- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Powers Rubrik's AI-Ready Data Security Platform Expansion

Reviewed by Simply Wall St

The integration of AMD EPYC processors into Rubrik's platform exemplifies a recent push for enhanced cost-effectiveness and AI capabilities among enterprise clients. Over the past month, Advanced Micro Devices (NasdaqGS:AMD) experienced a price move of 16%, aligning with several influential corporate events. The earnings report on May 6 highlighted strong financial performance with significant sales and net income growth. Additionally, the announcement of a substantial increase in its equity buyback plan on May 14 likely added confidence among investors. These developments potentially provided momentum to AMD's share price, exceeding the market's broader 2% climb last week.

The recent integration of AMD EPYC processors into Rubrik's platform highlights AMD's strategic push to enhance its competitiveness in AI and enterprise markets. Despite this, regulatory challenges and competition are expected to limit AMD's access to key international markets, impacting revenue opportunities. Nevertheless, over the last five years, AMD's total shareholder return was 116.41%. This significant growth contrasts with its 1-year underperformance against the US Semiconductor industry, where it lagged with an 11.6% change.

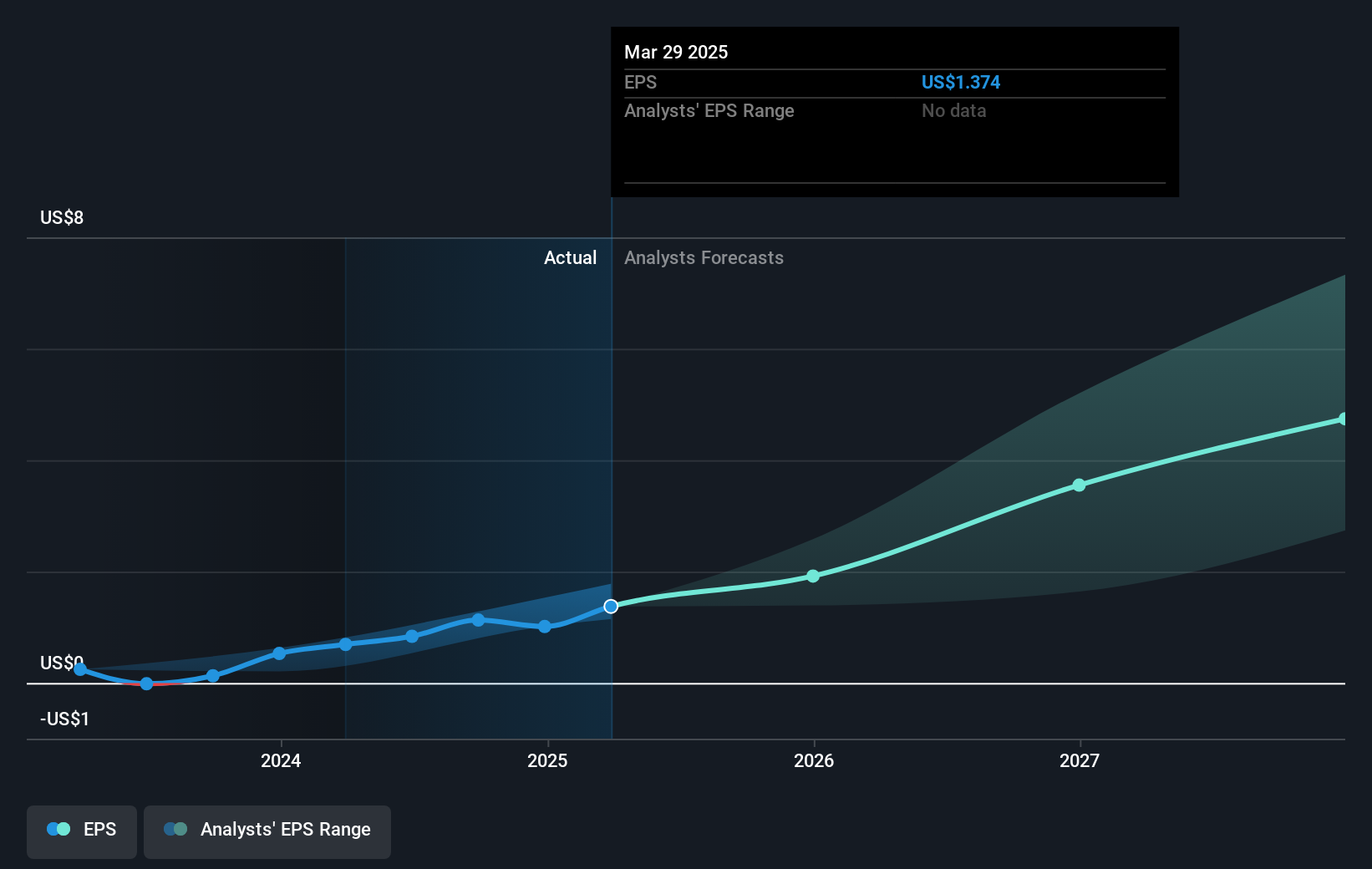

Looking ahead, the recent developments boost investor confidence with potential positive effects on AMD's earnings forecasts, particularly through expanded share in server CPUs and AI-driven demand. While the recent 16% share price movement reflects some immediate investor optimism, it remains below the consensus price target of US$127.53, suggesting room for potential appreciation. It's important to weigh these optimistic growth drivers against the bearish analyst sentiment, which sets a lower price target of US$76.7, recognizing risks such as increased competition and regulatory constraints. As AMD’s forward-looking strategies unfold, investor attention will likely remain focused on execution and market conditions affecting its valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)