- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Warby Parker (WRBY): Evaluating Valuation Following High-Profile Arch Manning College Football Partnership Announcement

Reviewed by Simply Wall St

Warby Parker (WRBY) just kicked off a headline-grabbing partnership with college football quarterback Arch Manning, marking a major step in the company’s brand-building playbook. By teaming up with one of the sport’s most watched young stars, Warby Parker is aiming for national exposure through new eyewear collections and high-profile commercials, all timed to coincide with the start of the college football season. For investors, this move could signal a heightened push to capture a younger, sports-loving audience and expand the company’s footprint beyond its core urban base.

This marketing effort comes at a time when momentum has already been building for Warby Parker’s stock. Shares are up 92% over the past year and have risen 15% in the past month alone, a notable acceleration compared to the more moderate gains seen earlier in the year. The uptick follows several recent initiatives, including school-based vision programs and collaborations tied to local communities. As brand awareness continues to grow, questions about long-term profitability and market share are increasingly coming into focus for investors tracking the company’s next phase.

After this sharp rally and notable new partnership, some may be asking whether Warby Parker is trading at a bargain or if the market already anticipates significant future growth.

Most Popular Narrative: 2% Overvalued

The prevailing narrative suggests Warby Parker’s current share price is slightly above its estimated fair value, based on robust growth projections but also significant execution risks.

The partnership with Google to develop AI-powered intelligent eyewear positions Warby Parker to enter a substantially larger market. This leverages advancements in wearable technology and artificial intelligence to drive new, higher-margin revenue streams in the future.

What’s really boosting this valuation? Behind the scenes, a set of surprising assumptions about future revenue growth, profit margins, and massive innovation bets are at play. Do these bold financial forecasts really stack up? Find out what factors shape the analysts’ calculations and see if they match your own expectations about Warby Parker’s future.

Result: Fair Value of $26.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected e-commerce growth or setbacks with the new AI eyewear partnership could quickly dampen these bullish expectations.

Find out about the key risks to this Warby Parker narrative.Another View: SWS DCF Model

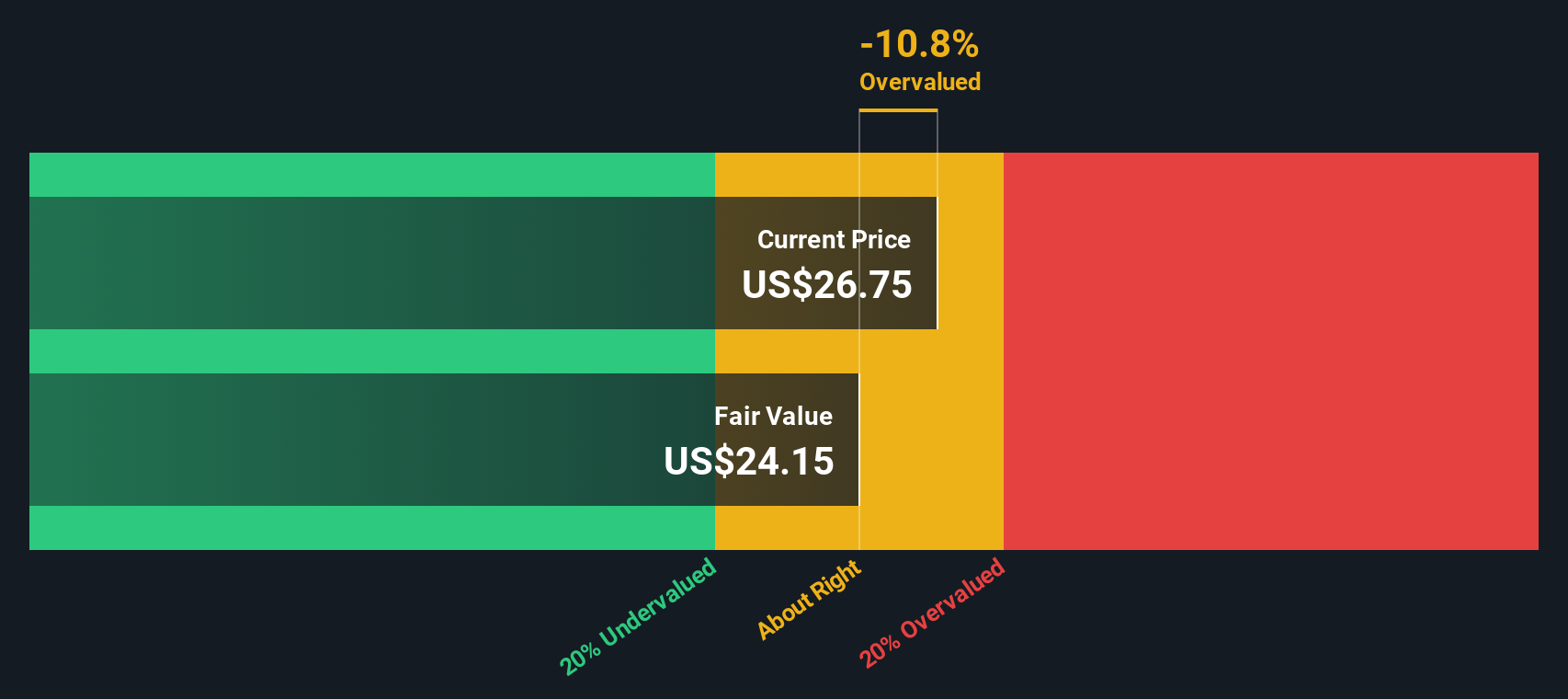

Looking from a different angle, our DCF model suggests Warby Parker is trading above what the fundamentals support. This approach focuses closely on future cash flows. Could the market be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Warby Parker Narrative

If you have a different perspective or want to dig into the numbers yourself, you can easily build a custom narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Warby Parker.

Looking for More Smart Investment Opportunities?

Don’t let a great opportunity slip past you. The right stock can make all the difference, and these unique themes could unlock your next big winner.

- Catch rising stars with strong fundamentals and let penny stocks with strong financials point you toward smaller companies turning heads on Wall Street.

- Ride the wave of artificial intelligence transforming every industry by using AI penny stocks to spot companies on the cutting edge of smart technology.

- Secure reliable income streams for your portfolio by choosing dividend stocks with yields > 3%. Discover businesses with payouts that go the extra mile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives