- United States

- /

- Semiconductors

- /

- NasdaqCM:AEHR

Here's Why We Think Aehr Test Systems (NASDAQ:AEHR) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Aehr Test Systems (NASDAQ:AEHR), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Aehr Test Systems

Aehr Test Systems' Improving Profits

Over the last three years, Aehr Test Systems has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Aehr Test Systems' EPS skyrocketed from US$0.36 to US$0.51, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 41%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Aehr Test Systems is growing revenues, and EBIT margins improved by 5.2 percentage points to 21%, over the last year. Both of which are great metrics to check off for potential growth.

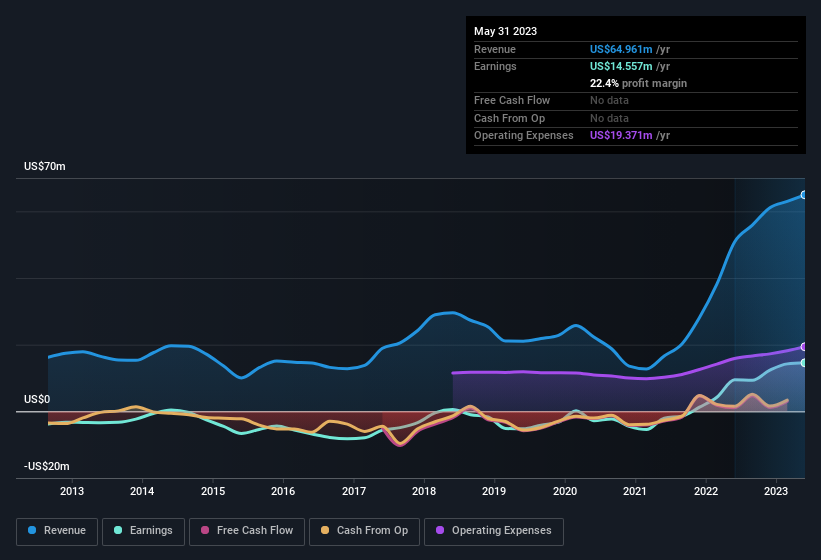

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Aehr Test Systems' future profits.

Are Aehr Test Systems Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Aehr Test Systems shares worth a considerable sum. Given insiders own a significant chunk of shares, currently valued at US$73m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Aehr Test Systems, with market caps between US$1.0b and US$3.2b, is around US$5.1m.

The Aehr Test Systems CEO received US$4.2m in compensation for the year ending May 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Aehr Test Systems Deserve A Spot On Your Watchlist?

You can't deny that Aehr Test Systems has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Aehr Test Systems has underlying strengths that make it worth a look at. What about risks? Every company has them, and we've spotted 3 warning signs for Aehr Test Systems you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AEHR

Aehr Test Systems

Provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, package part form, and installed systems in the United States, Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives