- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

AMD (NASDAQ:AMD): A Great Stock for the Long Run, but There are more Risks in the Near Term

Reviewed by Michael Paige

Key Takeaways from This Analysis:

- AMD has announced that third-quarter revenue will be ~14% lower than expected.

- Demand from the PC market has dropped substantially compared to previous quarters.

- AMD is well positioned for the long term, but there are risks to the share price in the medium term.

Advanced Micro Device's (Nasdaq: AMD) shares price fell sharply on Friday after the company released selected preliminary third-quarter results. In summary, the release indicated that revenue will be substantially lower than expected due to softer demand from the PC market.

Notable points from the announcement:

- AMD expects third-quarter revenue to be about $5.6 billion, compared to previous estimates of $6.7 billion. This will reflect year-on-year growth of 29% where it was previously expected to be 55%.

- The slowdown reflects lower demand from the PC market which has led to revenue for the Client segment falling ~40% year on year, and 53% from the second quarter.

- Data Center revenue is still expected to be 45% higher than a year ago, and revenue from the gaming segment will be 14% higher.

- Operating expenses are expected to be lower than expected, but the gross margin would also be lower than expected.

- This renewed guidance is really all about lower sales due to the PC market.

This news wasn’t a total surprise as analysts have been expecting a slowdown in the PC market. It’s also been reflected in the prices of most semiconductor stocks for the last few months. The question now is whether this news was already in the price, and could the slowdown spread to other semiconductor market segments?

See our latest analysis for AMD

Was this news already in the price?

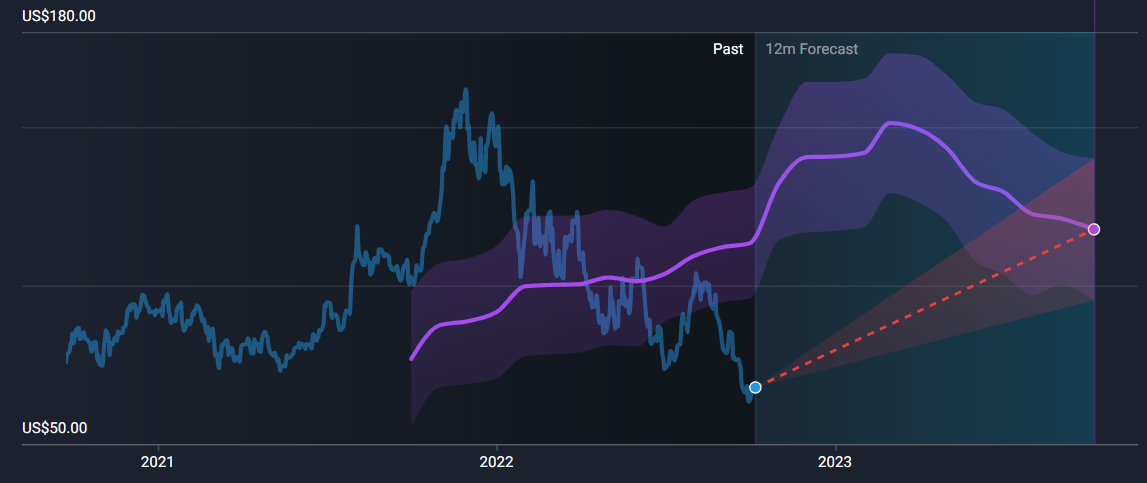

While the slowdown in PC demand has been expected, analysts have been quite bullish on the stock based on the valuation. Current 12-month price targets average $117, implying a 73% upside. However, as the chart below reflects there’s a wide range between the highest and lowest targets. This typically means we can’t be very confident about the average target price.

The general opinion in the market seems to be that AMD is quite reasonably valued. But that assumes there will be reasonable growth in the next few years. If the slowdown in the semiconductor market is more severe, valuations will have to change. A lot hinges on whether demand from the data center market also drops off.

AMD vs Nvidia and Intel

AMD and Nvidia (Nasdaq: NVDA) dominate the discrete GPU market, while AMD and Intel (Nasdaq: INTC) dominate the CPU market. AMD is in second place in both markets, but has gained share of the CPU market, and managed to hold its own in the GPU market.

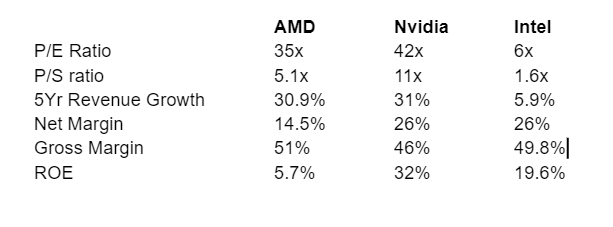

Intel trades on far lower multiples as its growth has stagnated in recent years. AMD trades on lower earnings and sales multiples than Nvidia, but it is less profitable. One could argue that AMD has more room to improve both market share and margins.

While we can argue about the merits of investing in AMD vs Nvidia, they are likely to remain highly correlated. Share Price performance will probably have more to do with market conditions than anything company-specific factors.

What this means for investors

AMD is a leading supplier of hardware to many of the world’s rapidly growing industries - cloud computing, AI, automation, crypto, and the metaverse to name a few. AMD is a picks and shovels stock that provides indirect exposure to all of these industries. If you believe these industries will continue to grow, AMD should be able to deliver over the long term.

But in the short to medium term there are risks - if demand for semiconductors falls off more sharply than expected - which is a distinct possibility - sentiment is likely to weigh on the share price regardless of the valuation.

Check out the full analysis for AMD to find out more about the company. Alternatively, if you are looking for an investment with less downside risk, have a look at this list of recession stocks, or this list of stocks Warren Buffet has been buying this year.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion