI revenue. These pivotal developments in the AI space may have contributed to Broadcom's share price surge of 24% over the last quarter, complementing broader tech market trends.

Every company has risks, and we've spotted 2 risks for Broadcom you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Broadcom's partnership with OpenAI to develop an AI chip could significantly influence its growth narrative by solidifying its position in the AI sector. This strategic collaboration is expected to drive further AI revenue, aligning well with the company's ongoing investments in AI technology and partnerships with hyperscale customers. This move could positively impact future revenue and earnings, supporting analyst projections of a 20.4% annual revenue growth over the next three years.

Over the last five years, Broadcom's total return has been very large at 866.27%, underlining the company's robust long-term performance. Contextually, this eclipses the 47% return of the US Semiconductor industry over the past year, showcasing Broadcom's exceptional growth trajectory compared to its peers.

The recent developments, coupled with strong quarterly earnings and AI revenue growth, have helped Broadcom's stock surge by 24% in the last quarter. However, its current share price of US$306.10 is closely aligned with the consensus price target of approximately US$307.57, indicating a minimal discount and suggesting analysts view the stock as fairly valued. This alignment may reflect confidence in the projected growth of earnings to US$42.4 billion by 2028, necessitating an eventual price-to-earnings adjustment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026