- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (NasdaqGS:AMAT) Ends Collaboration With Nanexa

Reviewed by Simply Wall St

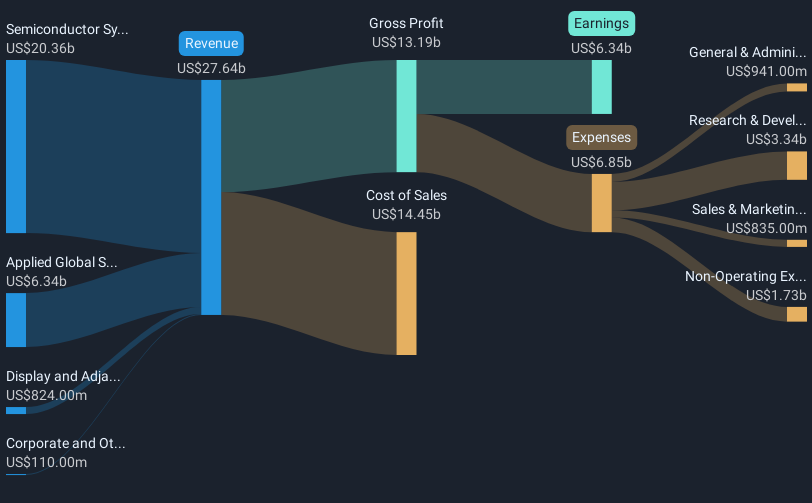

Applied Materials (NasdaqGS:AMAT) recently experienced a notable development with the end of its collaboration with Nanexa, significantly impacting its operational landscape. Over the past month, Applied Materials' stock price moved 19% amid this transition, with the market itself rising 4%. While the termination may have exerted pressure on the company's shares, the broader market's positive trend likely supported some of this upward movement. This conclusion of exclusive manufacturing and intellectual property rights with Nanexa provides a new phase for Applied Materials to realign its strategies and opportunities within the semiconductor sector.

With the termination of the collaboration with Nanexa, Applied Materials is expected to undergo a strategic shift, potentially impacting future revenue and earnings forecasts. This exit opens opportunities for the company to redirect efforts and resources within the semiconductor sector, potentially aligning with its advancements in AI and emerging technologies. While the end of this collaboration might pose short-term operational challenges, it could also allow for a more focused approach to capitalizing on high-growth areas, enhancing their market position over time.

Applied Materials' shares have shown remarkable long-term performance. Over the past five years, the company's total return, encompassing both share price appreciation and dividends, was 226.58%. However, over the past year, the shares have underperformed compared to the US semiconductor industry, which experienced an 18.5% increase. This performance contrast could highlight the impact of recent market and operational changes, including the recent strategic adjustments resulting from the Nanexa agreement termination.

The recent share price movement of 19% coincides with the broader market's rise of 4% and the current price tag of US$153.03. This price is a significant discount to the analyst consensus price target of around US$200.11, indicating potential upside as the market reassesses the impact of the company's new strategic direction. Revenue and earnings forecasts could therefore see adjustments based on how swiftly and successfully Applied Materials realigns its strategy towards high-velocity co-innovation and integrated solutions in semiconductors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives