- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Ambarella, Inc.'s (NASDAQ:AMBA) 30% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Ambarella, Inc. (NASDAQ:AMBA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

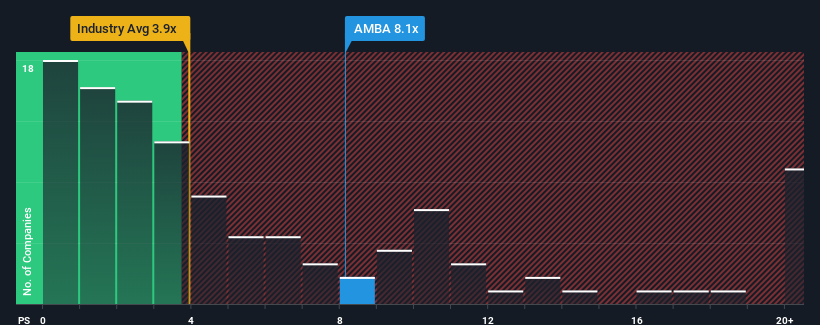

Even after such a large drop in price, Ambarella may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 8.1x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 3.9x and even P/S lower than 1.6x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ambarella

How Ambarella Has Been Performing

While the industry has experienced revenue growth lately, Ambarella's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ambarella.Is There Enough Revenue Growth Forecasted For Ambarella?

Ambarella's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. As a result, revenue from three years ago have also fallen 8.2% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 29% per annum over the next three years. That's shaping up to be similar to the 27% per annum growth forecast for the broader industry.

In light of this, it's curious that Ambarella's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Ambarella's P/S?

Ambarella's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Ambarella currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ambarella you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026