- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

Amkor Technology (AMKR) Is Up 25.8% After Intel Awards First High-End EMIB Packaging Mandate

Reviewed by Sasha Jovanovic

- In recent trading, Amkor Technology gained attention after reports that Intel outsourced its high-end EMIB chip packaging to Amkor’s South Korea facility, alongside Amkor’s stronger-than-expected third-quarter earnings and a positive analyst rating from Aletheia Capital.

- This marks the first time Intel has entrusted Amkor with such advanced packaging work, highlighting Amkor’s growing role in cutting-edge semiconductor manufacturing services.

- With this first-time EMIB outsourcing win from Intel, we’ll examine how the development reshapes Amkor’s investment narrative and competitive positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Amkor Technology's Investment Narrative?

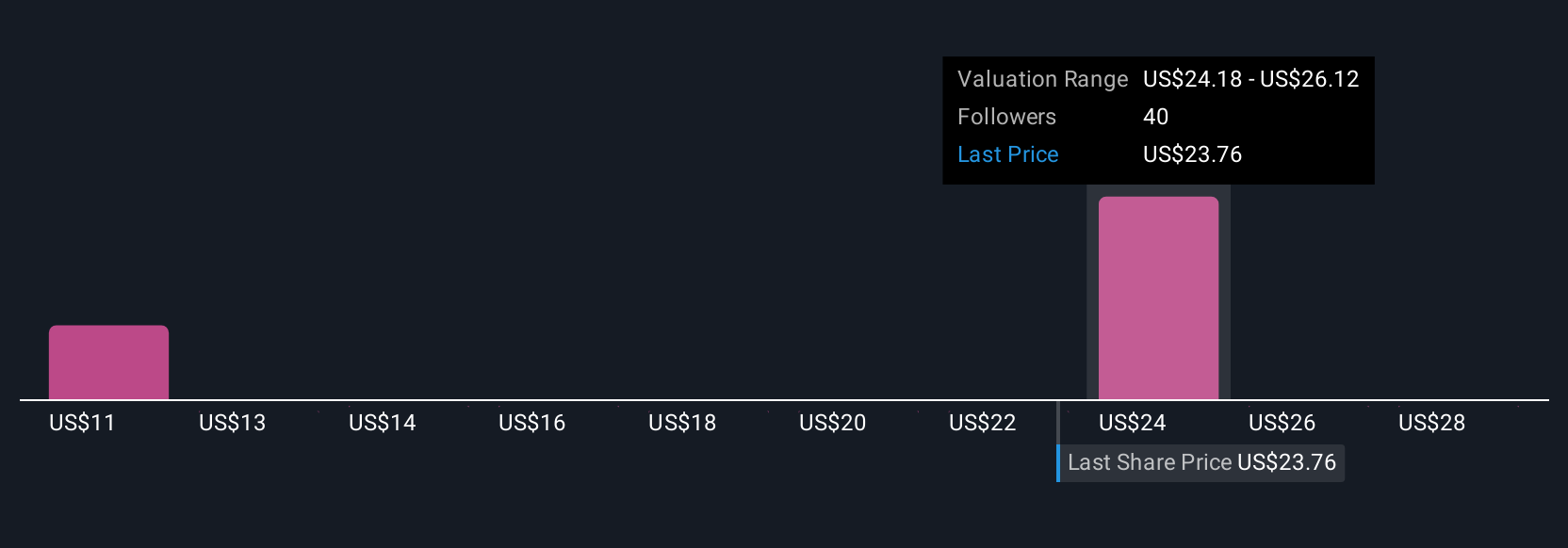

To own Amkor today, you really have to believe in the long-term demand for advanced outsourced chip packaging and testing, even if near-term profitability and returns on equity remain modest. The latest Intel EMIB outsourcing win reinforces that story by validating Amkor’s capabilities at the high end and potentially strengthening near-term revenue visibility, but it does not erase existing issues such as relatively low margins and earnings that have been uneven over the past five years. With the share price already up very strongly over the past quarter and trading above some earlier fair value estimates, the key short term catalyst is whether additional high-complexity packaging wins follow Intel’s move or whether this proves more one-off in nature. On the risk side, investors still need to watch execution, capital intensity and pricing discipline carefully.

However, investors should also be aware of how quickly expectations have shifted after the recent share price surge. Amkor Technology's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 8 other fair value estimates on Amkor Technology - why the stock might be worth less than half the current price!

Build Your Own Amkor Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Amkor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amkor Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026