Exploring Savers Value Village (SVV) Valuation as Analyst Optimism Rises and Shareholder Sales Weigh on Outlook

Reviewed by Kshitija Bhandaru

BTIG has started coverage of Savers Value Village (SVV) with a bullish outlook, pointing to ongoing sales improvements and potential long-term growth. At the same time, SVV faces unique hurdles related to persistent share sales by a major investor.

See our latest analysis for Savers Value Village.

Savers Value Village’s share price has pulled back modestly from its recent high, down 2.2% over the past month, but zooming out reveals serious momentum. Investors have seen a 24.4% share price return over the last 90 days and a total shareholder return of 23.3% for the year. The company’s solid underlying sales progress and bullish new analyst coverage are fueling fresh optimism, even as ongoing share sales by a major investor continue to influence the stock’s short-term swings.

If you’re on the lookout for more dynamic movers like this, consider broadening your search and discover fast growing stocks with high insider ownership

With analyst enthusiasm rising and shares trading at a slight discount to price targets, the question remains: Is Savers Value Village currently trading below its true value, or has the market already priced in its growth potential?

Most Popular Narrative: 11.3% Undervalued

The most widely tracked narrative sees Savers Value Village's fair value at $14.22 per share, notably above the last close price of $12.61. Analysts point to stepped-up expansion and improved inventory systems as key value drivers.

The ongoing expansion of the store footprint, especially in underpenetrated markets like the U.S. Southeast (supported by landlord appetite and a high-quality real estate pipeline), will increase square footage and drive additional market share and revenue growth over the coming years.

The optimism here depends on a future where sales outpace consensus and profit margins steadily widen. The secret lies in bold assumptions for earnings growth and profitability that most rivals could only hope for. If you want to uncover the specific financial leaps built into this price target, follow the narrative to see what powers this 11.3% upside.

Result: Fair Value of $14.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing labor cost inflation and intensified competition from online resale platforms could quickly dampen Savers Value Village’s growth story if these issues are left unchecked.

Find out about the key risks to this Savers Value Village narrative.

Another View: Market Ratios Raise Caution

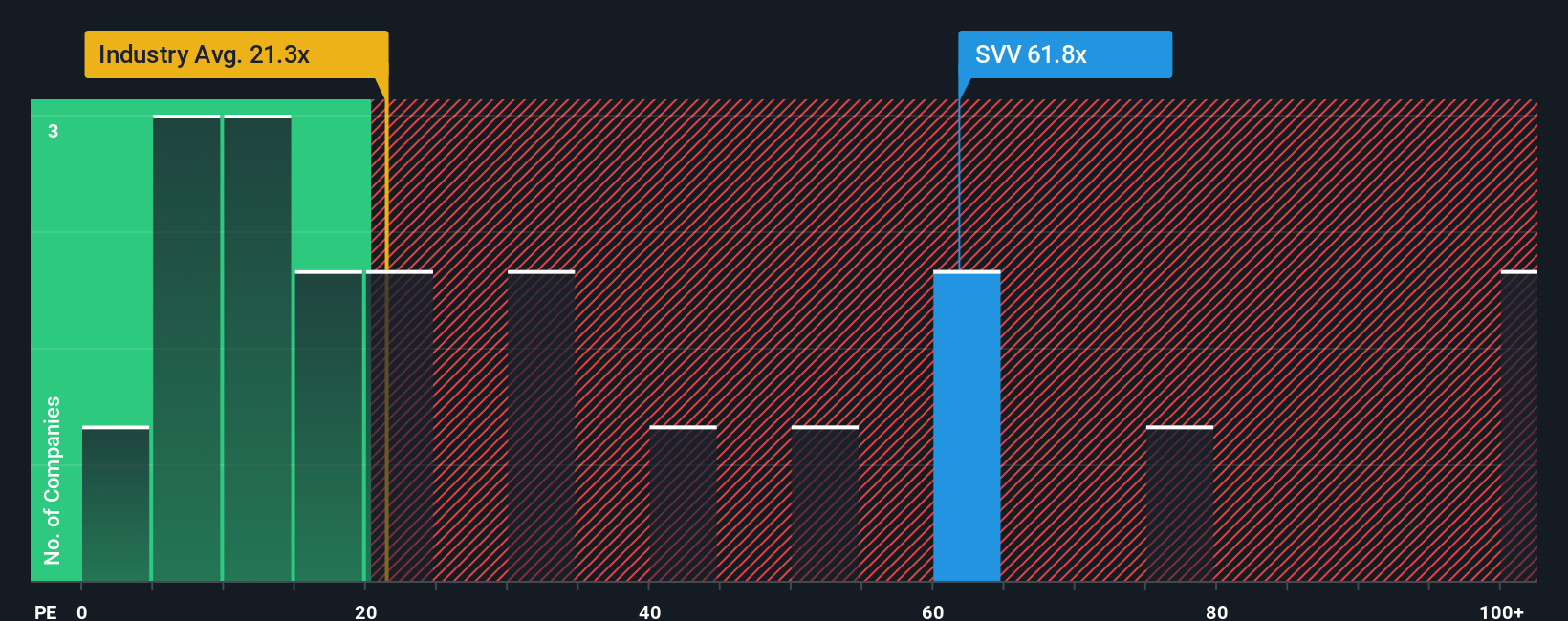

While the most popular valuation pegs Savers Value Village as undervalued, a look at the price-to-earnings ratio tells a different story. The company trades at nearly 57.7 times earnings, which is much higher than both the industry average of 21.1 and its own fair ratio of 33. This large gap suggests the stock is richly valued on this basis and could face pressure if expectations are not met. Could these high multiples mean the market is getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Savers Value Village Narrative

If you want to dig deeper and analyze the numbers your way, you can easily craft your own take on where Savers Value Village stands in just minutes, Do it your way

A great starting point for your Savers Value Village research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Miss out and you could leave serious opportunities on the table. Expand your strategy with these hand-picked paths to growth, value, and innovation, powered by the Simply Wall Street Screener.

- Boost your search for high-potential companies by tapping into these 874 undervalued stocks based on cash flows, offering standout cash flow advantages that are easy to overlook at first glance.

- Capitalize on rapid breakthroughs transforming healthcare by targeting these 33 healthcare AI stocks, at the cutting edge of medicine, diagnostics, and AI-driven innovation.

- Maximize yield with these 20 dividend stocks with yields > 3% if you're eager for reliable income from stocks with robust payouts above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SVV

Savers Value Village

Sells second-hand merchandise in retail stores in the United States, Canada, and Australia.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives