- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO): Exploring Valuation After Strong 12-Month Share Price Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for Broadcom.

After an impressive year, Broadcom’s share price cooled off recently with a 9.8% decline over the past month. However, longer-term momentum remains clearly positive thanks to an 81% total shareholder return in the past year alone. Short-term volatility aside, investors seem to be recalibrating expectations after such a strong extended run, with the stock’s fundamentals still providing plenty for bullish holders to like.

If you’re keeping an eye on semiconductors or tech momentum, it might be the perfect moment to discover See the full list for free.

With Broadcom trading below some analyst price targets and boasting robust growth, the real question for investors is whether the market has already factored in its strong future prospects or if a genuine buying window remains open.

Most Popular Narrative: 12.3% Undervalued

Broadcom’s most popular narrative pegs its fair value at $370.36 per share, which stands notably above the latest close of $324.63. The stage is set for a deeper dive, with numbers and industry momentum pushing this price projection.

Broadcom is experiencing accelerating demand for custom AI accelerators (XPUs) from hyperscale and large language model customers, underscored by the addition of a major fourth customer and a strengthened backlog, indicating robust multi-year revenue growth in the AI semiconductor segment.

Curious how such a premium price gets justified? The underlying narrative blends ambitious future growth assumptions and a bold view on profit margins with a sky-high profit multiple rarely seen outside the most hyped tech stories. But which numbers are doing the heavy lifting here? The answers might surprise you. Unpack the building blocks behind this valuation and see why the consensus is betting big on Broadcom.

Result: Fair Value of $370.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential pitfalls lurk, including customer concentration risk and mounting competitive pressures. These factors could quickly alter Broadcom’s growth outlook.Find out about the key risks to this Broadcom narrative.

Another View: Multiples Tell a Different Story

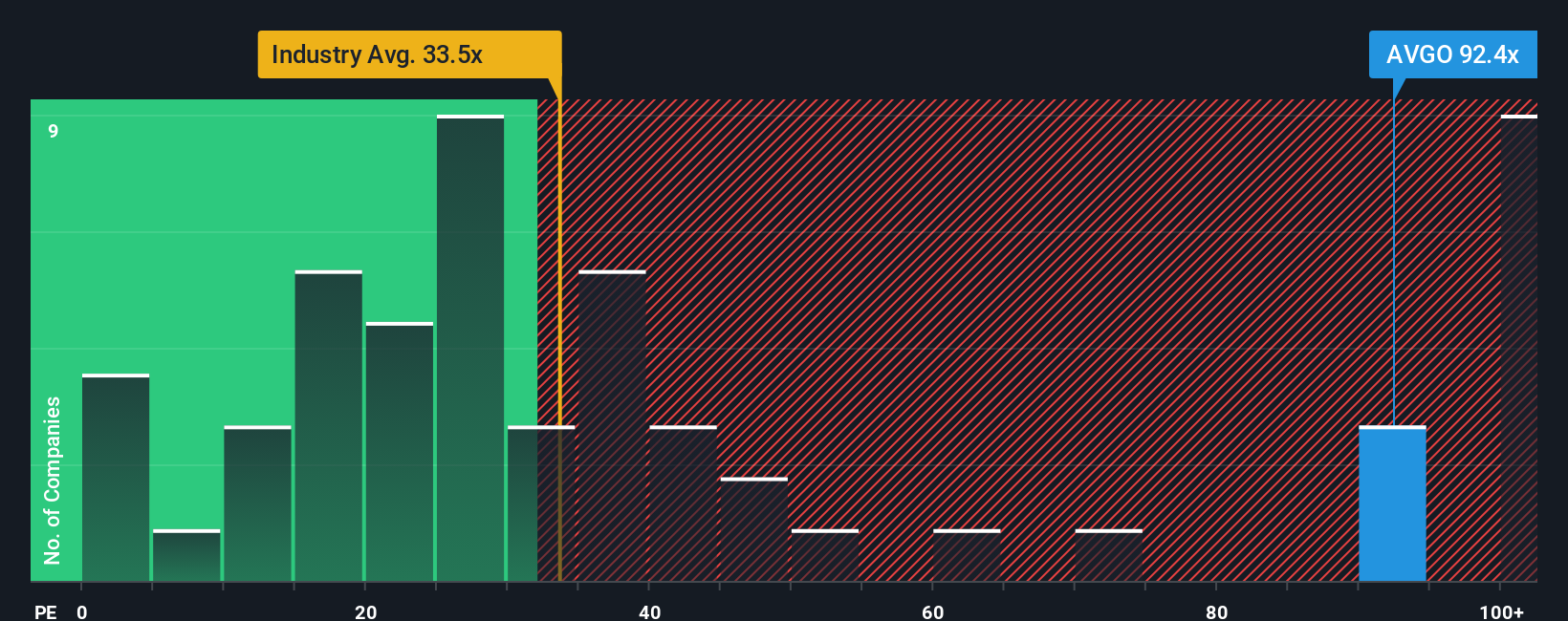

Looking through a different lens, Broadcom’s current price-to-earnings ratio sits at 81.5x, far above both its peer average (54.3x) and the industry average (35.3x). Even compared to its fair ratio of 60.8x, the gap suggests investors are paying a hefty premium for growth. Is this optimism justified, or does it heighten future downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If you want to dig deeper or take a different approach, you can piece together your own perspective in just a few minutes. Do it your way

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to broaden your portfolio? Don’t let standout opportunities pass you by when you could be ahead of the crowd with the right research tools.

- Catch the next wave of tech growth by targeting high-potential companies, starting with these 24 AI penny stocks, which are powering AI innovation and redefining what’s possible in the market.

- Secure steady income in any market by checking out these 19 dividend stocks with yields > 3%, where you’ll find strong-yielding stocks well-suited for long-term investors looking for reliable returns.

- Unlock forward-thinking investment trends and capitalize on tomorrow’s breakthroughs through these 26 quantum computing stocks, featuring pioneers in quantum computing with real momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.