- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

A 45% Miss on Target's (NYSE:TGT) Earnings may make Investors Skeptical of a Second Half Recovery

Summary:

- Expected EPS $0.71 vs $0.39 reported - a 45% negative surprise.

- Average price target at $183, roughly in-line with current level.

- Management expects operating margins to recover to 6% in the 2nd half of 2022, but the current economic uncertainty makes this a risky prediction.

Target ( NYSE:TGT ) just released the latest Q2 earnings report and surprised investors with a higher than expected (45%) decline in profitability. While the inflationary pressures are eroding the bottom line of retailers, investors may have anticipated management to be better prepared for the quarter.

View our latest analysis for Target

Second Quarter Earnings Analysis

- Sales growth at 2.6 %, down 70.8% from last year. The growth represents a mix between store sales growth of 1.3% and digital sales growth of 9%, both of which are down 85% and 9% respectively.

- 95%+ of Target's sales come from their stores.

- Operating margin down to 1.2%, mostly impacted by higher freight and transportation costs.

- Diluted EPS at $0.39 down 89.2% from last year - Expected EPS was $0.71.

- Management reiterated the 2022 full-year revenue growth guidance for a low to mid-single digit range (0% to 5%).

The company is on track with the expected sales growth. Before the report, analysts were modeling $109.7b in revenue, and with the current $107.471b revenue on a 12-month basis, the company is executing as expected.

The biggest issue and surprise came in the bottom line, where analysts were expecting a diluted EPS of $0.71, but marked a 45% negative surprise , while the bottom line is expected to recover to a 6% operating margin in the back half of the year.

What This Means For Investors

Target’s pre-open P/E ratio of 14.26x is trading slightly above its industry peers’ ratio of 11.83x - this makes the stock look relatively cheap. However, when we factor-in the negative earnings surprise and future estimates, we get a forward P/E above 22x. While investors may be willing to swallow the loss and move on, it is likely that the stock is not undervalued.

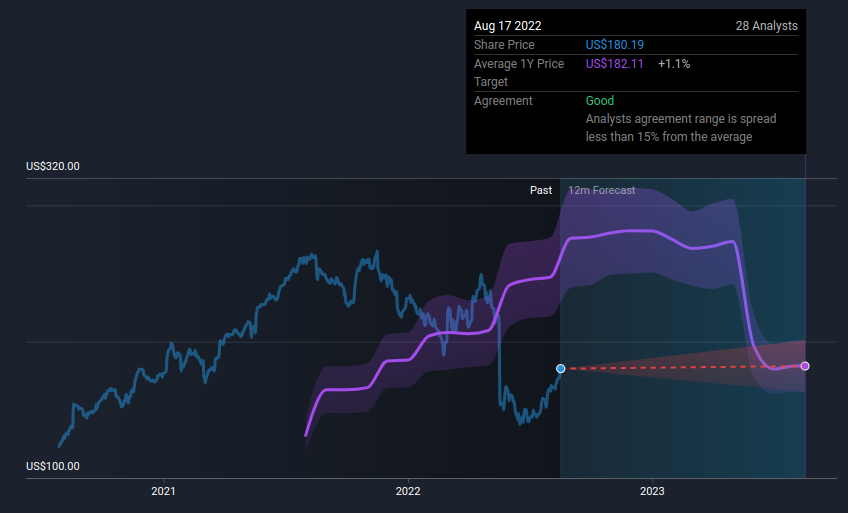

Additionally, the 28 analysts covering the stock have updated their price targets today, and the new average price target for the company is $182.11 - roughly in-line with the last close price.

We can see how the historical price targets have changed in the chart below:

Conclusion

While the stock is currently trading within the average price target, implied in it is the assumption of a substantial profit recovery. This may be risky as the economic outlook unfolds. If you are an investor, the key questions revolve around future consumer spending, the price of international shipping and local transport, sustained price inflation. Investors that are bearish on the next few years of the economy may find it hard to justify management's outlook for the company.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. At Simply Wall St, we found 1 warning sign for Target and we think they deserve your attention.

If you are no longer interested in Target, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:TGT

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives