- United States

- /

- Specialty Stores

- /

- NYSE:W

Wayfair (W): Is the Stock’s Recent Momentum Justified by Its Current Valuation?

Reviewed by Simply Wall St

See our latest analysis for Wayfair.

Wayfair’s recent 9.8% seven-day share price return and 26.6% gain over the last month show renewed momentum building behind the stock. This comes against a backdrop of a remarkable 132% total shareholder return over the past year. While multi-year returns remain mixed, recent performance has reignited investor interest and hints at shifting sentiment around the company's growth prospects.

If strong momentum stories like this pique your interest, now is a great time to uncover new contenders with fast growing stocks with high insider ownership.

The key question now for investors is whether Wayfair’s strong run has left it undervalued with more room to grow, or if the market has already priced in the company’s improving outlook and future gains.

Most Popular Narrative: 7.7% Undervalued

With Wayfair closing at $105.20 and the narrative's fair value set at $114, analysts still see upside potential above the recent price action. The gap between the current price and the narrative's estimate signals lingering optimism in the mid-term outlook.

Wayfair's proprietary logistics network, CastleGate, is expected to provide a meaningful growth unlock by improving efficiency and customer experience, which can positively impact revenue growth through higher conversion rates and potentially improved net margins.

Want to see which financial levers are fueling this bullish stance? The story banks on a dramatic turnaround in future profitability and aggressive operating improvements. Get the scoop on the ambitious targets packed inside this fair value formula. These are assumptions you will want to dig into before investors catch on.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, macroeconomic headwinds such as persistent inflation or ongoing challenges in the housing market could quickly dampen momentum around Wayfair’s improving outlook.

Find out about the key risks to this Wayfair narrative.

Another View: Multiples Paint a Pricier Picture

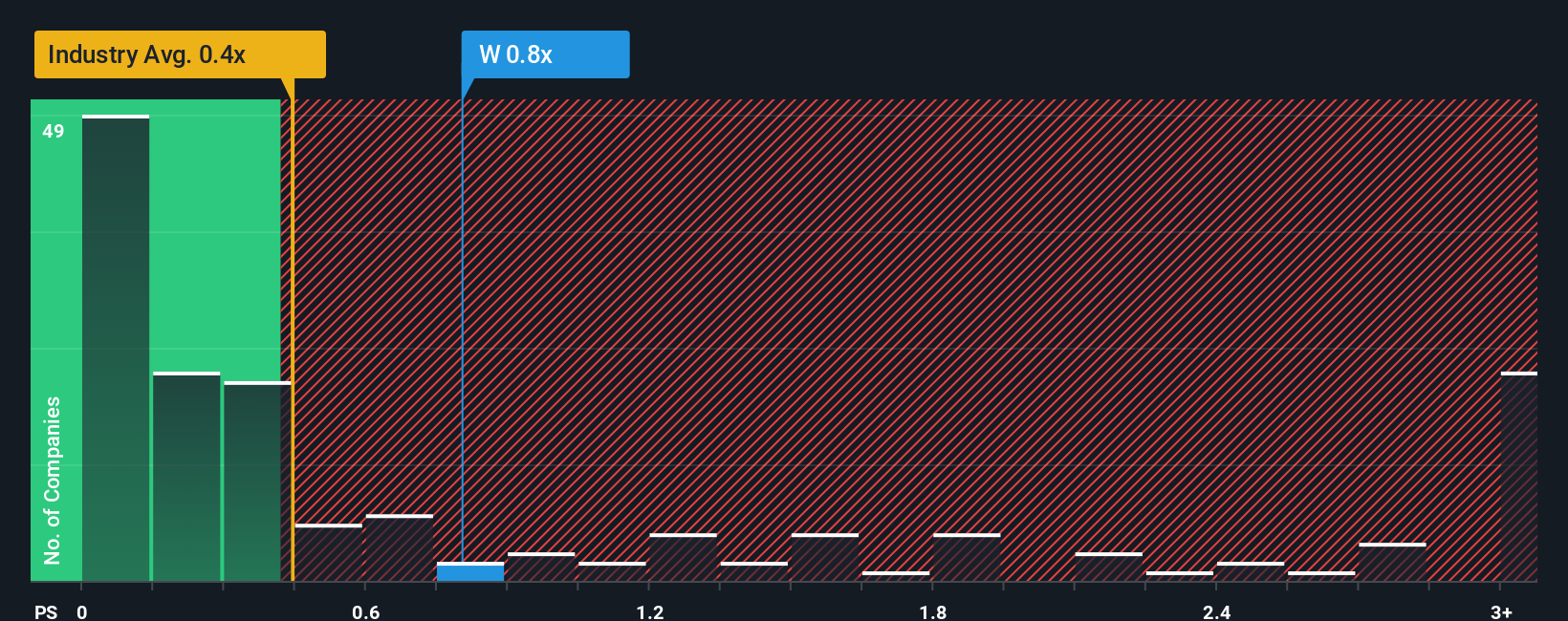

While the fair value estimate suggests Wayfair could be undervalued, a look at its price-to-sales ratio tells a different story. At 1.1x, Wayfair is considerably more expensive than both the US Specialty Retail industry average (0.5x) and its own fair ratio of 0.7x. This suggests investors are paying a premium for future growth hopes. How sustainable is that optimism if results fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wayfair Narrative

If you see the story differently or want to dig deeper into the numbers, you can easily craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always having fresh opportunities on your radar. Stay ahead by tracking unique stocks and sectors that could make a major impact on your portfolio.

- Capitalize on tech breakthroughs by reviewing these 26 AI penny stocks, which are shaking up the world with artificial intelligence advancements and strong growth prospects.

- Power your search for value with these 924 undervalued stocks based on cash flows, which are flying under Wall Street’s radar and show real cash flow potential right now.

- Hunt for tomorrow’s winners by checking out these 14 dividend stocks with yields > 3%, offering higher yields for steady income as markets shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success