Assessing Sea’s 22.5% Drop Amid E-Commerce Strategy Shift and Valuation Debate

Reviewed by Bailey Pemberton

- Wondering if Sea is fairly priced, overhyped, or offering hidden value? You are not alone, especially with investors constantly debating what this company is truly worth.

- The stock has been on a rollercoaster recently, down 8.8% in the past week and 22.5% over the past month. However, it is still up 33.5% year-to-date and shows a strong 35.5% gain over the last year.

- Recent headlines have focused on Sea’s shifts in their e-commerce strategy and ongoing regulatory developments in key Southeast Asian markets. These news stories have fueled both optimism about growth potential and raised questions about the risks ahead, providing key context for the dramatic share price swings.

- When it comes to valuation, Sea earns a score of 3 out of 6 on our valuation checks, indicating a mix of signals. We will break down exactly what this means by examining various valuation approaches. Stick with us as we dive into a smarter way to assess whether Sea is a bargain or not by the end of the article.

Approach 1: Sea Discounted Cash Flow (DCF) Analysis

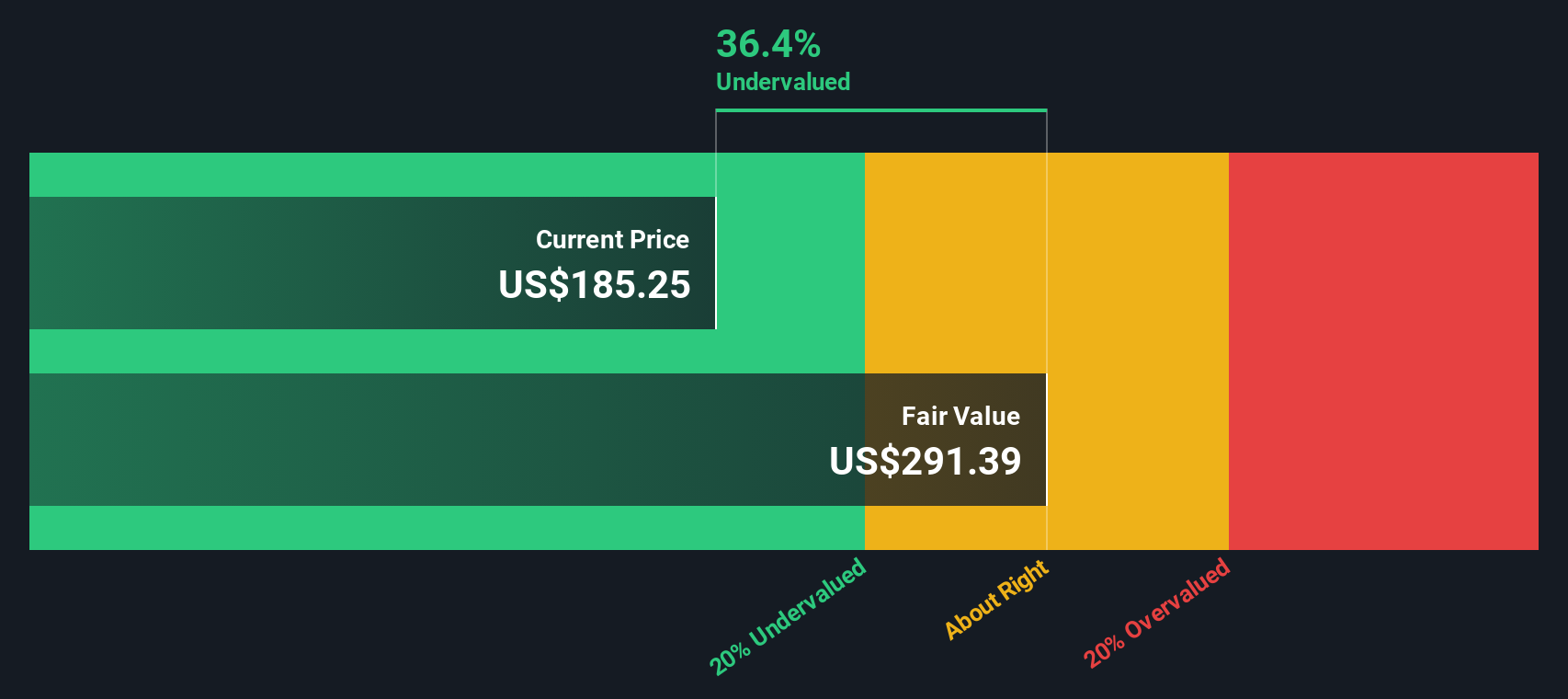

A Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to today's value. The goal is to estimate what the business is truly worth based on its capacity to generate cash, rather than relying only on current market sentiment.

For Sea, the latest reported Free Cash Flow stands at $3.68 billion. Analysts provide forecasts for the next several years, with estimates reaching $7.80 billion in Free Cash Flow by 2029. After that, further projections are extrapolated to gauge longer-term trends. These estimates highlight an expected period of substantial cash flow growth, with Sea potentially more than doubling its cash generation over the coming decade.

Based on this DCF model, Sea’s intrinsic value per share is estimated at $314.65. With the model indicating a 55.5% discount to the current share price, the stock is viewed as significantly undervalued according to future cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sea is undervalued by 55.5%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Sea Price vs Earnings (PE Ratio Analysis)

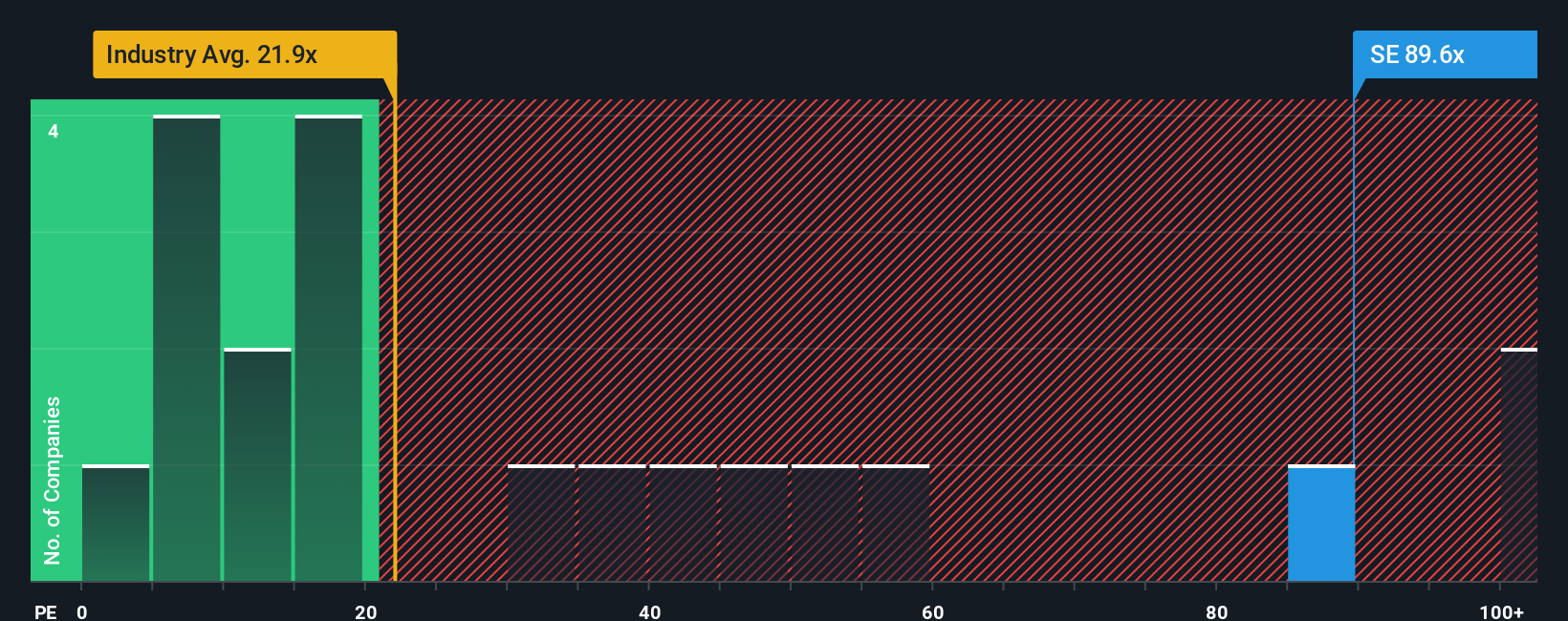

The price-to-earnings (PE) ratio is a widely used measure for valuing companies that have consistent profits. It tells investors how much they are paying for each dollar of earnings and is especially helpful for comparing companies that are generating positive net income, like Sea. A higher PE often signals that investors expect stronger growth, while a lower ratio can indicate lower expectations or higher risk.

Sea’s current PE ratio stands at 58.45x. For context, the average PE for the Multiline Retail industry is 20.25x. A group of peer companies trade at an average of 52.23x. This places Sea above both key benchmarks, which suggests that the market is pricing in higher expectations for future growth or perhaps overlooking some risks.

To provide a fuller perspective, Simply Wall St calculates a “Fair Ratio” of 34.22x for Sea. This proprietary measure adjusts for the company’s earnings growth, profit margin, market cap, industry profile, and various risk factors. It is more tailored than a simple benchmark comparison. While industry averages and peer multiples provide some context, the Fair Ratio better captures the nuances unique to Sea.

Right now, Sea’s actual PE of 58.45x is significantly higher than its Fair Ratio of 34.22x. This signals the stock may be overvalued based on what investors should reasonably pay given its specific outlook and fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sea Narrative

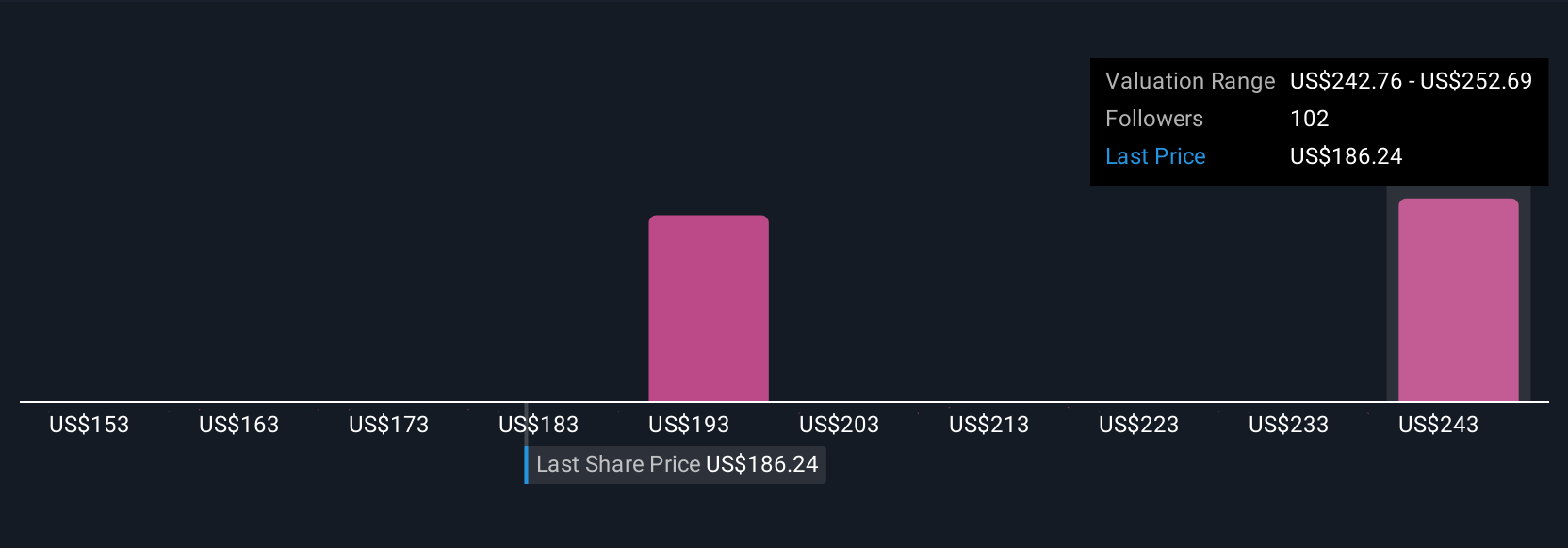

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple but powerful way to combine your own view of Sea’s story with the numbers behind the business, including your estimates for future revenue, earnings, and margins, to arrive at a fair value that truly reflects your perspective.

A Narrative links a company’s qualitative story to a quantitative financial forecast and then ties both to an actionable fair value estimate. Rather than relying solely on general market benchmarks or static models, Narratives make investment decisions more dynamic and personal, showing how your reasoning translates into value. They are easily accessible to everyone through the Simply Wall St Community page, where millions of investors use them to clarify their thinking and share perspectives.

With Narratives, the decision of when to buy or sell Sea becomes clearer, as you can directly compare your Fair Value with the latest share price. These insights automatically update as new information, such as news or earnings, becomes available. For example, one investor might forecast exceptional user growth and set a Fair Value near $241, while another, focusing on rising competition and regulatory risks, may land closer to $165. Narratives give you the tools and flexibility to act confidently on your own convictions.

Do you think there's more to the story for Sea? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives