- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Is Ambarella’s Momentum Justified After AI Chip Demand Sparks 49% Rally?

Reviewed by Bailey Pemberton

Trying to figure out if Ambarella is a buy, hold, or avoid right now? You are not alone. Investors have taken a keen interest in this stock lately, with its price creeping up a steady 1.1% over the past week and gaining an impressive 49.8% over the last year. The momentum is hard to ignore, and there is a palpable sense that sentiment is shifting, with some market-watchers pointing to Ambarella’s underlying technology and its potential foothold in the advancing automotive and AI markets as possible drivers.

But here is the twist: while growth has been strong, and the stock has delivered a solid 13.6% return so far this year, Ambarella scores a 0 out of 6 on a standard valuation checklist. That means, based on traditional valuation markers, it is not considered undervalued on any front. Intriguing, right?

In a market where growth stories can sometimes overshadow fundamentals, you may be wondering whether these gains have taken Ambarella out of ‘fair value’ territory. This is the perfect moment to dig into the different valuation methods investors use to assess a stock like this, and to explore if there is a smarter, more holistic way to judge a company’s real value that goes beyond the usual numbers.

Ambarella scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ambarella Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method for estimating the intrinsic value of a company. DCF works by projecting Ambarella’s expected future cash flows and then discounting those amounts back to today using a required rate of return. This approach aims to capture the total future earning power of the company in present-day dollars.

For Ambarella, the latest reported Free Cash Flow (FCF) is $36.96 million. Analysts provide projections up to five years, after which estimates are extrapolated. Forecasts suggest notable growth, with FCF projected to reach $140.2 million by 2030. These rising cash flows reflect expectations that Ambarella’s underlying business, particularly in the automotive and AI segments, will accelerate meaningfully in the coming years.

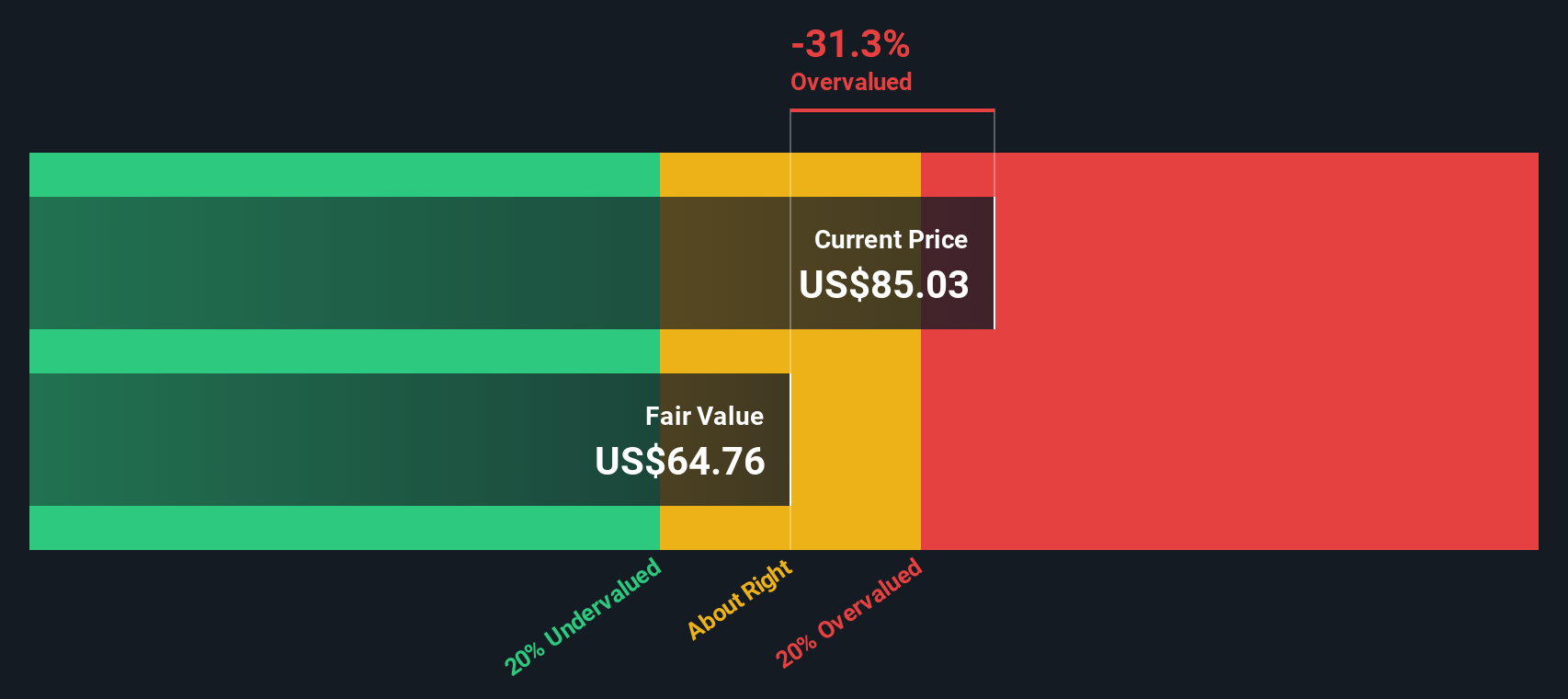

After discounting these future cash flows, the DCF model places Ambarella’s intrinsic value at $64.71 per share. Compared to the current share price, this means the stock is trading at a 30.1% premium and appears significantly overvalued from a cash flow perspective.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ambarella may be overvalued by 30.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ambarella Price vs Sales

The Price-to-Sales (P/S) ratio is often a solid choice for evaluating growth-oriented companies like Ambarella, especially when earnings are volatile or negative. This multiple helps investors get a sense of how much the market is willing to pay for each dollar of Ambarella's revenue. It is particularly suitable for technology businesses reinvesting for expansion.

Growth expectations and risk play a big role in what counts as a "normal" or "fair" price multiple. Fast-growing tech companies often command a higher P/S ratio, reflecting optimism about future revenues. However, high multiples also come with greater risk if the anticipated growth does not materialize.

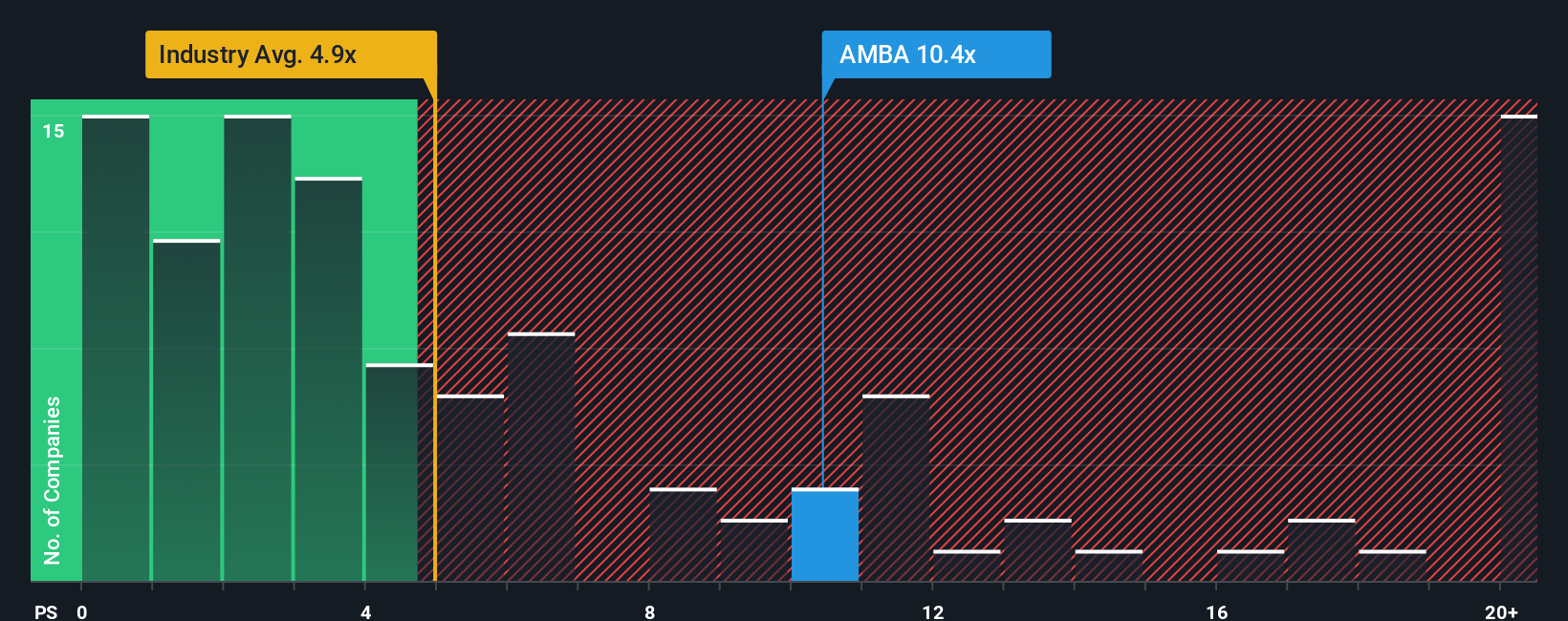

Ambarella currently trades at a P/S ratio of 10.3x. To put this into perspective, the semiconductor industry average is 4.9x, and the average among its closest peers is 4.8x. At first glance, this makes Ambarella look quite expensive on a sales basis compared to its wider industry and direct competitors.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio for Ambarella is 5.5x, which is based on a detailed assessment of the company’s expected revenue growth, profit margins, risk profile, market capitalization, and other industry-specific factors. Since the Fair Ratio is tailored to Ambarella’s unique position rather than generic benchmarks, it gives a more balanced idea of what the market should be paying for its shares at this time.

Comparing Ambarella’s actual P/S of 10.3x to its Fair Ratio of 5.5x, the stock appears to be valued significantly above what would be reasonable based on company fundamentals and growth outlook.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ambarella Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just numbers; it is your story for a company, combining your perspective on its direction with your own estimates for future revenue, profit, and what you believe is a fair price.

Narratives link the company’s business story to financial forecasts and a fair value, helping you move beyond static analysis to see how future events might change your investment outlook. With Simply Wall St's Narratives tool, you can easily craft or follow these stories on the Community page, just like millions of other investors.

This makes it accessible for anyone: you can quickly see if Ambarella looks like a buy (when Fair Value is above the current Price) or a sell (when the opposite is true), all based on your own or others' Narratives. Plus, Narratives update automatically as the facts change, reflecting the latest news or earnings reports in real time, so your investment thesis evolves as the world does.

For Ambarella, some investors forecast robust gains fueled by AI-driven growth, setting a target as high as $105 per share, while others remain cautious about competition and revenue risks, valuing the stock closer to $49.6. Your own Narrative can be just as dynamic and personal.

Do you think there's more to the story for Ambarella? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives