- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB) Reports Positive Q1 Earnings with Strong Revenue and Net Income Growth

Reviewed by Simply Wall St

Astera Labs (ALAB) recently experienced a notable 85% rise in its stock price over the last quarter, despite being removed from several Russell indices. This index exclusion may impact the stock's visibility and trading volume, adding weight to the broader market trends. However, Astera Labs also announced positive Q1 earnings with significant revenue and net income growth, and strategic collaborations with Alchip Technologies and NVIDIA, aimed at enhancing AI infrastructure. These moves likely supported its stock appreciation, aligning with the robust performance seen in major stock indexes, such as the S&P 500 and Nasdaq, both hitting record highs.

You should learn about the 1 possible red flag we've spotted with Astera Labs.

Astera Labs' recent 85% rise in stock price comes amidst strategic developments, such as positive Q1 earnings and collaborations with Alchip Technologies and NVIDIA, which are expected to enhance AI infrastructure. Over the longer term, the company's shares achieved a total return of 92.84% over the past year, outperforming both the US market, which returned 14.8%, and the US Semiconductor industry, which returned 31.8% over the same period.

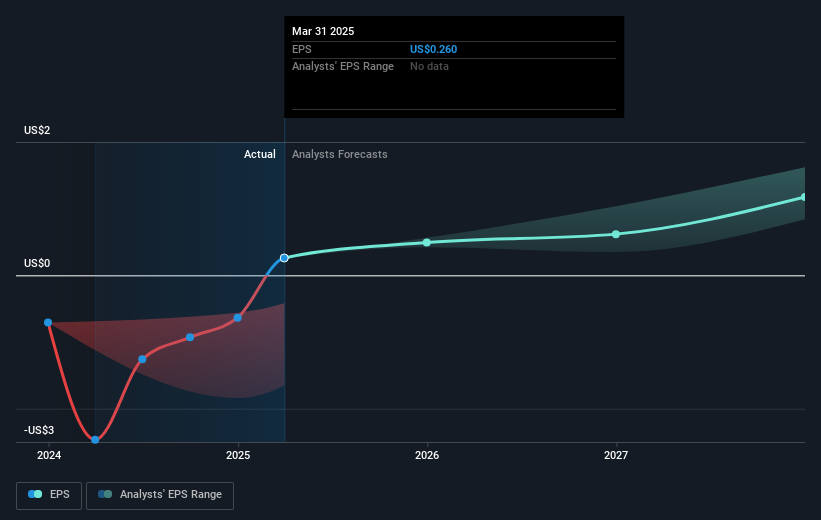

The expansions into AI and CXL technologies are projected to boost revenue and earnings, aligning with analysts' forecasts for substantial growth. Astera Labs’ product offerings and increased R&D investments are anticipated to drive annual revenue growth of 44.3% over the next three years, with projected earnings growth supporting an eventual shift to profitability and margin improvement. The news could intensify this upward trajectory, enhancing the company's financial outlook despite possible revenue concentration risks.

In terms of valuation, the current share price at $102.13 approaches the consensus analyst price target of $103.34, suggesting limited room for immediate appreciation. This is also reflected in the estimated fair value of $53.25, indicating that Astera Labs is trading above this valuation benchmark. With varying analyst projections, future performance remains contingent on revenue diversification and successfully managing competitive industry dynamics.

Gain insights into Astera Labs' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives