- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Did You Miss Advanced Micro Devices's Whopping 922% Share Price Gain?

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. For example, the Advanced Micro Devices, Inc. (NASDAQ:AMD) share price is up a whopping 922% in the last three years, a handsome return for long term holders. On top of that, the share price is up 11% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Advanced Micro Devices

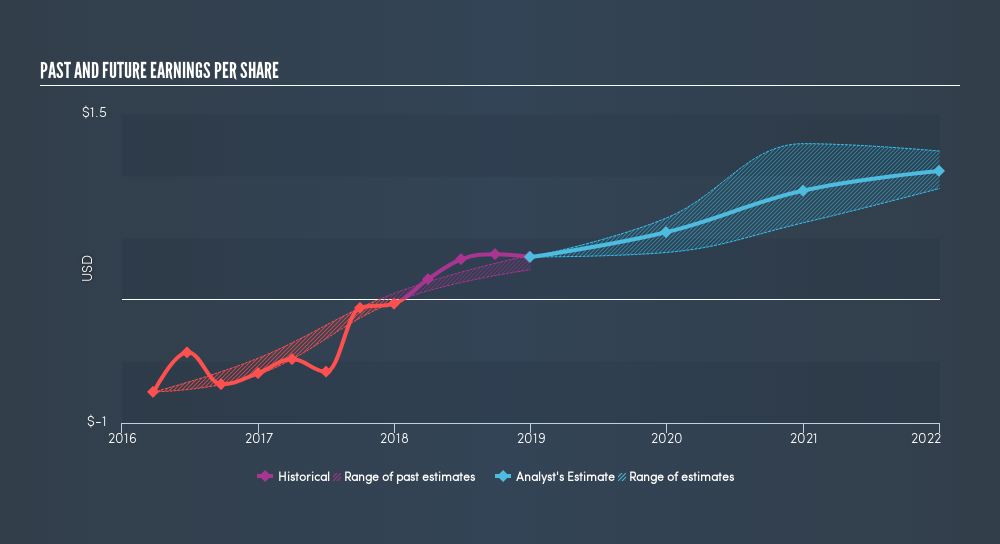

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Advanced Micro Devices moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Advanced Micro Devices has grown profits over the years, but the future is more important for shareholders. This free interactive report on Advanced Micro Devices's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Advanced Micro Devices shareholders have received a total shareholder return of 100% over the last year. That gain is better than the annual TSR over five years, which is 44%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on Advanced Micro Devices it might be wise to click here to see if insiders have been buying or selling shares.

But note: Advanced Micro Devices may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives