- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Expands AI Capabilities With New Partnerships And Innovations

Reviewed by Simply Wall St

Advanced Micro Devices (NasdaqGS:AMD) recently expanded collaborations with key partners like Infobell IT Solutions and Oracle, enhancing AI capabilities with new product offerings. These advancements coincide with the company reporting substantial earnings growth and an increased equity buyback plan. In the context of global market fluctuations, including geopolitical tensions affecting oil and defense stocks, AMD's stock price moved 17% higher last quarter, reflecting confidence in its strategic moves. While broader market trends showed mixed performances, the company's latest technological innovations and partnerships likely added positive weight to its share price performance.

The recent expansion of Advanced Micro Devices' collaborations with Infobell IT Solutions and Oracle is likely to bolster its AI capabilities and product offerings. This aligns with the company's ongoing efforts to drive innovation and diversify its revenue streams despite the challenges of regulatory barriers and global competition. Over the longer term, AMD shares have shown robust performance, posting a total return of 119.28% over the past five years. In contrast, within the past year, AMD's share movement was less favorable, underperforming compared to the broader US semiconductor industry, which saw a return of 6.1%.

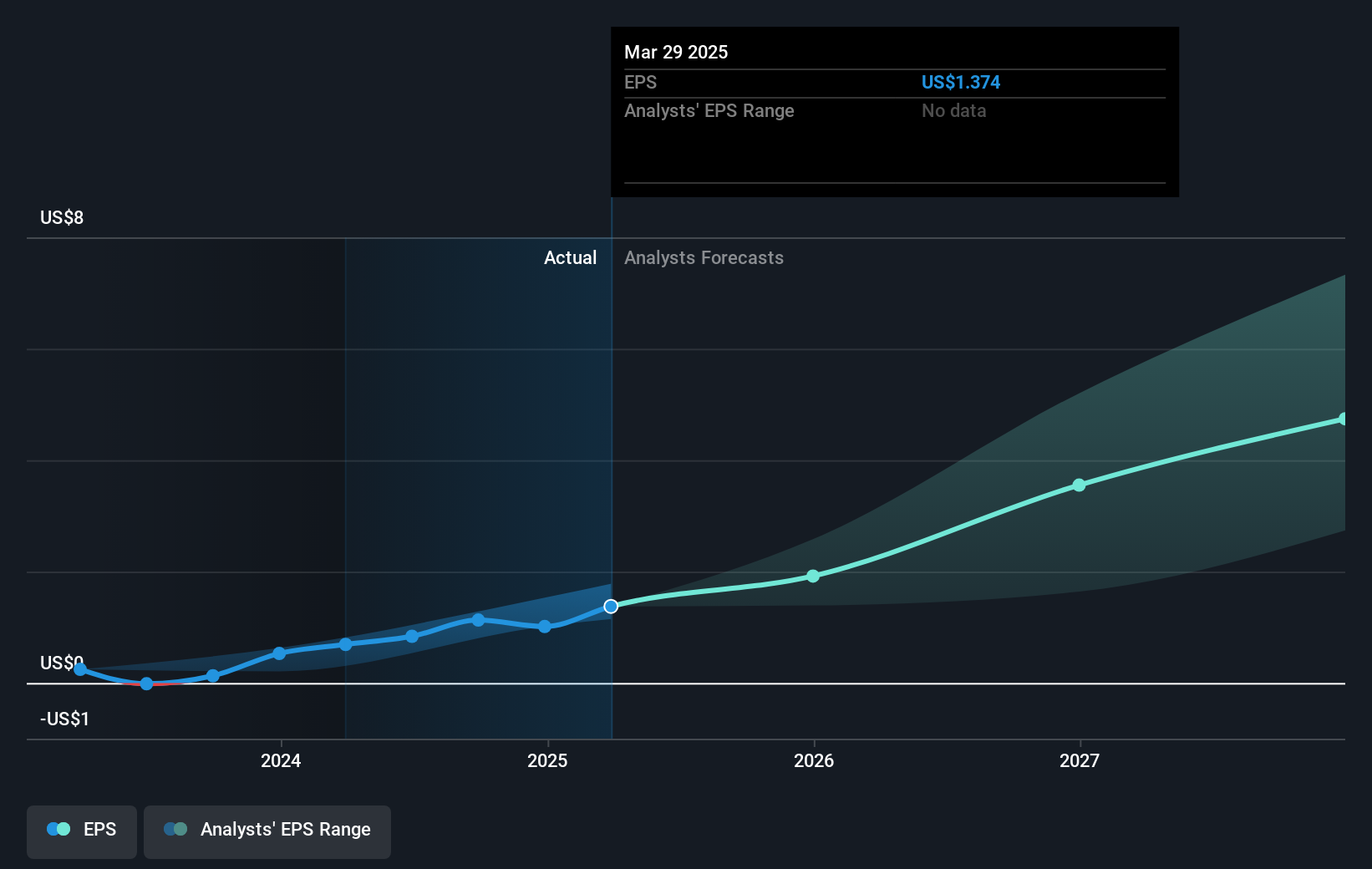

The recent news may positively influence AMD's revenue and earnings forecasts by enhancing its market positioning and competitive edge, potentially mitigating some of the concerns about future market restrictions and margin pressures. Despite a current share price of US$98.62, which reflects a solid quarterly gain, it remains priced below the consensus analyst price target of approximately US$128.76, indicating potential market optimism regarding its growth prospects. However, analysts' views on AMD's valuation differ, with some cautioning that market expectations might be elevated compared to more conservative projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion