- United States

- /

- Entertainment

- /

- NYSE:SE

3 US Stocks Estimated To Be Undervalued For September 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with the Dow Jones Industrial Average hitting record highs while the S&P 500 retreats slightly, investors are keenly observing opportunities for undervalued stocks. In this environment, identifying stocks that are trading below their intrinsic value can provide a strategic advantage, especially as market participants anticipate further rate cuts by the Federal Reserve to support economic growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Silicon Motion Technology (NasdaqGS:SIMO) | $54.97 | $107.87 | 49% |

| Heartland Financial USA (NasdaqGS:HTLF) | $57.41 | $112.66 | 49% |

| KBR (NYSE:KBR) | $63.58 | $126.64 | 49.8% |

| Trustmark (NasdaqGS:TRMK) | $32.72 | $64.64 | 49.4% |

| California Resources (NYSE:CRC) | $52.85 | $104.26 | 49.3% |

| Progress Software (NasdaqGS:PRGS) | $57.59 | $114.51 | 49.7% |

| EVERTEC (NYSE:EVTC) | $33.02 | $65.83 | 49.8% |

| Vitesse Energy (NYSE:VTS) | $24.86 | $49.07 | 49.3% |

| Enphase Energy (NasdaqGM:ENPH) | $114.90 | $225.08 | 49% |

| Carter Bankshares (NasdaqGS:CARE) | $17.68 | $35.12 | 49.7% |

Let's dive into some prime choices out of the screener.

Astera Labs (NasdaqGS:ALAB)

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $7.91 billion.

Operations: Astera Labs generates $229.55 million in revenue from its semiconductor-based connectivity solutions for cloud and AI infrastructure.

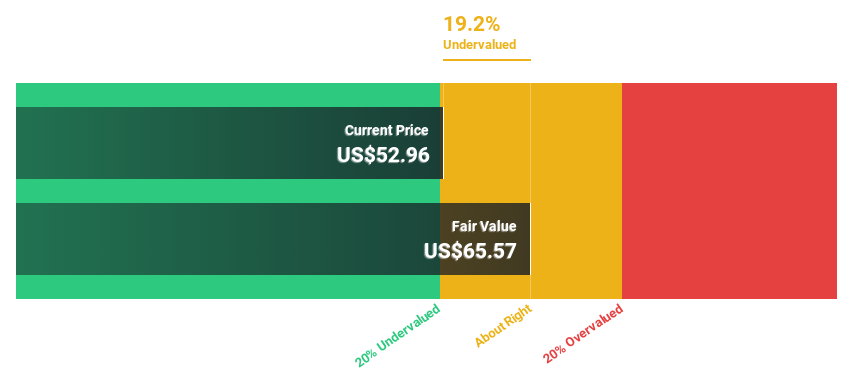

Estimated Discount To Fair Value: 23.3%

Astera Labs is trading at US$50.51, significantly below its estimated fair value of US$65.87, indicating it is undervalued based on cash flows. Revenue grew by 135% over the past year and is forecast to grow at 30.8% annually, outpacing the market average. Despite a net loss reduction from US$20 million to US$7.55 million in Q2 2024, profitability is expected within three years, supported by recent index inclusions and expansion plans in India.

- In light of our recent growth report, it seems possible that Astera Labs' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Astera Labs' balance sheet health report.

Flex (NasdaqGS:FLEX)

Overview: Flex Ltd. provides manufacturing solutions to various brands across Asia, the Americas, and Europe with a market cap of $13.08 billion.

Operations: Flex Ltd.'s revenue is derived from two main segments: Flex Agility Solutions, generating $13.69 billion, and Flex Reliability Solutions, contributing $12.15 billion.

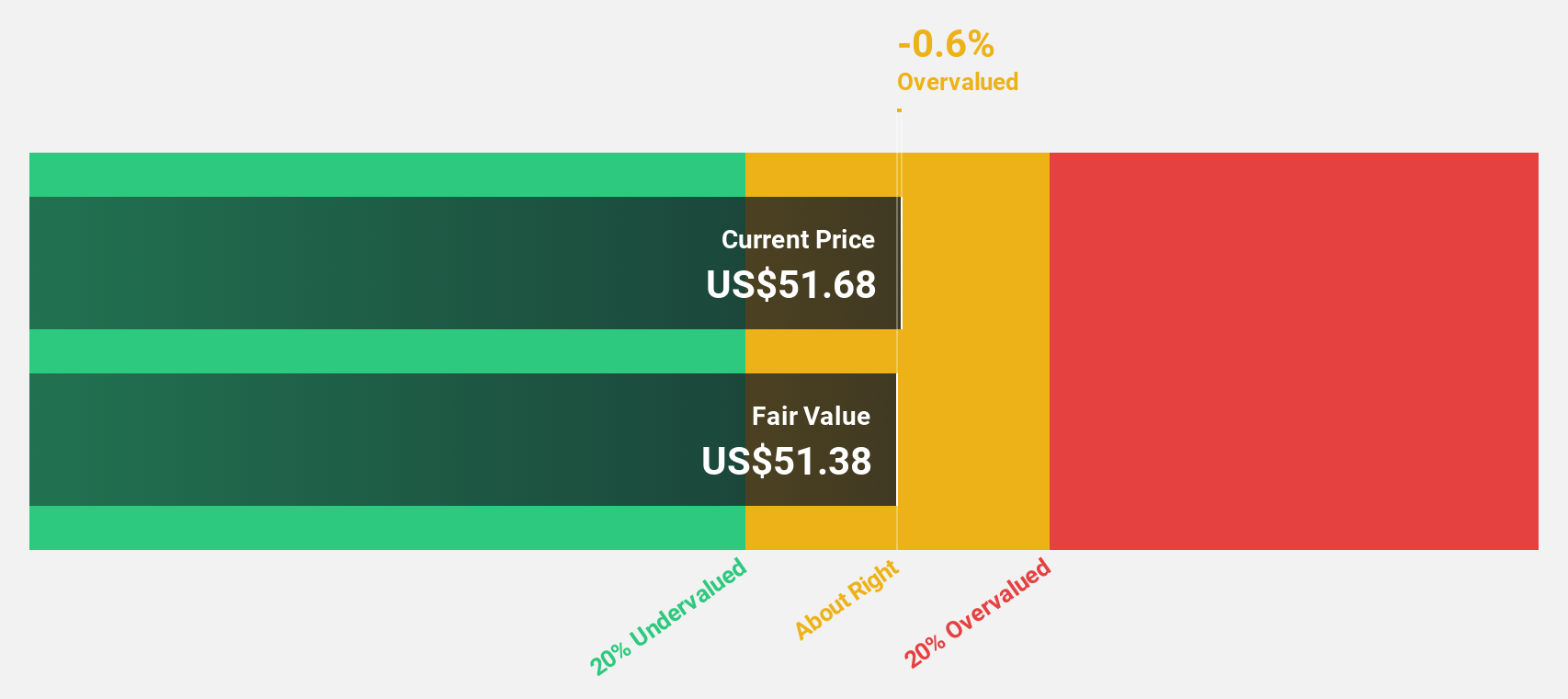

Estimated Discount To Fair Value: 12.6%

Flex, trading at US$32.93, is undervalued with an estimated fair value of US$37.68 based on discounted cash flows. Earnings are forecast to grow 21.7% annually, surpassing the market's 15.2%. Despite a recent dip in revenue from US$6.89 billion to US$6.31 billion and net income from US$186 million to US$139 million year-over-year, the company remains strong with high-quality earnings and significant insider buying over the past quarter.

- The growth report we've compiled suggests that Flex's future prospects could be on the up.

- Take a closer look at Flex's balance sheet health here in our report.

Sea (NYSE:SE)

Overview: Sea Limited, with a market cap of $49.23 billion, operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, the rest of Asia, and internationally.

Operations: The company's revenue segments include digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, the rest of Asia, and internationally.

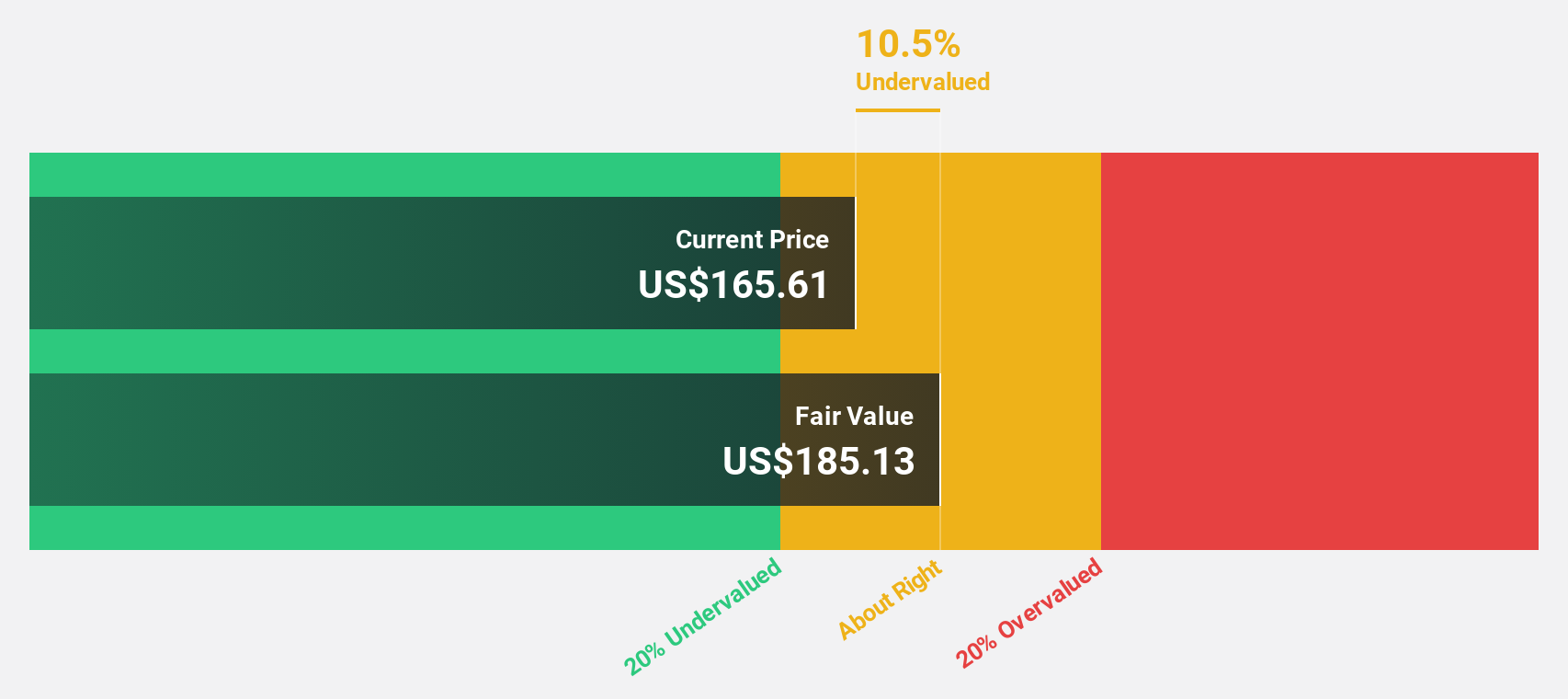

Estimated Discount To Fair Value: 43.1%

Sea Limited is trading at US$85.71, significantly below its estimated fair value of US$150.53 based on discounted cash flows. Revenue for Q2 2024 was US$3.81 billion, up from US$3.10 billion a year ago, though net income decreased to US$79.91 million from US$330.98 million year-over-year. Despite lower earnings per share and return on equity forecasts, the stock is expected to become profitable within three years with strong annual revenue growth projections of 12.5%.

- Our comprehensive growth report raises the possibility that Sea is poised for substantial financial growth.

- Dive into the specifics of Sea here with our thorough financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 195 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally.

Excellent balance sheet with reasonable growth potential.