- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Is AMD’s (AMD) ZAYA1 AI Milestone Shifting the Competitive Landscape for Advanced AI Workloads?

Reviewed by Sasha Jovanovic

- In November 2025, Zyphra announced it achieved a milestone by training ZAYA1, the first large-scale Mixture-of-Experts AI model entirely on an AMD GPU and networking platform, leveraging the AMD Instinct MI300X and Pensando technologies in collaboration with IBM Cloud infrastructure.

- This development showcases AMD's expanding capabilities in powering advanced AI workloads, highlighting not just technological progress but also growing industry partnerships and competitive benchmarks against leading open models.

- We'll now examine how news of major AI clients evaluating alternative suppliers, like Google's custom AI chips, could influence AMD's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Advanced Micro Devices Investment Narrative Recap

To be a shareholder in Advanced Micro Devices, you need to believe that AMD will capture significant long-term growth from rising AI adoption, expanding its data center and accelerator business while remaining competitive against other industry giants. The recent news of major cloud clients exploring alternatives like Google’s custom AI chips increases short-term uncertainty and highlights competitive risk, but the core catalyst, adoption of AMD's MI300/MI350 accelerators at scale, remains most important and is not immediately impacted in a material way.

Among the recent announcements, Zyphra’s milestone with the ZAYA1 Mixture-of-Experts model trained entirely on AMD hardware is especially relevant. This achievement highlights AMD’s growing ability to support advanced, large-scale AI workloads and strengthens its case as a viable supplier in production AI environments, supporting optimism around its accelerator portfolio as a near-term catalyst. The collaboration also reflects deepening partnerships within the industry, a key component for future growth expectations.

However, it’s equally important for investors to be aware that, in contrast, competitive pressure from custom AI chips, especially from large hyperscalers, could limit AMD’s...

Read the full narrative on Advanced Micro Devices (it's free!)

Advanced Micro Devices' outlook anticipates $46.2 billion in revenue and $9.0 billion in earnings by 2028. This projection implies an 18.5% annual revenue growth rate and an increase in earnings of $6.8 billion from the current $2.2 billion.

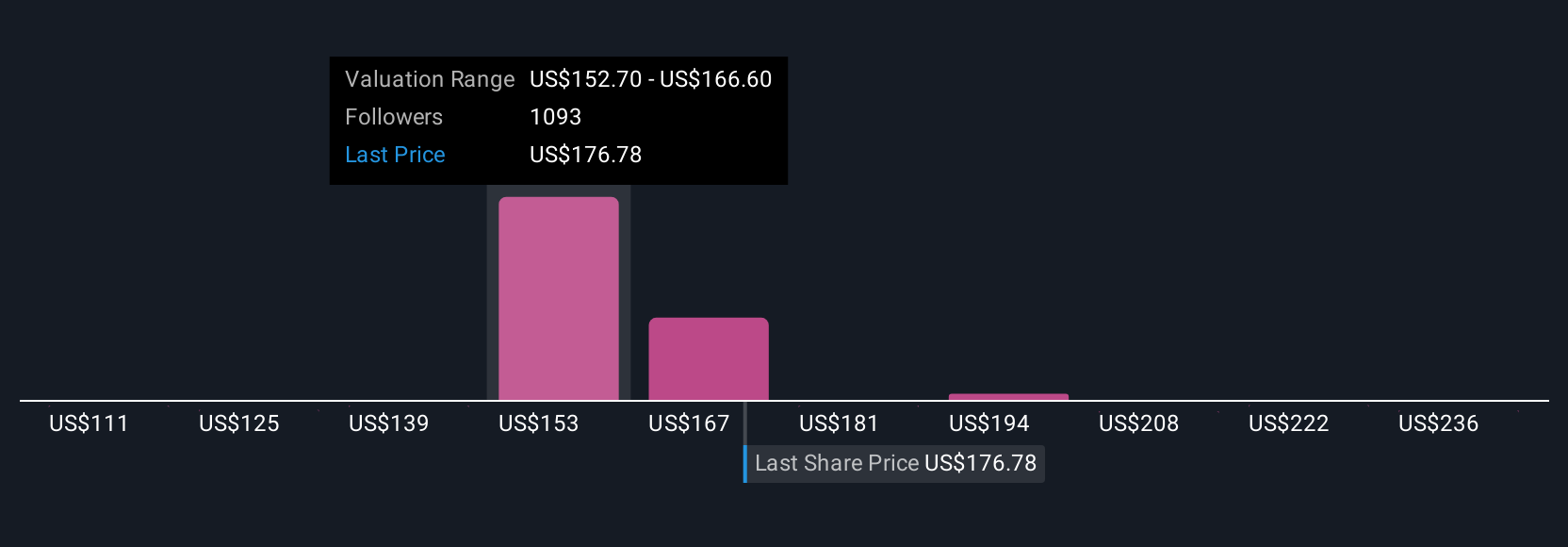

Uncover how Advanced Micro Devices' forecasts yield a $276.76 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Some of the highest analyst forecasts before this recent news were projecting AMD’s annual revenue could reach US$59.8 billion and earnings hit US$12.5 billion by 2028, assuming rapid AI expansion and strong margin gains. These optimistic outlooks hinge on AMD’s ability to outpace competition and ramp advanced architectures much faster than the consensus view. This shows how much opinions can vary, and why it's useful to explore a range of perspectives when considering where AMD might go next.

Explore 121 other fair value estimates on Advanced Micro Devices - why the stock might be worth 36% less than the current price!

Build Your Own Advanced Micro Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Micro Devices research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Advanced Micro Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Micro Devices' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.