- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (NasdaqGS:ARM) Declines 18% Amid Acquisition Decision

Reviewed by Simply Wall St

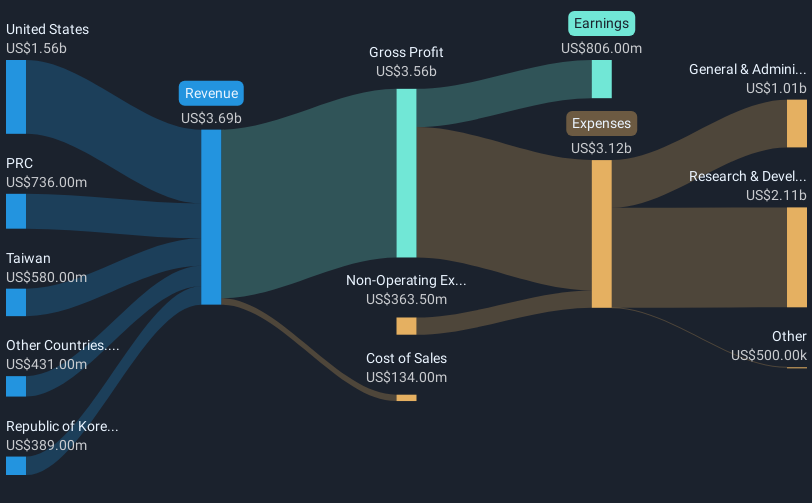

Arm Holdings (NasdaqGS:ARM) experienced an 18% decline in its share price last week. This negative movement was likely influenced by the broader market turmoil caused by tariff tensions, as tech-heavy indexes such as Nasdaq plummeted into bear market territory. Despite the company's recent exploration of an acquisition of Alphawave IP Group, Arm ultimately decided not to proceed, underscoring the challenging environment for mergers and acquisitions during such volatile periods. The overall market fell by 9%, impacted by widespread concerns over the economic implications of a potential trade war, further weighing on sentiment across the semiconductor sector.

Buy, Hold or Sell Arm Holdings? View our complete analysis and fair value estimate and you decide.

The recent news of Arm Holdings’ share price falling by 18%, amid broader market concerns over tariff tensions and potential trade wars, has introduced uncertainties into the company's growth narrative. This external market disruption, impacting the semiconductor sector substantially, could strain Arm's ambitious expansion plans and the predicted revenue upticks from its AI and data center segments. Amid these market conditions, Arm's decision to stop pursuing an acquisition of Alphawave IP Group may reflect the broader hesitation in the M&A landscape during periods of volatility.

Over the past year, Arm's total shareholder return, including share price movement and dividends, reached a decline of 29.73%. Compared to the dip in tech-heavy indices and the US semiconductor industry’s 10.7% decrease over the same period, Arm has underperformed, highlighting the firm-specific challenges alongside sector-wide pressures. Furthermore, in comparison to the overall US market's 3.4% drop during the year, Arm's performance remains significantly lower.

The recent market developments may influence analyst revenue and earnings forecasts significantly, casting doubt on meeting the anticipated revenue growth rate of 22.5% annually over the next few years. Arm's current share price of US$106.98 illustrates a 32.2% discount compared to the consensus analyst price target of US$157.68. However, the uncertain economic backdrop could affect investor confidence and realization of the projected earnings of $2.3 billion by April 2028.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Arm Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers rely on to develop products.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives