Sea Ltd (NYSE:SE): Examining Valuation After Strong Revenue Growth and Recent Share Price Swings

Reviewed by Simply Wall St

See our latest analysis for Sea.

Sea’s rollercoaster year has seen its share price climb an impressive 36.7% year-to-date, but that comes after some sharp pullbacks, including a 21.5% dip in the last month. The one-year total shareholder return stands at 36.6%, illustrating meaningful long-term momentum even amid recent swings.

If you’re watching for other compelling growth trends, now is an ideal moment to expand your search and discover fast growing stocks with high insider ownership

But with Sea still trading at a 34.5% discount to the average analyst price target and intrinsic metrics suggesting even deeper undervaluation, is there a real buying opportunity here, or is the market already factoring in the company’s growth?

Most Popular Narrative: 27% Undervalued

Compared to Sea’s last close of $143.35, the most widely followed narrative assigns a fair value of $196.66, seeing considerable upside in current prices. This narrative weighs future expansion, profitability, and strategic investments as substantial drivers behind Sea’s valuation outlook.

“Successful international expansion, particularly Shopee's profitable leadership and rapid user growth in Brazil, is diversifying revenues, lowering regional concentration risk, and positioning the company for outsized earnings growth as high-value product categories and digital financial services scale in new markets.”

Want to know what’s fueling this bullish outlook? Discover which bold projections drive this premium valuation and how Sea’s rapid expansion figures into the narrative. There is a key assumption about profitability and revenue mix that might surprise you. Dive in for the specific growth blueprint underpinning this fair value call.

Result: Fair Value of $196.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competition from global e-commerce rivals and reliance on key gaming titles may pose challenges to Sea's ability to sustain growth and profitability.

Find out about the key risks to this Sea narrative.

Another View: Do Multiples Tell a Different Story?

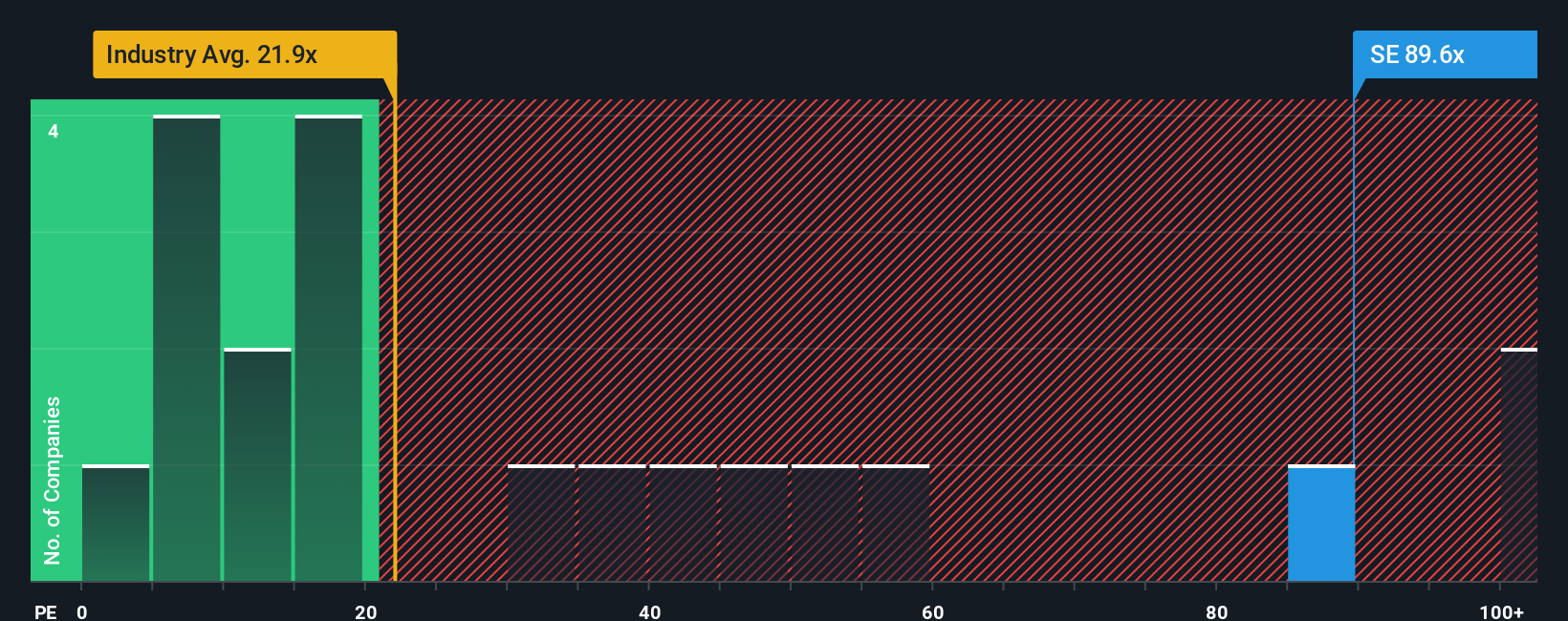

While fair value estimates suggest Sea is deeply undervalued, its current price-to-earnings ratio stands at 71x, which is significantly higher than peers at 53.2x and the global industry average of 20.4x. The market’s optimism may be outpacing fundamentals. Could multiples signal valuation risk as growth expectations surge?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Looking for More Smart Investment Ideas?

Don’t just stop at Sea. The market is filled with opportunities you might be missing. These investment angles could put you ahead of the next big move:

- Begin your search for undervalued gems with strong cash flows by checking out these 862 undervalued stocks based on cash flows, tailored for today’s value seekers.

- Tap into the momentum of rapid growth in healthcare by scouting these 32 healthcare AI stocks, which harnesses artificial intelligence for tomorrow’s health breakthroughs.

- Explore income potential by looking into these 14 dividend stocks with yields > 3%, offering yields above 3 percent for investors seeking reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives