- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Reports Strong Q1 Earnings With US$7.4 Billion Sales

Reviewed by Simply Wall St

Advanced Micro Devices (NasdaqGS:AMD) showcased a notable 15% price increase over the past month, in line with impressive first-quarter earnings that exceeded Wall Street's expectations amid strong AI-related demand. The company reported a robust increase in revenue and net income, further supported by optimistic guidance for the upcoming quarter. Amid a mixed market environment with broader indexes showing slight variances due to tariff news and Fed decisions, AMD's solid performance and ongoing advancements in AI and new product releases likely added weight to its upward trajectory, contrasting the flat performance of some other companies.

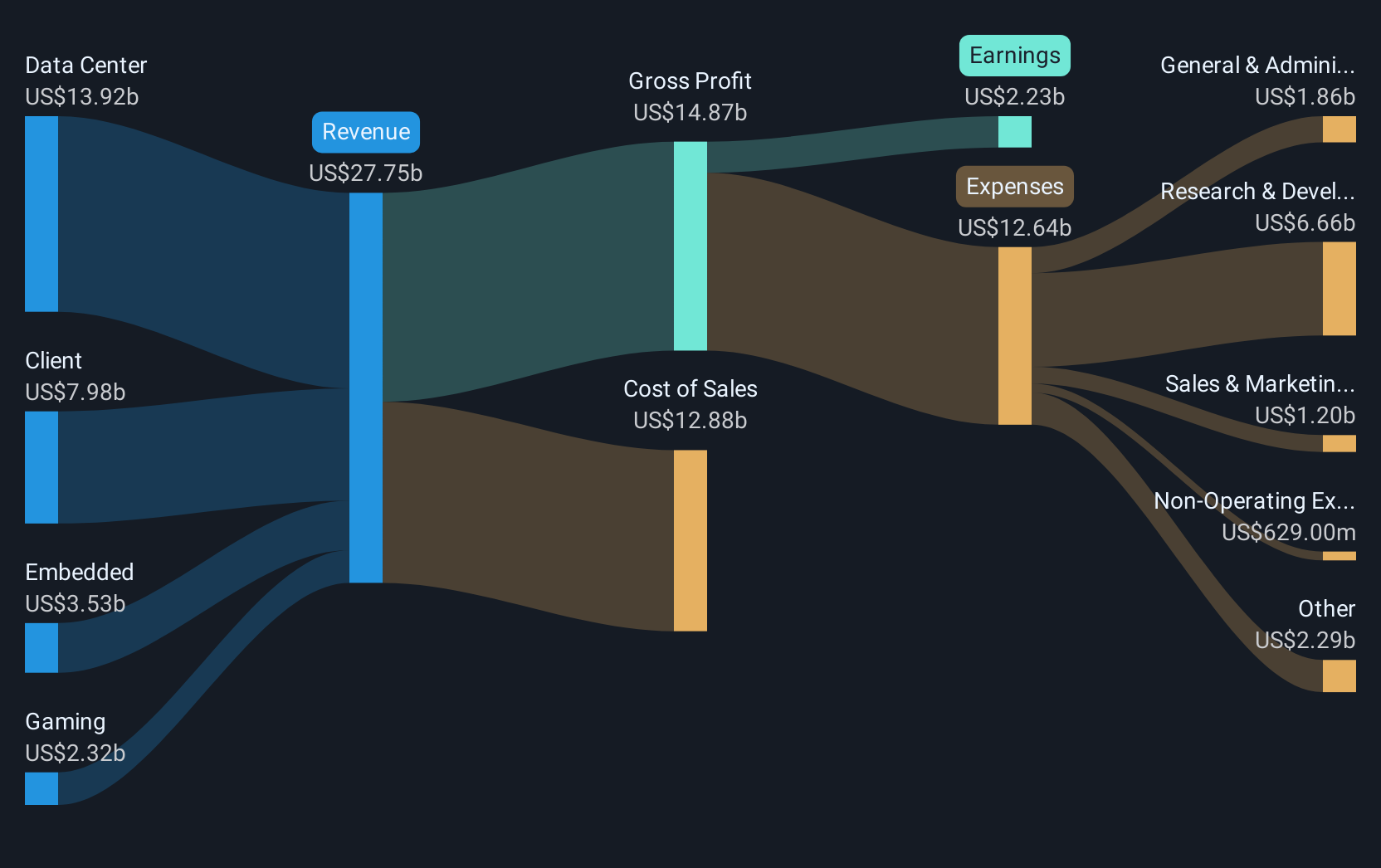

The recent news driving Advanced Micro Devices' (NasdaqGS:AMD) 15% share price increase is likely to bolster perceptions surrounding its AI potential, as highlighted in the narrative. The MI350 series and EPYC processors are expected to invigorate data center revenue, aligning with the company's recent earnings beat. The impact on revenue forecasts is noteworthy, as analysts anticipate AMD's revenue to grow by 10.2% annually over the next three years despite certain market headwinds. Meanwhile, increased investments in AI suggest sustained earnings growth, though potential price pressures may affect profit margins.

AMD's shares delivered an 83.44% total return over five years, providing a robust context for evaluating its recent 15% rise. This longer-term growth contrasts with a 1-year underperformance against the broader U.S. market and the U.S. semiconductor industry, which posted gains of 7.2% and 8.8%, respectively, over the same period. Such historical performance underscores AMD’s capacity to rebound, supported by AI developments and strategic partnerships.

In relation to analyst expectations, AMD's current share price remains at a discount of around 35.85% to the consensus price target of US$133.98. The favorable guidance and improved market positioning through new product developments give credence to revised upward forecasts, with the price target offering a potentially optimistic outlook relative to its past stock performance. However, maintaining cautious optimism is essential due to identified risks, such as over-reliance on the Data Center segment, which comprises half of AMD's annual revenue.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives