- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Assessing AMD (AMD) Valuation After Recent Pullback in a Longer-Term Uptrend

Advanced Micro Devices (AMD) has quietly drifted lower over the past month, even as its longer term returns stay strong, and that disconnect is exactly what has traders debating whether this pullback is a fresh entry point.

See our latest analysis for Advanced Micro Devices.

That recent 15.25% 1 month share price return slump looks more like a pause within a powerful uptrend, with a 31.42% 3 month share price return and 67.31% 1 year total shareholder return still signaling strong underlying momentum as investors reassess near term AI demand and valuation.

If AMD’s swingy moves have you thinking about what else could run, this is a good moment to explore other high growth tech and AI names via high growth tech and AI stocks.

With revenue and earnings still growing strongly and the stock trading at a sizable discount to analyst targets, is AMD now a rare chance to buy high quality AI exposure at value, or has the market already priced in its next leg of growth?

Most Popular Narrative: 22.5% Undervalued

Against AMD’s last close of $209.17, the most followed narrative sees materially higher long term value potential, framing today’s pullback as a valuation gap.

AMD has evolved into a formidable player in AI and enterprise compute, propelled by leadership in CPUs (EPYC) and a growing presence in GPUs (Instinct MI series). With solid revenue and earnings growth, strong analyst upgrades, and a valuation that still looks reasonable compared to peers, AMD is viewed by some as a balanced exposure to AI infrastructure growth.

Want to see how aggressive AI infrastructure demand, margin expansion, and a richer business mix combine into that upside view? The underlying projections may surprise you.

Result: Fair Value of $270.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case faces real tests if Nvidia’s AI lead persists and if export controls or tariffs squeeze AMD’s margins and growth in China.

Find out about the key risks to this Advanced Micro Devices narrative.

Another Angle on Valuation

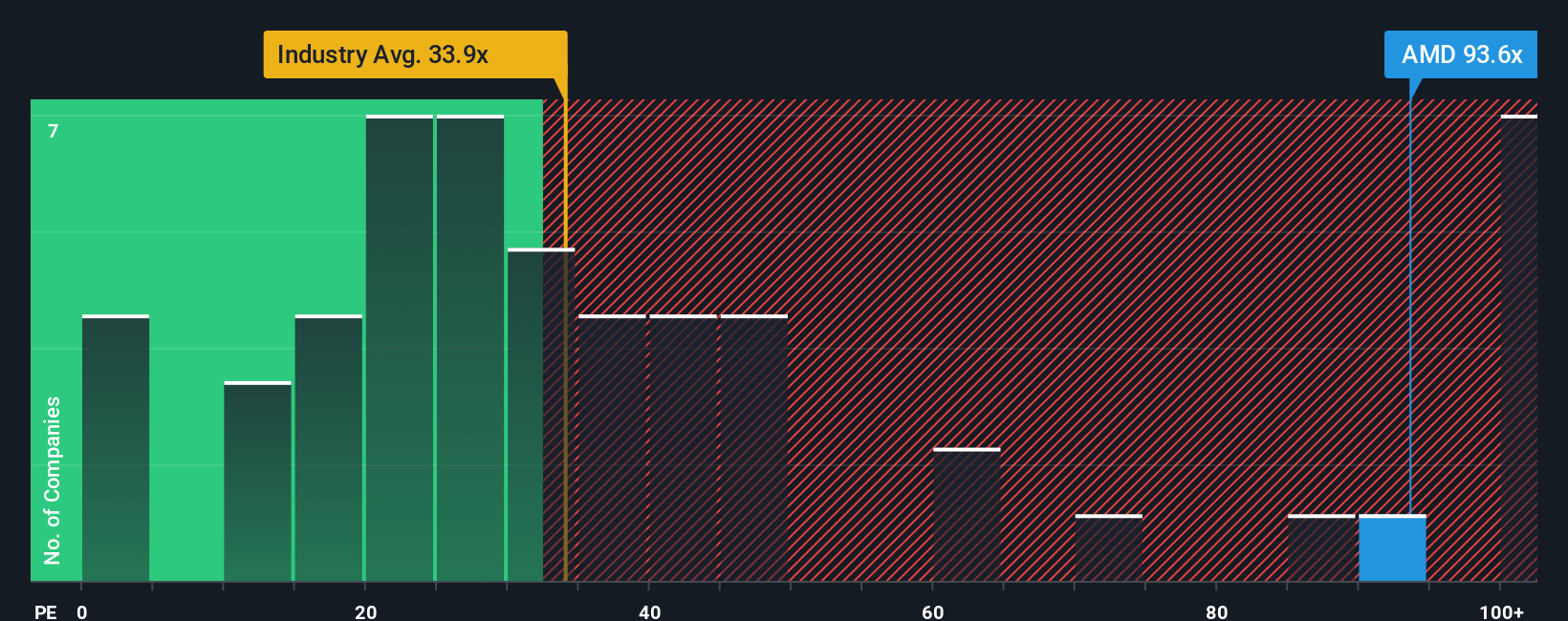

On earnings, the picture flips. AMD trades at about 108.8 times earnings versus 37.3 times for the US semiconductor industry and a fair ratio of 63.8 times, suggesting investors are paying a steep premium that could unwind quickly if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Micro Devices Narrative

If you would rather dive into the numbers yourself, challenge these assumptions, or build a different story around AMD, you can create a custom view in minutes, Do it your way.

A great starting point for your Advanced Micro Devices research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before AMD makes its next big move, take a moment to line up your wider watchlist so you are not chasing the market after it runs.

- Capture early stage momentum with these 3625 penny stocks with strong financials that already show solid financial footing instead of guessing which speculative names might survive.

- Target the next wave of AI infrastructure growth by screening for these 25 AI penny stocks poised to benefit as demand spreads beyond the current headline leaders.

- Consider focusing on these 911 undervalued stocks based on cash flows where prices currently trail underlying cash flow characteristics and prevailing market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Advanced Micro Devices

Operates as a semiconductor company internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

30 Baggers Silver Miner with Gold/VTM Optionality

13x Aussie Polymetal Silver/Zinc/Lead Project

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks