- United States

- /

- Specialty Stores

- /

- NYSE:W

Is Now the Right Moment to Revisit Wayfair After Its 119% Rally?

Reviewed by Bailey Pemberton

- Wondering if Wayfair is a hidden bargain or fully priced? You are not alone, especially with its wild ups and downs lately.

- After soaring 119.0% year-to-date and 149.5% over the past 12 months, Wayfair’s stock has shown serious momentum, even if it's down slightly by 2.7% in the last week.

- Traders and investors have been buzzing recently due to renewed optimism around e-commerce trends, as well as headlines about Wayfair’s cost-cutting strategies and expansion into new product lines. Both of these factors are fueling excitement but also some skepticism about sustainability.

- When you break it down, Wayfair scores a 3 out of 6 on our core valuation checks, suggesting there is still a lot to unpack. We will walk through the usual valuation approaches next, but stick around because there is a smarter way to look at Wayfair’s real value that you will not want to miss.

Approach 1: Wayfair Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation approach that estimates how much a company is worth today, based on its future cash flows projected over several years and then discounted back to their present value. This method focuses on real cash generated by the business, not accounting tricks or market opinions.

For Wayfair, the most recent reported Free Cash Flow sits at $205.6 Million. Looking at projections, analysts expect this to grow rapidly over the next decade, reaching around $1.2 Billion by 2029. Keep in mind that while analyst estimates generally cover five years, projections beyond that are extrapolations based on those trends.

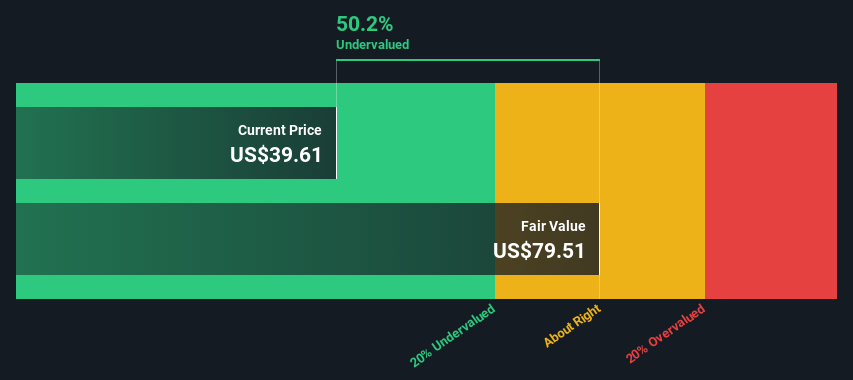

Wayfair’s DCF valuation uses the 2 Stage Free Cash Flow to Equity approach and estimates an intrinsic value of $203.71 per share. This suggests the stock is trading at a 50.5% discount to its calculated fair value. In other words, the market currently values it much lower than what these projected cash flows justify.

The bottom line is that, according to DCF analysis, Wayfair appears to be significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wayfair is undervalued by 50.5%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Wayfair Price vs Sales

The Price-to-Sales (P/S) ratio is often used as a valuation metric for companies like Wayfair, especially when earnings are negative but there is significant sales growth. It helps investors assess how much they are paying for a dollar of the company’s sales. This is especially relevant when profits have not yet stabilized but revenue momentum is strong.

For context, what counts as a "normal" or "fair" P/S ratio depends on several factors, including expectations for future growth, profit margins, and the risks associated with the business. Companies with higher expected growth or lower risk typically warrant a higher ratio, and vice versa.

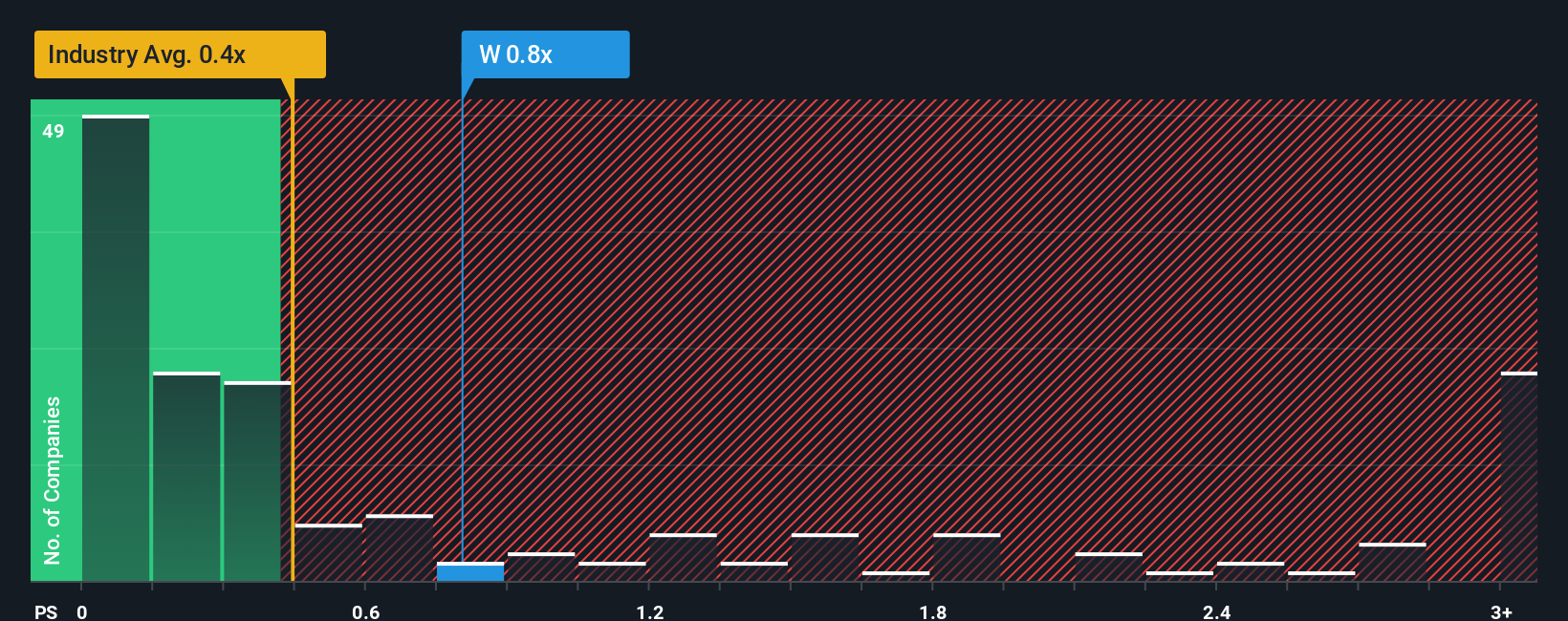

Currently, Wayfair’s Price-to-Sales ratio stands at 1.07x. This compares to a Specialty Retail industry average of 0.46x and a peer group average of 1.38x, positioning Wayfair in the middle of the pack. However, the proprietary Simply Wall St Fair Ratio, which incorporates more detailed factors like growth, profit margins, market capitalization, and company-specific risks, sits at 0.74x. This Fair Ratio acts as a custom benchmark calibrated to Wayfair’s unique fundamentals and offers a more nuanced perspective than industry or peer comparisons alone.

Comparing Wayfair’s current 1.07x P/S ratio to the Fair Ratio of 0.74x, the stock appears to be trading above what Simply Wall St considers its intrinsic sales-based valuation level. This suggests it may be overvalued using this method.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wayfair Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a powerful tool that goes beyond numbers to give you the story behind a company’s future.

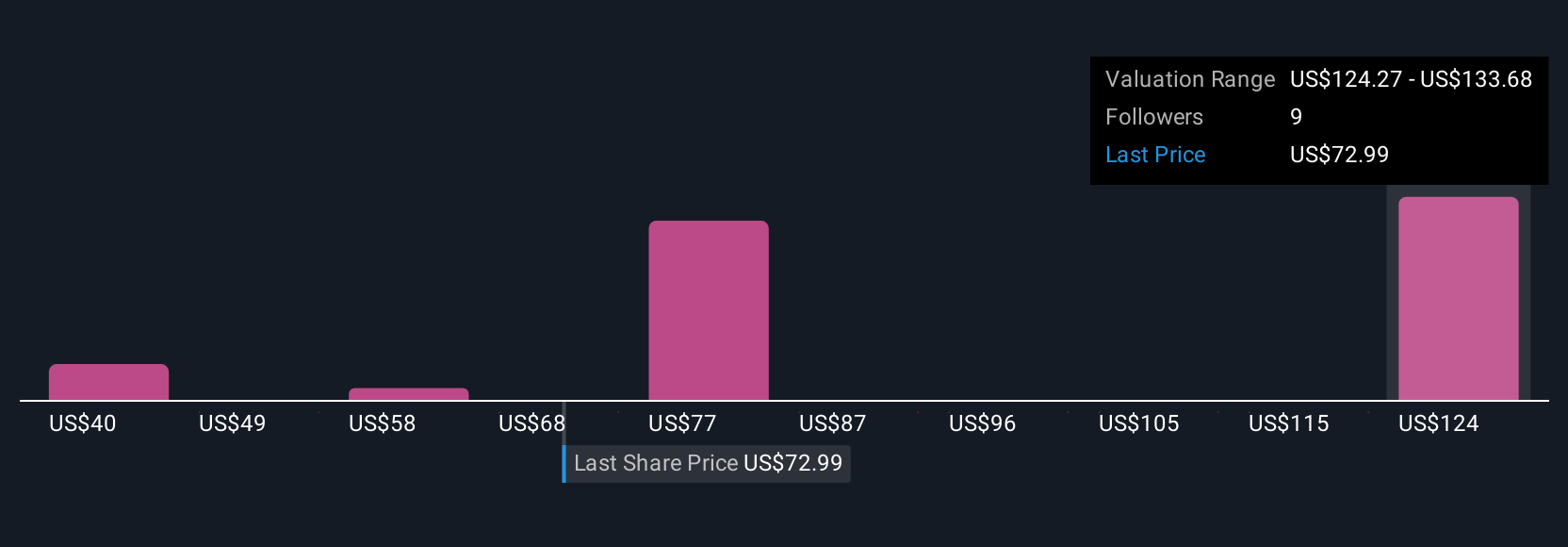

A Narrative is your own, easy-to-create investment thesis. It connects your view of Wayfair’s business prospects to detailed financial assumptions and tells you what the company’s shares are worth based on that story. With Narratives, you are not just looking at isolated stats or ratios; instead, you are forming a clear, evidence-based picture of where you think the company is headed and how that translates to fair value.

On Simply Wall St’s Community page, millions of investors use Narratives to map out their assumptions about revenue growth, margins, future profits and more. The platform automatically tracks how these stack up versus current prices. When new information such as earnings announcements or news breaks, those Narratives update instantly, helping you stay ahead in your decision making.

For example, one investor might build a Narrative for Wayfair based on rapid margin improvements and new store rollouts, resulting in a fair value of $112.31. Another could focus on tough consumer trends and competitive pressures and arrive at a much lower $51.00.

Do you think there's more to the story for Wayfair? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives