- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Evaluating Valuation After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Applied Materials (AMAT) shares moved modestly in today's session, catching some attention after a stretch of relatively stable trading. Investors may be weighing recent performance trends along with the company’s fundamentals as they examine what could drive the stock next.

See our latest analysis for Applied Materials.

Applied Materials has seen a surge in momentum recently, with a 30.8% 1-month share price return grabbing attention. This volatility follows a relatively muted 1-year total shareholder return of just 3.7%. This underscores how near-term enthusiasm does not always translate into meaningful long-term gains.

If you’re interested in what else the dynamic semiconductor sector has to offer, explore See the full list for free.

With a strong run-up in recent weeks but flat results over the longer term, investors are now asking if there is real value left in Applied Materials, or if the market has already priced in future growth.

Most Popular Narrative: 10.3% Overvalued

Compared to the latest closing price of $219.48, the narrative’s fair value estimate of $198.97 suggests the stock is currently priced above what consensus expects. The driving factors behind this premium reflect both opportunities and challenges unique to the company's landscape.

Structural growth in AI and high-performance computing is reshaping semiconductor demand. This is driving heavy investments in advanced chip architectures such as gate-all-around (GAA) transistors, high-bandwidth memory (HBM), and advanced packaging. Applied is set to benefit from these device inflections due to its leadership in materials engineering and strong customer adoption of new process technologies. These advancements are expected to deliver outsized revenue and market share gains as these nodes ramp from 2026 onward.

Curious what future breakthroughs and projected market share jumps have fed this optimistic narrative? The full story teases bold financial moves and next-generation chip technologies that could transform earnings projections. Find out which assumptions are powering the bullish case.

Result: Fair Value of $198.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent export restrictions with China and customer concentration risks remain. These factors pose potential catalysts that could quickly shift the current outlook.

Find out about the key risks to this Applied Materials narrative.

Another View: Stronger Value Signals on Earnings Multiples

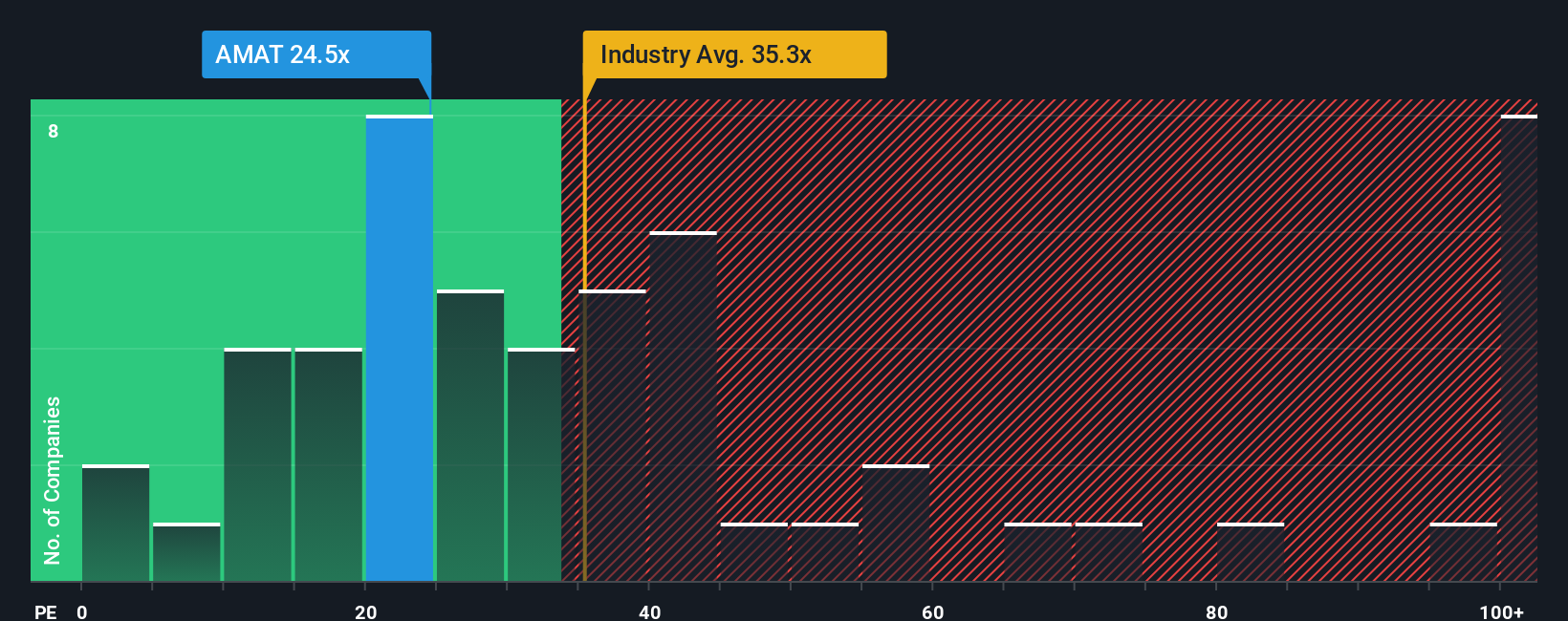

Looking through the lens of price-to-earnings, Applied Materials trades at 25.6x, noticeably below the semiconductor industry average of 35.3x and peer averages around 34.6x. The fair ratio suggests the market could move closer to 32.3x. This gap hints at a potential value opportunity if sentiment shifts or industry warmth returns. But will the market eventually recognize this, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Materials Narrative

If you want to challenge these perspectives or prefer to draw your own conclusions, our platform lets you craft a personal narrative in under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for More Smart Investment Ideas?

Don't limit your strategies to a single stock. Tap into unique growth opportunities by using our screeners. Savvy investors track what's next before everyone else.

- Capitalize on tomorrow’s biggest tech disruptors by reviewing these 25 AI penny stocks that are set to benefit from surging demand for artificial intelligence and automation.

- Secure more consistent income streams by checking out these 18 dividend stocks with yields > 3% that offer robust yields and a track record of reliable payouts.

- Get ahead of the curve with these 79 cryptocurrency and blockchain stocks making waves in the blockchain and digital asset space as innovation accelerates worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026