- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO): Assessing Valuation After a Multi‑Month Share Price Rally

Reviewed by Simply Wall St

Broadcom stock extends strong multi month rally

Broadcom (AVGO) has been on a steady tear lately, with the stock up roughly 15% over the past month and nearly 20% in the past 3 months, catching investors attention.

See our latest analysis for Broadcom.

That surge sits on top of a huge run, with the share price up strongly year to date and a powerful multi year total shareholder return that suggests momentum is still very much building as investors re rate Broadcom’s growth story.

If Broadcom’s strength has you thinking about what else is working in tech and chips, this could be a good moment to explore high growth tech and AI stocks.

With Broadcom delivering rapid earnings growth and a huge multi year run, investors now face a tougher question: is AVGO still trading below its true potential, or are markets already fully pricing in the next leg of growth?

Most Popular Narrative: 0.6% Undervalued

With Broadcom last closing at $401.10 against a narrative fair value of about $403.66, the story suggests a slightly positive potential upside from here.

The analysts have a consensus price target of $360.199 for Broadcom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $415.56, and the most bearish reporting a price target of just $218.0.

Want to see how ambitious revenue growth, rising margins, and a rich future earnings multiple all fit together? The full narrative describes the overall framework.

Result: Fair Value of $403.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated AI customer exposure and ongoing VMware integration risks could quickly challenge today’s upbeat assumptions if spending slows or execution wobbles.

Find out about the key risks to this Broadcom narrative.

Another Angle on Valuation

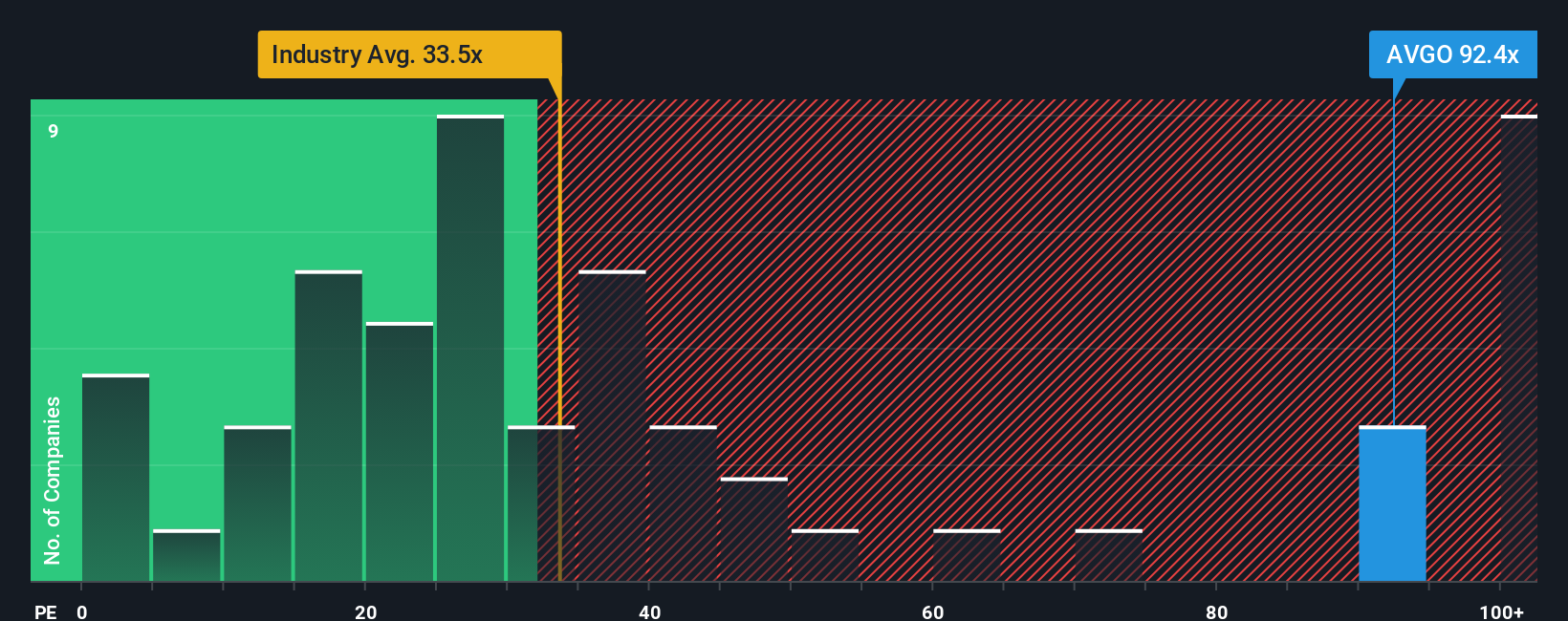

While the narrative fair value pegs Broadcom as modestly undervalued, its 100.7x price to earnings ratio tells a tougher story. That is far above both the US semiconductor average of 38x and a fair ratio of 66x, and it raises real questions about how much future growth is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If you are not fully convinced or would rather examine the numbers yourself, you can build a fresh, personalized view in minutes using Do it your way.

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before markets shift again, use the Simply Wall St Screener to uncover fresh opportunities you might regret missing, tailored to the themes that matter most to you.

- Capture early stage growth by scanning these 3593 penny stocks with strong financials that pair small market caps with resilient financials.

- Position yourself at the forefront of automation by targeting these 27 AI penny stocks powering developments across software, data centers and intelligent devices.

- Focus on quality at sensible prices by reviewing these 908 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in market valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026