- United States

- /

- Specialty Stores

- /

- NYSE:W

Can Wayfair’s (W) Bold Holiday Discounts Reveal Its Real Customer Growth Strategy?

Reviewed by Sasha Jovanovic

- Wayfair recently unveiled its full lineup of Black Friday and holiday season sales, offering deep discounts of up to 80%, daily special deals, and free shipping across its platforms from November 20 through December 1.

- This aggressive promotional campaign aims to capture heightened holiday shopping demand and showcases Wayfair’s focus on driving higher sales volumes and customer engagement during a peak retail window.

- We’ll examine how this major holiday sales launch may shape Wayfair’s investment narrative, particularly in terms of revenue growth potential.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Wayfair Investment Narrative Recap

To believe in Wayfair as an investment today, you need confidence in its ability to boost revenue and margin growth through strong holiday sales execution, effective marketing, and improved customer engagement, while managing risks like elevated advertising costs and a still-challenging housing market. The launch of Wayfair’s aggressive Black Friday and holiday promotions could offer a short-term catalyst for higher sales, but the most immediate risk remains whether these sales generate enough lasting demand to offset ongoing macroeconomic pressures. If consumer response falls short or sustained high ad spend cuts into margins, the positive impact may not be material.

The recent appointment of Hal Lawton, current CEO of Tractor Supply Company and former Macy’s executive, to Wayfair’s Board brings extensive retail leadership to the company at a time when effective execution and operational oversight are crucial. The experience and insight from a leader with a proven track record of steering large retail operations could help inform Wayfair’s efforts to convert promotional tactics into meaningful revenue growth, addressing the immediate catalyst of driving performance during a competitive holiday season.

However, in contrast to the sales optimism, investors should also be aware of the risk that higher advertising spend may not deliver the expected returns if...

Read the full narrative on Wayfair (it's free!)

Wayfair's narrative projects $13.9 billion revenue and $124.7 million earnings by 2028. This requires 4.9% yearly revenue growth and a $424.7 million increase in earnings from the current -$300.0 million.

Uncover how Wayfair's forecasts yield a $114.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

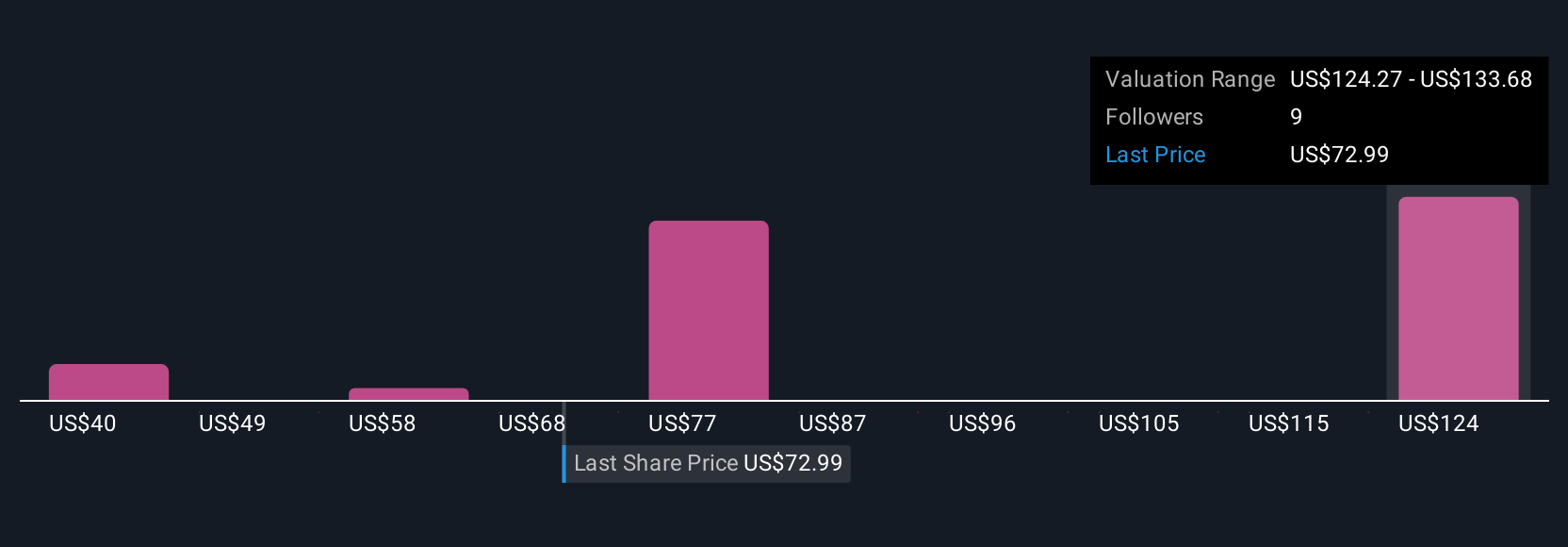

Five community fair value estimates for Wayfair span from US$39.54 to US$200.16. While many see upside, the key near-term question remains whether major holiday promotions will generate revenue growth robust enough to improve future returns, consider how these contrasting views might inform your own outlook.

Explore 5 other fair value estimates on Wayfair - why the stock might be worth over 2x more than the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives