- United States

- /

- Specialty Stores

- /

- NYSE:SIG

Does SIG’s Celebrity Boost Reveal a Turning Point in Its Brand Strategy?

Reviewed by Simply Wall St

- Earlier this week, Taylor Swift announced her engagement to NFL star Travis Kelce on social media, showcasing a cushion-cut engagement ring and featuring Signet jewelry in the photos.

- The high-profile exposure connected Signet's brand with a major cultural event, drawing increased attention from both investors and consumers.

- We'll examine how this celebrity endorsement could shape Signet Jewelers' brand strategy and future consumer demand outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Signet Jewelers Investment Narrative Recap

Shareholders in Signet Jewelers need to believe in the company’s ability to convert brand moments into sustainable consumer demand, especially as it shifts focus from individual store banners to a unified brand strategy. While the Taylor Swift engagement has generated short-term interest and a spike in the stock, the immediate impact on revenue or margin trends is likely limited; the biggest catalyst remains improved brand consideration, while the key risk continues to be execution challenges as the company reorganizes and centralizes operations.

A recent collaboration with De Beers, announced alongside efforts to target an anticipated rise in engagements, stands out as particularly relevant. This partnership aligns with the ongoing push for emotional brand resonance and aims to elevate Signet’s appeal in a competitive market where celebrity influence and consumer trends can quickly shift, reinforcing the company’s efforts to drive higher brand consideration.

However, despite the media buzz, investors should be especially aware that a misalignment with evolving consumer demand during critical gifting seasons could...

Read the full narrative on Signet Jewelers (it's free!)

Signet Jewelers' outlook projects $6.9 billion in revenue and $598.3 million in earnings by 2028. This is based on a projected annual revenue decline of 0.6% and a $560.3 million increase in earnings from the current $38.0 million.

Uncover how Signet Jewelers' forecasts yield a $96.17 fair value, a 3% upside to its current price.

Exploring Other Perspectives

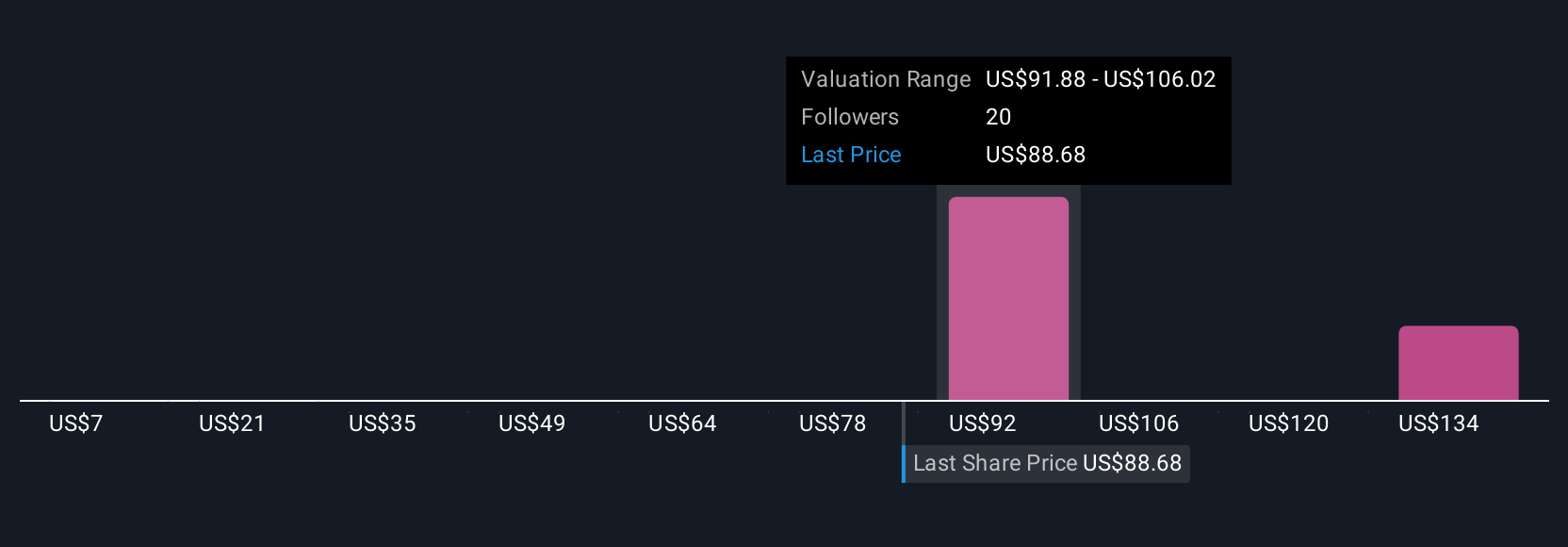

Fair value estimates from five Simply Wall St Community members span US$7 to US$159.43 per share, reflecting wide-ranging opinions. A key ongoing catalyst is the pursuit of stronger brand differentiation, which could have broad implications for sustaining growth and profitability, explore how these diverse views might affect your understanding of Signet’s potential.

Explore 5 other fair value estimates on Signet Jewelers - why the stock might be worth less than half the current price!

Build Your Own Signet Jewelers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Signet Jewelers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Signet Jewelers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SIG

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives