- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR) Unveils Major Upgrades to Ultra C wb Cleaning Tool

Reviewed by Simply Wall St

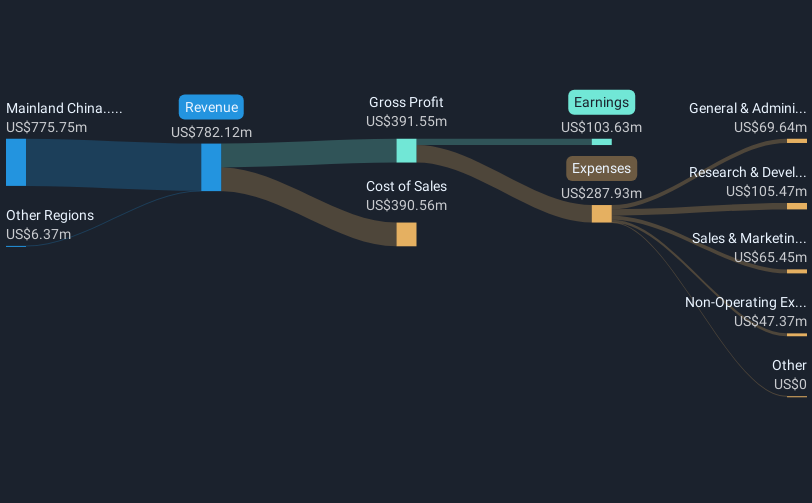

ACM Research (ACMR) recently announced significant enhancements to its Ultra C wb cleaning tool, a move that likely supported its stock's impressive 40% rise in the last quarter. This upgrade, highlighted by a patent-pending nitrogen bubbling technology, coincided with an upswing in market conditions where major indexes like the S&P 500 and Nasdaq reached all-time highs. ACMR also reported strong earnings, with sales climbing to $172 million. However, the company's removal from several Russell indices might have countered the positive momentum. Overall, recent events contributed to ACMR's strong performance in alignment with broader market gains.

Buy, Hold or Sell ACM Research? View our complete analysis and fair value estimate and you decide.

ACM Research's recent enhancements to its Ultra C wb cleaning tool, supported by patent-pending nitrogen bubbling technology, not only spurred a significant quarterly share price increase but also align with the company's broader strategic focus on global expansion and product innovation. The share price, currently at $29.80, reflects a 17.66% discount to the consensus analyst price target of $35.06, suggesting room for upward adjustment if anticipated revenue and earnings improvements materialize.

Looking at a longer-term horizon, ACM Research has delivered a total shareholder return of 78.55% over three years, showcasing robust growth relative to the semiconductor industry's 38.6% return over the past year. This performance underlines the company's successful navigation of competitive pressures and operational challenges, particularly its efforts to localize the supply chain, enhancing efficiencies and potentially improving margins. However, geopolitical risks and reliance on key customers remain potential headwinds that could impact these projections.

Review our historical performance report to gain insights into ACM Research's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives