- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices, Inc.'s (NASDAQ:AMD) High Price Might be Backed by Growth and Product Demand

Advanced Micro Devices, Inc.'s ( NASDAQ:AMD ) price-to-earnings (or "P/E") ratio of 39.2x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 19x and even P/E's below 11x are quite common.

As we remember, P/E shows investors the number of years it takes for the company to earn the same amount currently paid for an individual share. It is common for investors to be willing to pay a large P/E if a company has high growth potential, but when growth settles down, they may start weighing the difference between the price of shares and their earning capacity.

We need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

We will start by looking at why AMD has a high P/E, and explore possible implications.

As you might know, AMD saw a 93% growth in aggregate from both of its segments in Q1 2021 compared to the same period in 2020.

The main drivers are the mass uptake of its Ryzen™ processors and Radeon™ products, as well as the increase of EPYC™ server processors.

This led to a high growth in both of their segments. The computing & graphics segment grew from US$1.4b to US$2.1b, a 46% growth compared to the prior year period and the Enterprise, Embedded and Semi-Custom net revenue was US$1.345b marking a 286% increase in the same manner.

Price to Earnings

In the graph below, we can see the current P/E of AMD in comparison to the semiconductor industry and US Market.

View our latest analysis for Advanced Micro Devices

Want the full picture on analyst estimates for the company? Then our free report on Advanced Micro Devices will help you uncover what's on the horizon.

Is There Enough Growth For Advanced Micro Devices?

In order to justify its P/E ratio, Advanced Micro Devices would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 458% last year. Pleasingly, EPS has also lifted 2,758% in aggregate from three years ago, thanks to the last 12 months of growth.

Looking ahead now, EPS is anticipated to climb by 6% per year during the coming three years, according to the analysts following the company.

Based on the quality of AMD's current technology, this might be the long term expected growth. However, as long as AMD can keep up innovating and set a comparable quality standard to Intel ( NASDAQ:INTC ), they will have an opportunity to expand even more, and possibly cut into their competitor's market share.

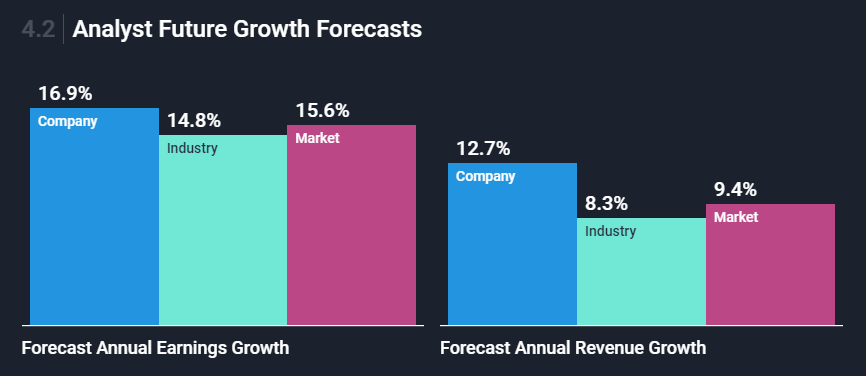

Looking at analyst expectations both for earnings and revenue, we can see that there is a lot of optimism for the future, with an expected revenue growth of 12.7% and expected earnings growth of 16.9%.

NASDAQ:AMD Analyst Forecasts for Revenue & Earnings vs the Market and Industry

Competitor Comparison

AMD's main competitors are Intel and NVIDIA ( NASDAQ:NVDA ), and are considered leaders in their respective segments, as outlined in AMD's competition analysis . Intel is a competitor in microprocessors, while NVIDIA competes in graphical processing units (GPUs). Interestingly, Intel has also announced it is developing and testing their own high-end discrete GPUs.

In the table below, we will compare the Price to Earnings ratio and revenue growth rates of AMD and 2 of their competitors. Keep in mind that these companies are chosen based on their connection to the demand of comparable products such as GPUs and Microprocessors.

| AMD | Intel | NVDIA | Industry | Market | |

| P/E | 39.2 | 12.7 | 95.2 | 34.9 | 19.3 |

| Future Revenue Growth | 12.7% | -0.2% | 11.6% | 8.3% | 9.4% |

From the table above, we can see that AMD does not differ too much from the current industry P/E, and their projected growth rate may give investors some piece of mind when considering the valuation. Intel looks more fairly priced, but seems to be currently approaching a mature growth phase. It is also interesting to see that the market gives NVIDIA even more credit for their potential future growth and innovation.

What We Can Learn From Advanced Micro Devices' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument, but rather to gauge current investor sentiment and future expectations.

When tying the P/E ratio to growth, the picture we get is no longer that of sole overconfidence. We see that investors may value future innovation and growth more than their current earning capacity.

Considering the competitor analysis, we can notice that it is not uncommon to see semiconductor stocks trading at high P/E valuations, but we should be also mindful that this industry is highly cyclical and has experienced severe downturns in demand in the past.

AMD is part of an industry that is currently in high demand and whose products drive decentralized growth across multiple sectors in the market. It seems that investors are factoring-in the known but also the possible unknown future applications of their technology.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Advanced Micro Devices (of which 1 is significant!) you should know about.

If you're unsure about the strength of Advanced Micro Devices' business , why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives