- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Is Ambarella’s Rally Sustainable After Recent AI Chip Demand Surge?

Reviewed by Bailey Pemberton

So, you’re wondering what to do with Ambarella’s stock after its recent run. Maybe you’ve noticed the 41.9% surge over the past year, or the solid 13.4% jump just in the last week. Long-term holders have done alright too, with a 52.9% gain over three years and 44.7% over five. Clearly, momentum has returned in a big way. This is not just because of general market buzz. Tech-focused investors are re-evaluating image processing and AI hardware companies, with Ambarella benefiting from strengthened sentiment around autonomous vehicles and next-generation security tech.

But what about valuation? If you’re worried you’ve missed the train, or the price is running ahead of fundamentals, you’re not alone. According to our value score, which adds a point for each undervaluation check Ambarella passes out of six, the company scores a 0. None of the traditional valuation checks flag Ambarella as undervalued right now. That doesn’t automatically mean there’s no upside. It sets up a deeper conversation about what’s priced in, what’s next, and whether these quantitative models are catching everything that matters.

Next, we’ll break down those valuation checks and see exactly where Ambarella stacks up. Stick around, because there’s an even better way to size up this stock at the end of our analysis.

Ambarella scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ambarella Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future free cash flows and discounting them back to today's value. This approach provides an estimate of intrinsic value based on how much cash the business is expected to generate in the years ahead.

For Ambarella, the most recent free cash flow stands at $36.96 million. Analysts have offered detailed estimates through 2027, suggesting that free cash flow could increase steadily, reaching $140.2 million by 2030. Years beyond the analyst window are extrapolated based on growth trends. All forecasts are converted to dollars, matching the company’s reporting currency.

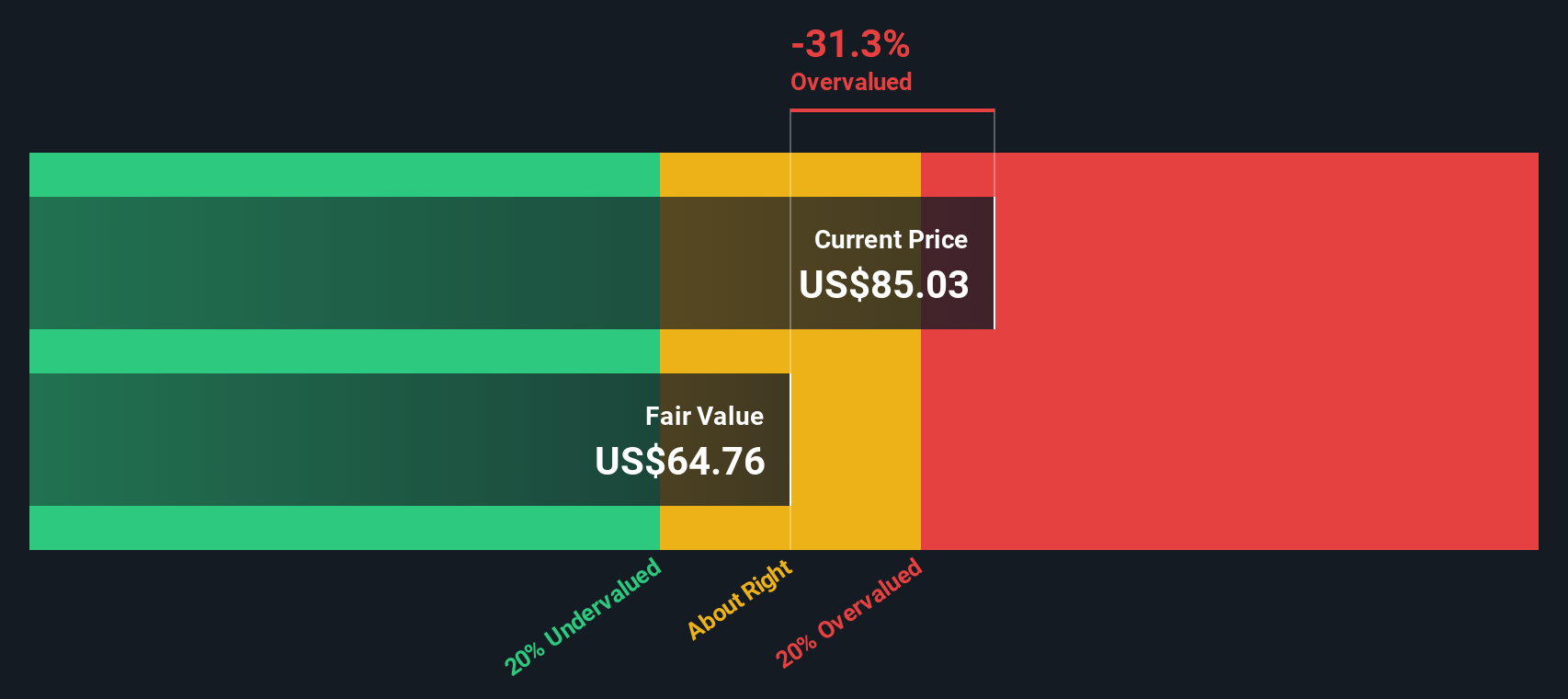

According to the DCF model, Ambarella's estimated intrinsic value per share is $65.09. This value represents a 27.0% premium compared to the current share price, which means the stock appears overvalued using this methodology. The implication is that Ambarella’s future growth may already be reflected in the current price, so further upside would require a new catalyst or performance beyond the present projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ambarella may be overvalued by 27.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ambarella Price vs Sales

The Price-to-Sales (P/S) ratio is often considered a reliable valuation metric for tech companies like Ambarella, especially when earnings are negative or volatile and revenue growth remains strong. While Price-to-Earnings is common for established, profitable firms, the P/S ratio provides a useful sense of value for businesses at earlier growth stages or those investing heavily in future expansion.

Growth expectations and perceived risks play a significant role in determining what constitutes a reasonable P/S ratio. Higher expected sales growth can justify above-average multiples, while greater uncertainty or risk often leads to a discount. Context from the company’s peer set and industry benchmarks helps set these expectations, but each company's unique profile means the numbers can vary widely.

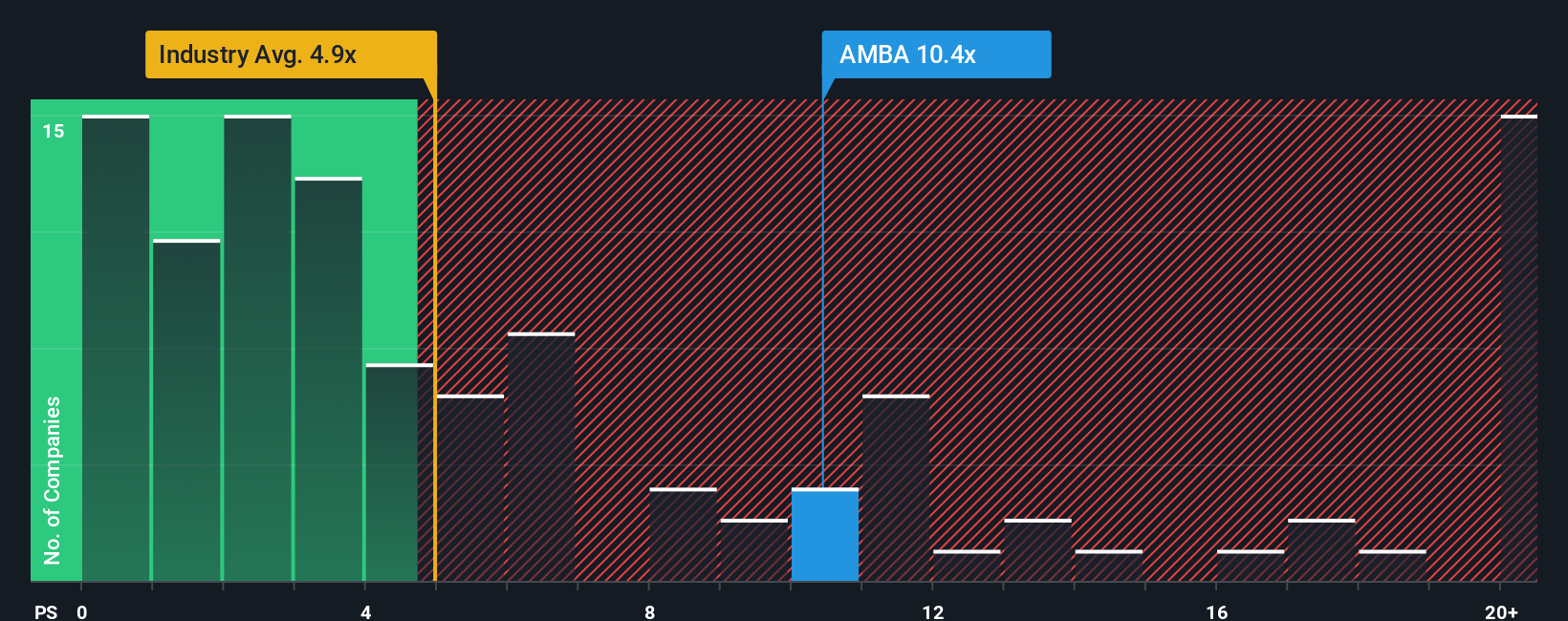

Currently, Ambarella’s P/S ratio stands at 10.1x. This is more than double the peer average of 4.85x and is also notably higher than the Semiconductor industry average of 5.19x. At face value, Ambarella appears expensive relative to its direct competitors and the broader sector.

However, Simply Wall St takes this analysis a step further with its proprietary “Fair Ratio.” This metric estimates what a reasonable P/S multiple would be for Ambarella, factoring in anticipated earnings growth, profit margins, industry, company size, and risks. This offers a more tailored view than industry or peer comparisons alone, which may overlook these specific factors. For Ambarella, the Fair Ratio is calculated at 5.70x.

Comparing the Fair Ratio (5.70x) to Ambarella’s actual P/S ratio (10.1x), the stock is trading at a meaningful premium to its fundamentals according to this framework.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ambarella Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives—a simple, powerful framework that lets you articulate your own view of Ambarella by connecting your story about the company to financial forecasts and a fair value.

With Narratives, you do not just accept the numbers at face value; instead, you create a reasoned perspective that weaves together what you believe about Ambarella’s growth prospects, future revenue, earnings, and margins. This approach links Ambarella’s unique business story, such as expansion in edge AI and evolving industry risks, to your forecasts and ultimately to a fair value estimate.

Narratives are available to millions of investors on Simply Wall St’s Community page, making them an accessible tool for everyone. By building a Narrative, you can see when your estimate of Fair Value is above or below the current Price, helping you decide if now is a good time to buy, hold, or sell. Plus, Narratives update dynamically whenever fresh news or earnings reports come in, ensuring your insights stay relevant.

For example, some investors are optimistic, forecasting a $105 target for Ambarella by expecting rapid AI adoption. Others are more cautious, seeing fair value closer to $49.60 due to automotive and IoT risks. This demonstrates how Narratives capture a wide spectrum of informed opinion.

Do you think there's more to the story for Ambarella? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives