- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (NASDAQ:ACMR) stock performs better than its underlying earnings growth over last five years

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the ACM Research, Inc. (NASDAQ:ACMR) share price. It's 453% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. In more good news, the share price has risen 51% in thirty days.

Since it's been a strong week for ACM Research shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for ACM Research

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

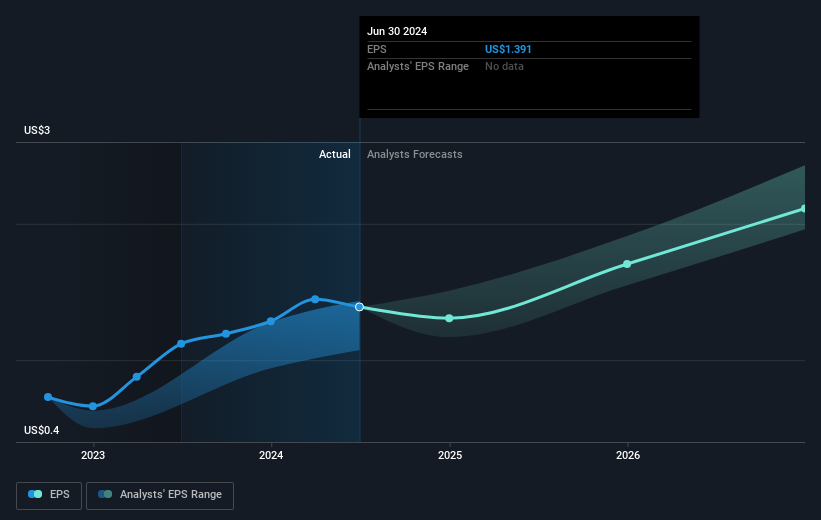

During five years of share price growth, ACM Research achieved compound earnings per share (EPS) growth of 40% per year. This EPS growth is remarkably close to the 41% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how ACM Research has grown profits over the years, but the future is more important for shareholders. This free interactive report on ACM Research's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

ACM Research shareholders have received returns of 30% over twelve months, which isn't far from the general market return. It has to be noted that the recent return falls short of the 41% shareholders have gained each year, over half a decade. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes ACM Research a stock worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with ACM Research (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells single-wafer wet cleaning equipment for enhancing the manufacturing process and yield for integrated chips worldwide.

Undervalued with adequate balance sheet.