- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

With A 29% Price Drop For Warby Parker Inc. (NYSE:WRBY) You'll Still Get What You Pay For

Warby Parker Inc. (NYSE:WRBY) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

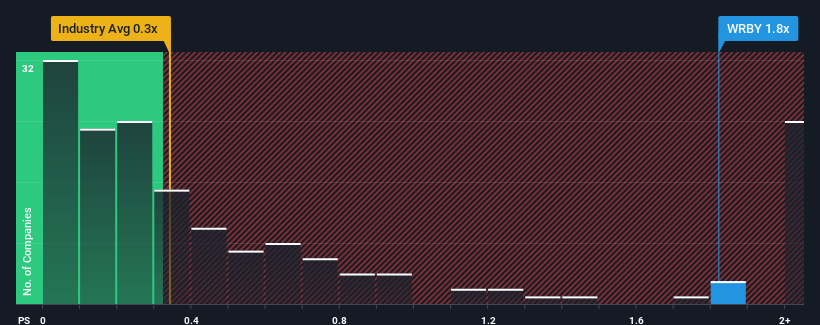

In spite of the heavy fall in price, when almost half of the companies in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.3x, you may still consider Warby Parker as a stock probably not worth researching with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Warby Parker

How Has Warby Parker Performed Recently?

Warby Parker certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Warby Parker's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Warby Parker would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 66% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% over the next year. That's shaping up to be materially higher than the 6.3% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Warby Parker's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Warby Parker's P/S Mean For Investors?

Warby Parker's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Warby Parker's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Warby Parker with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives