- United States

- /

- Semiconductors

- /

- NasdaqCM:AEHR

We Ran A Stock Scan For Earnings Growth And Aehr Test Systems (NASDAQ:AEHR) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Aehr Test Systems (NASDAQ:AEHR), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Aehr Test Systems

Aehr Test Systems' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Aehr Test Systems grew its EPS from US$0.051 to US$0.44, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

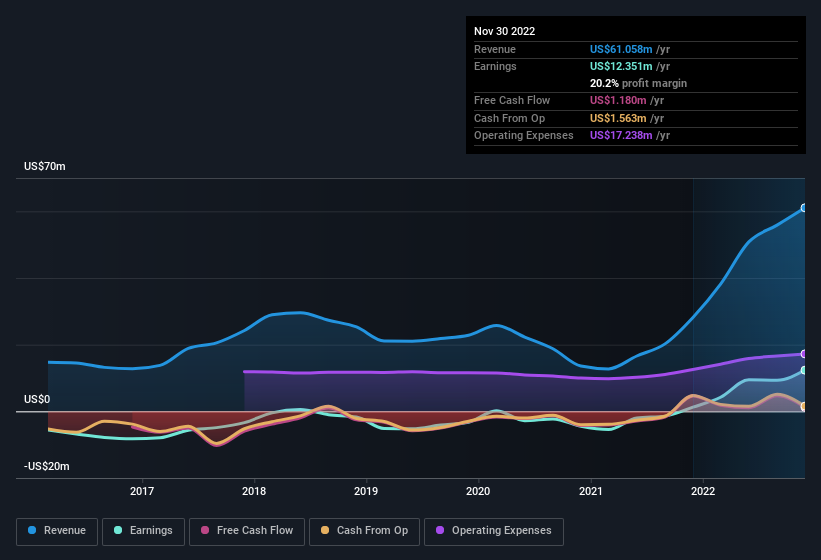

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Aehr Test Systems is growing revenues, and EBIT margins improved by 20.8 percentage points to 20%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Aehr Test Systems.

Are Aehr Test Systems Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Aehr Test Systems insiders have a significant amount of capital invested in the stock. With a whopping US$66m worth of shares as a group, insiders have plenty riding on the company's success. At 8.2% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

Does Aehr Test Systems Deserve A Spot On Your Watchlist?

Aehr Test Systems' earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Aehr Test Systems is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. We don't want to rain on the parade too much, but we did also find 4 warning signs for Aehr Test Systems (1 makes us a bit uncomfortable!) that you need to be mindful of.

Although Aehr Test Systems certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AEHR

Aehr Test Systems

Provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, package part form, and installed systems worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives