Sea (NYSE:SE) Valuation in Focus After Analyst Optimism on Shopee Monetization and Growth Prospects

Reviewed by Simply Wall St

Sea (SE) drew fresh attention after a wave of upbeat analyst updates, with firms like JPMorgan voicing optimism in the company’s efforts to boost e-commerce profitability through Shopee’s new monetization strategies. Investors are watching closely because these improvements could shape the company’s growth trajectory.

See our latest analysis for Sea.

Sea’s shares are making waves again after those upbeat updates, and it’s easy to see why. Even with recent volatility, the stock is still showing serious momentum. A 52.7% year-to-date share price return and an impressive 61.3% total shareholder return over the past twelve months hint at revived optimism around its growth path and profitability story.

If you want to spot other companies where insiders and momentum are driving the story, now’s a good time to explore fast growing stocks with high insider ownership.

But with analyst price targets still well above current levels and profitability trending upward, the key question remains: is Sea’s stock actually undervalued, or have investors already priced in its next phase of growth?

Most Popular Narrative: 21.8% Undervalued

Sea's most-followed narrative estimates fair value meaningfully higher than the last close. This sets up the debate on whether its long-term earnings potential is still underestimated at current prices.

Accelerating mobile internet adoption and rising youth digital literacy in Southeast Asia and Brazil are fueling user growth across Sea's e-commerce (Shopee), fintech (Monee), and gaming (Garena) businesses. This is supporting robust double-digit revenue growth and expanding the company's total addressable market for the long term.

Want a glimpse into the logic behind Sea’s ambitious fair value? The secret sauce is big projections for revenue, margin lift, and a profit multiple rarely seen outside fast-growing tech firms. Surprised at how bold these estimates get? Click through and find out why this expected upside is fueling debate on Sea’s future.

Result: Fair Value of $295.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger rivals in Southeast Asia and reliance on key gaming titles could quickly change Sea’s momentum if competitive or regulatory pressures increase significantly.

Find out about the key risks to this Sea narrative.

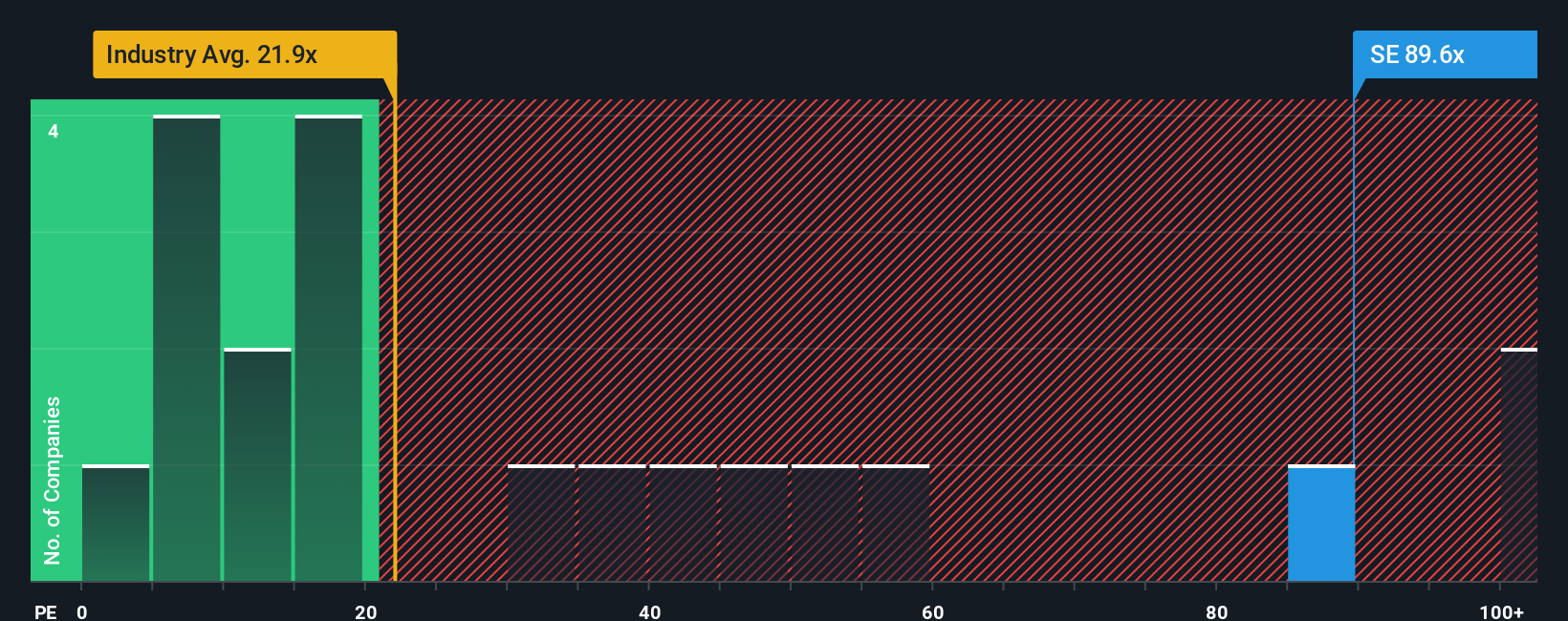

Another View: Are High Earnings Multiples a Warning?

While the narrative points to undervaluation, Sea’s price-to-earnings ratio is extremely high at 79.3x. This is not only higher than its peer average of 61.1x, but it also stands well above the industry benchmark of 21.3x and the fair ratio of 38.2x. In practical terms, if the market grows more cautious or Sea’s growth stalls, there is real risk these lofty multiples could compress sharply. Is today’s price justified, or is it time for a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If the numbers or assumptions here don’t fit your outlook, dig into the data yourself and construct your own take on Sea’s value in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Looking for More Investment Ideas?

Being ahead of the market means constantly refreshing your watchlist. Momentum doesn’t wait. Use these targeted ideas to step up your strategy before opportunities pass you by.

- Capture income potential and ride stable growth by checking out these 19 dividend stocks with yields > 3% offering yields above 3% in today’s market.

- Supercharge your portfolio with the latest innovations in artificial intelligence through these 27 AI penny stocks, where tomorrow’s technology leaders are emerging.

- Get ahead of the crowd and spot undervalued plays based on real cash flow insights with these 875 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives