- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Assessing Broadcom (AVGO) Valuation After A Recent Pullback In Share Price

Reviewed by Simply Wall St

Broadcom’s recent performance snapshot

Broadcom (AVGO) has drawn attention after a recent pullback, with the stock down about 1% over the past day, 2% over the past week and roughly 12% over the past month.

See our latest analysis for Broadcom.

The recent pullback comes after a strong run, with Broadcom’s 1-year total shareholder return of 51.56% and a very large 3-year total shareholder return. This suggests that momentum is cooling rather than accelerating at the current share price of $343.42.

If Broadcom’s move has you reassessing where growth and risk are shifting in chips and software, it could be a good moment to scan high growth tech and AI stocks for other potential ideas.

With Broadcom now at $343.42 after a strong multi year run and a 1 year total return above 50%, the key question is simple: are you looking at an undervalued compounder or a stock where future growth is already priced in?

Most Popular Narrative: 14.9% Undervalued

Broadcom’s most followed narrative sets fair value at about $403.66 per share versus the last close of $343.42, framing the current pullback as a gap between price and projected fundamentals at a 10.52% discount rate.

Broadcom is experiencing accelerating demand for custom AI accelerators (XPUs) from hyperscale and large language model customers, underscored by the addition of a major fourth customer and a strengthened backlog, indicating robust multi-year revenue growth in the AI semiconductor segment.

Want to see what kind of revenue curve and margin profile are being built into that fair value? The narrative leans on aggressive earnings expansion, a richer software mix, and a future earnings multiple that assumes Broadcom keeps its edge in high value AI and infrastructure workloads. Curious how those ingredients combine to justify a valuation above today’s price?

Result: Fair Value of $403.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if AI spending from a few key XPU customers slows, or if the VMware integration fails to deliver the expected software profitability.

Find out about the key risks to this Broadcom narrative.

Another View: Multiples Point To A Richer Price

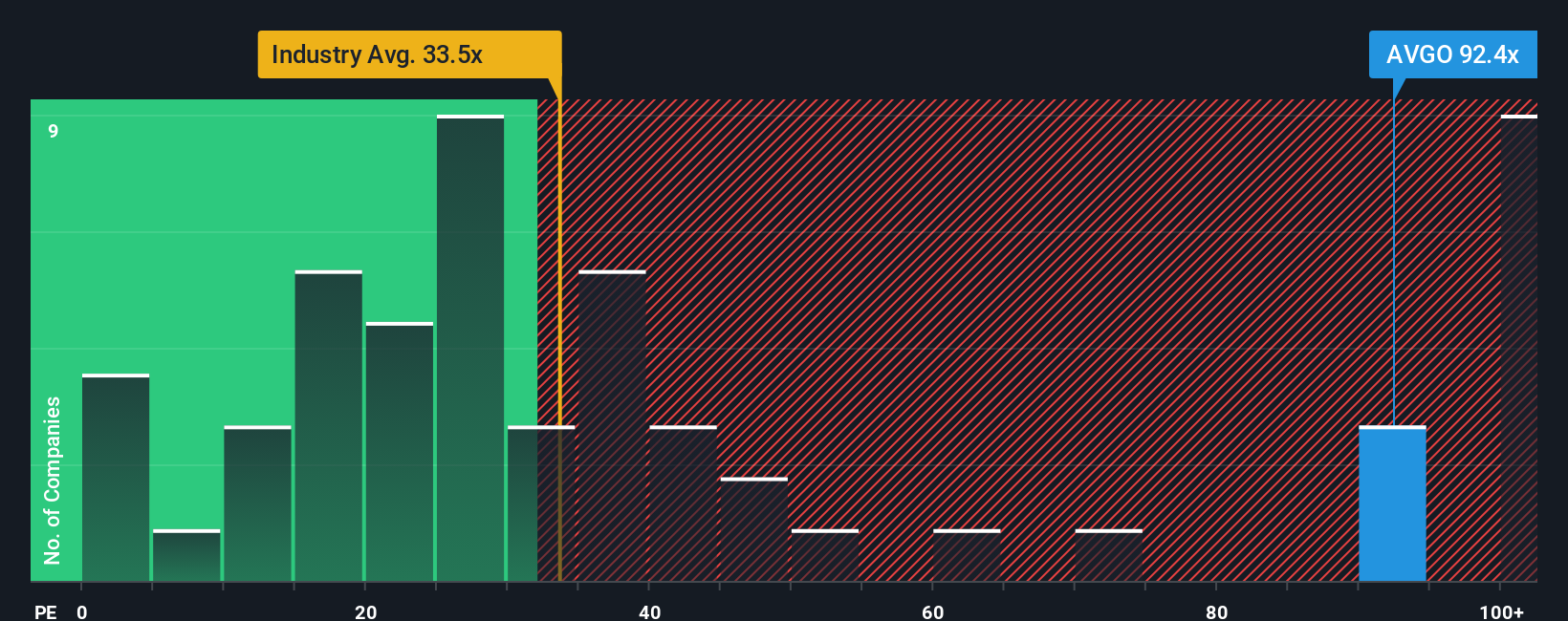

The popular narrative sees Broadcom as 14.9% undervalued, but its current P/E of 70.4x tells a different story. That is higher than both the US Semiconductor industry at 38.7x and Broadcom’s own fair ratio of 55.2x, which suggests valuation risk if expectations reset.

Investors are effectively paying a premium for Broadcom’s earnings today, on top of already strong growth forecasts. The practical question is simple: are you comfortable paying well above the industry and the fair ratio, or do you want a wider margin of safety before jumping in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If you see the numbers differently or prefer to rely on your own work, you can pull the data, test your assumptions, and build a custom view in a few minutes. Do it your way

A great starting point for your Broadcom research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Broadcom?

If you are serious about sharpening your watchlist, do not stop at one stock. Use the screener to spot opportunities others might overlook and stay ahead.

- Target dependable income by scanning these 14 dividend stocks with yields > 3% that can help anchor your portfolio with regular cash returns.

- Explore growth themes by checking these 25 AI penny stocks linked to artificial intelligence trends across different parts of the market.

- Look for potentially mispriced companies with these 878 undervalued stocks based on cash flows that our models flag as trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions internationally.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

West Africa's 20 Baggers Gold Play (Nigeria/Senegal)

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Micron's New Supercycle: Riding the High-Bandwidth Memory Wave

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale