Examining Vipshop’s True Worth After 46% Stock Surge and New Partnership News

Reviewed by Bailey Pemberton

- Ever wondered if Vipshop Holdings is a hidden bargain or just riding a wave of market excitement? Let’s get to the bottom of what the company could really be worth.

- This past year, the stock jumped 46.3% and is up a hefty 50.8% year-to-date, which may hint at a renewed sense of optimism or shifting risks.

- Vipshop Holdings has caught headlines recently for its expanding partnerships with major Chinese e-commerce platforms and new investments in technology infrastructure. Both of these developments have fueled investor enthusiasm and heightened market interest.

- On paper, Vipshop scores a strong 5 out of 6 for undervaluation across our main valuation checks. As we look at different approaches for judging value, keep an eye out for a fresh angle on what really matters at the end of this article.

Approach 1: Vipshop Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company’s value by projecting its future cash flows and discounting them back to their present value. This method gives investors an idea of what the company could be worth today, based on expectations for how much cash it will generate in the future.

For Vipshop Holdings, the most recent twelve months Free Cash Flow sits at CN¥5.18 billion. Analysts have projected that by 2028, the company’s Free Cash Flow could reach approximately CN¥10.02 billion, with growth estimates from multiple analysts feeding into these numbers for the next five years. Beyond those years, projections are extrapolated; however, the trend remains positive and suggests a steady rise in cash generation capacity over the next decade.

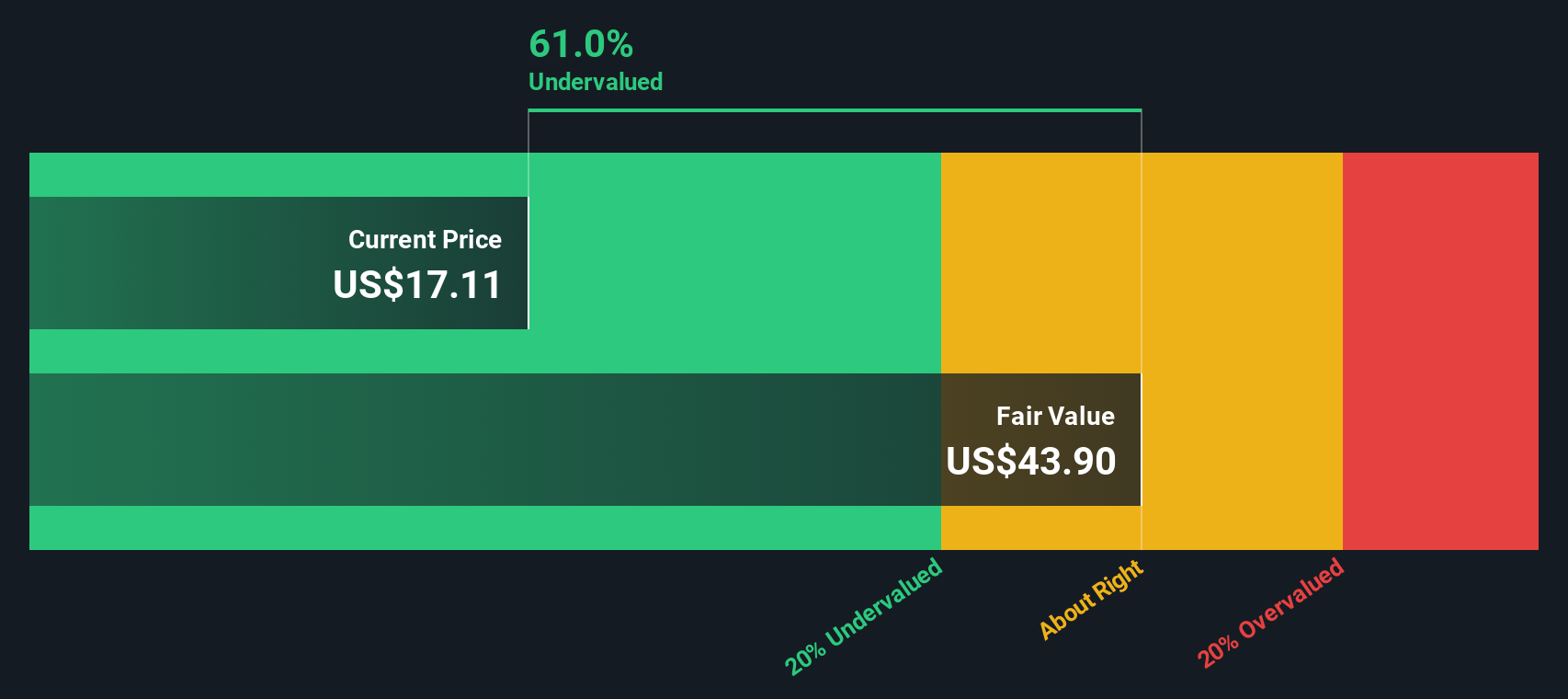

Based on these forecasts, the DCF model estimates Vipshop Holdings has an intrinsic value of $45.12 per share. This suggests the stock is trading at an impressive 56.3% discount to its estimated intrinsic value, which could indicate significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vipshop Holdings is undervalued by 56.3%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Vipshop Holdings Price vs Earnings

For profitable companies like Vipshop Holdings, the Price-to-Earnings (PE) ratio is a reliable and widely used valuation measure. It offers a straightforward view into how much investors are paying for each dollar of earnings and works best for established businesses with strong cash flows.

The PE ratio is often shaped by two major forces: growth expectations and perceived risk. Companies with higher anticipated growth in earnings typically command higher PE ratios, while greater risk or uncertainty tends to have the opposite effect. The "right" PE ratio depends significantly on how much the market believes future profits will rise and how predictable those profits seem.

Currently, Vipshop Holdings trades at a PE ratio of 10x. For comparison, the average PE among peers is 24.2x and the Multiline Retail industry average stands at 20.2x. At first glance, this makes Vipshop look quite inexpensive relative to both its industry and its main competitors.

Rather than just comparing raw numbers or industry averages, Simply Wall St uses the "Fair Ratio," which calculates what an appropriate PE should be for this company. The Fair Ratio considers factors such as Vipshop’s earnings growth expectations, profit margins, size, market risks, and its unique position within the industry. This provides a more tailored benchmark than a standard industry comparison.

For Vipshop Holdings, the Fair Ratio is 16.1x. Because the current PE of 10x is well below this Fair Ratio, it suggests the stock may be undervalued even when factoring in the company’s future prospects and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vipshop Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective or story about a company. It links your view of its future (including your assumptions about fair value, revenue, earnings, and margins) to a specific financial forecast and ultimately to a price you believe is reasonable.

On Simply Wall St’s platform, Narratives are an easy and accessible tool available within the Community page, used by millions of investors to connect the dots between a company's story, forecasted performance, and its fair value. Narratives help you decide when to buy or sell by directly comparing your calculated fair value to the current share price, making investment decisions much more transparent and personal.

Every Narrative updates automatically when new information such as news, earnings reports, or changing assumptions becomes available, ensuring your view adapts with the market and company developments. For example, some investors see Vipshop Holdings as poised for strong earnings growth and assign a fair value as high as $24.60, while others remain cautious and estimate a much lower fair value of $15.49. Narratives let you see the full spectrum of perspectives and choose which story fits your outlook best.

Do you think there's more to the story for Vipshop Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIPS

Vipshop Holdings

Operates online platforms in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives